Is the Bitcoin halving priced in? If so, when did that happen? Are all future bitcoin halvings priced in today? I promise to come back to these questions, but first I’ll explore the idea of information and events being “priced in” in traditional asset classes.

Pedantry Disclaimer: I oversimplify a bit in this essay, in ways that I think don’t sacrifice any meaning. For example, a stock’s fair value is dependent not just on its earnings, but also its current book value, interest rates, volatility, and even tax policy, but I’m only focusing on the first variable here.

Legal disclaimer: I may be long or short BTC in the past, present, and future. Not investment advice.

Is it priced in? The question implies that there is some “fair” price for an asset after the effects of some new information or new event. A trader who says they’re bullish because of an upcoming event would reasonably ask if the bullish impact of that event is already reflected in the current price. For example, let’s imagine you said that you were bullish on Amazon because it has an amazing CEO, monopolistic power in some business lines, and strong network effects. I might ask you if you think that other market participants who are setting the price for AMZN disagree with you. If they agree with you, then presumably the current price of AMZN already embodies all of these positive attributes – maybe that’s why Amazon is valued at $886 billion.

In equities, bonds, and consumable commodities, there are robust frameworks for identifying intrinsic value. These assets ultimately provide concrete value to holders in countable USD terms. An owner of AMZN is entitled to their share of AMZN profits via dividends or share buybacks. So all an investor has to due is to accurately identify AMZN’s future profits to come up with a “fair” value for the stock. Of course this is a tall task, but it facilitates easy discussion around valuation. If someone thinks AMZN is worth more than you do, they likely believe that future profits will be greater than you think they will be. You can then dig in to why. And they “why” falls into two categories: analysis or information. For example, you and another investor may analyze the same information but you may conclude that Amazon’s expansion into same-day delivery is likely to turbocharge sales, while another investor may be skeptical of the expansion. Alternatively, another investor may have information you don’t. Maybe Bezos told a few friends that he’s considering retiring, and this investor is bearish on the basis of this non-public information (which may be legal to trade on, depending on how the information was gained.)

In the context of AMZN, “is it priced in” is asking, “does the market have this information, and are they appreciating its bullishness or bearishness as I see it?”

Now for Bitcoin: while there are some nascent valuation approaches to Bitcoin, models like Stock-to-flow don’t even attempt to identify intrinsic value. Rather, they observe a historical relationship. What is the intrinsic value of bitcoin? 1. Bitcoins are how you pay to transact on the bitcoin protocol, so the value of a bitcoin can be modeled as a derivative of transaction demand, but this gets circular given that many bitcoin transactions are currently speculative in nature (arbitrage, trading, etc). Any valuation of Bitcoin based on this approach yields a fair value far below the current price. 2. Bitcoin provides utility to a holder who wants to store wealth in a confiscation-resistant way. This doesn’t easily contribute to a pricing model however, since for this use case, the bitcoin buyer is entirely price insensitive. If I want to store $10k of wealth in a seizure resistant way, I need to buy $10k worth of Bitcoin, regardless of the price per BTC.

So, we don’t have an easy way to connect fundamentals to price for bitcoin (or other speculative commodities). Imagine this conversation in late 2017:

Bitcoin bull: over the next 12 months, we’ll see further development in all areas around Bitcoin – infrastructure like ATMs and trading products, development of LN and the core client, broader education and adoption etc. So…I’m bullish.

Bitcoin bear: I agree with everything you said, but the current price is a bubble and even with improving fundamentals, we’ll still have a lower priced BTC in 12 months.

The bear is arguing that the “fair” price at the end of 2017 was much lower than the market price, and so despite their optimism for fundamentals over the coming year, they’re still bearish on price. How is the bear deriving a “fair” price? Not from a fundamental model, but with a trader’s mindset – by noting that the price was driven higher was short-term speculators, “weak hands”, and that when these people inevitably cut their overextended positions, we should expect a crash.

