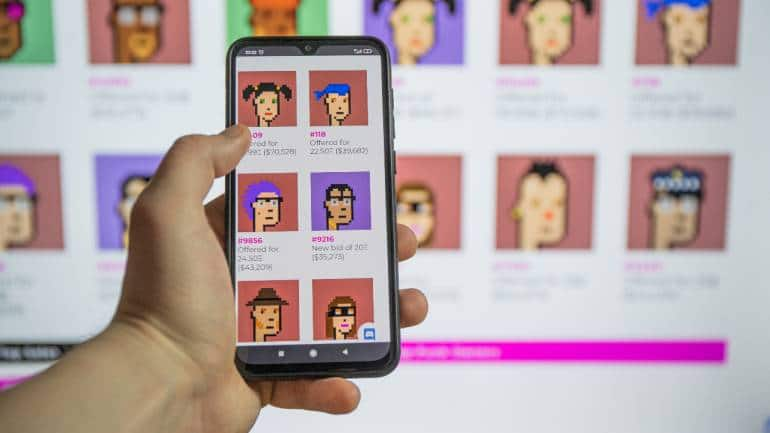

Non-fungible tokens. (PC-Shutterstock)

“In the last 3-4 months, I have invested in a minimum of 4-5 NFTs (non-fungible tokens). One of them being hashtags, #. I blocked a few #s like #car, #fashion and so if anyone uses these tags online, each time I earn something in a cryptocurrency,” said Maeraj Shaikh, a Mumbai-based architect and crypto educator. When he bought these hashtags, it cost him $200. They are now worth $350.

Shaikh also runs a training place for plant art and is now working on his own NFT, with plans to launch his Bonsai artwork. He says that this will help him create awareness and also expand his reach and grow the community.

Ashita Sondhi Chibbar, a freelance brand manager, recently bought her first NFT from Amitabh Bachchan’s collection. Her NFT cost $10 (around Rs 750) which is a poster from the Bollywood superstar’s movie Nastik. “I was one of the lucky ones because nearly 6 lakh people applied and only a few could actually buy. Even the website crashed,” says Chhibbar. She adds that she was looking to invest in this space for a while but only on NFTs which will actually have some value with time.

Shaikh and Chibber are among the early NFT buyers in India. Industry watchers say a few thousand may have invested in the space so far.

NFTs have become a hot commodity globally and celebrities from different walks of life are jumping on the bandwagon to cash in on the boom. Indian celebrities from Bollywood and sports are now rushing to launch digital memorabilia through NFTs