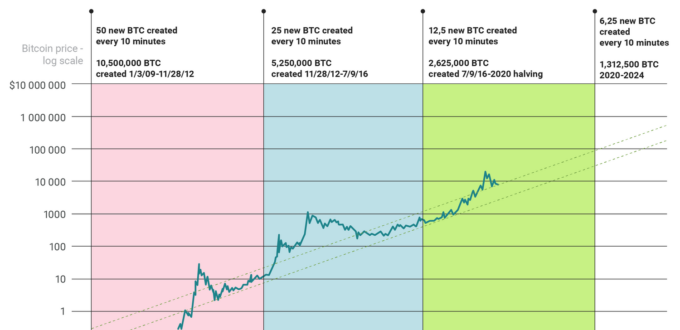

Okay, so what about the halving? With only 2 prior data points, we’re far short of sufficient data for a quantitative model, but it’s still worth a look. If I showed you a chart of Bitcoin, you couldn’t identify the halvings without knowing where to look ahead of time. Both halvings occurred in the midst of bull runs, without a clear change in slope of the rally. The simplest interpretation would be that the halving appears to have no effect. But how can that be? How could a 50% reduction in new supply be irrelevant?

One possible explanation is that the halving is “priced in” ahead of time. But when? Are all future halvings priced in today? I think the problem is that the whole framework of “pricing in” is wrong for long-term early stage investments. The concept of an efficient market, or of information being “priced in” is an inherently short-term framework. It assumes a consistent set of market participants who are constantly evaluating an asset.

In contrast, bitcoin wasn’t “investable” by a pension fund or bank in 2011. They didn’t avoid buying it in 2011 because they thought it was overvalued, they couldn’t buy it. It wasn’t part of their investable universe for a mix of regulatory, operational, and bureaucratic reasons. As bitcoin matures, the market participants who set its price evolves. In 2011, the exchange price was set by a small number of early bitcoin miners, investors, and developers. Today, the bitcoin price is set by that group, but also by professional crypto funds and some traditional investors and funds. Soon we may have pensions and sovereign wealth funds participating in price discovery in a big way. “Is it priced in” assumes some group doing the pricing. For an early stage asset, the pricing group evolves over time.

But I still haven’t answered the questions. Is the halving priced in? The lack of clear inflection points on the chart suggest that if the halving has an effect, some sort of “pricing in” must be happening. Often events are partially priced in to asset prices Rational traders and investors require a return for every risk. On average, they should “underprice” every bullish event by a bit – that bit is the profit on the trade or investment. This is the average result, but not a consistent one. Sometimes the market certainly “overprices” a bullish event, leading to the common “sell the news” situations. But I struggle to think of why the halving should be viewed as an “event” at all. I think it’s best characterized as just part of the general optimistic roadmap of bitcoin continuing to gain adoption and accrue network effects. Certainly bitcoin’s emission schedule is core to its value proposition. If 2020 was scheduled to be the last bitcoin halving, BTC probably wouldn’t have a $137 billion market cap today. So in that sense, all future halvings are “priced in” to some degree – they’re intrinsic to what Bitcoin is and why it’s as valuable as it is today. But again, this is an ineffectual framing. So let me throw it out and try for something different.

My mental model for Bitcoin’s returns is the same as for an early stage project with value coming primarily from network effects: its current value includes optimism about all future possible events, but the price increases over time as our confidence in those future events increases. Within this framework, the halvings are more like signposts that Bitcoin is passing along its trajectory of accruing network effects and intrinsic value. And as that future fundamental value becomes less risky, the BTC price increases over time. And, the BTC price increases as the project matures, and the pool of market participants who view it as within their investable universe increases.

With all of this said, when we zoom in a bit to a trading timeframe (<6 months), I do think “is it priced in” is a useful question, but as applies to second order effects. The halving causes miner profitability to suddenly plummet. This may cause miners to liquidate BTC to cover fixed costs or to invest in more ASICs. To at least some degree, miners try to “price in” these issues and adjust their behavior in advance. Diving deeper into these questions require an exploration of miner incentives and the current mining ecosystem, which will have to wait for a future essay.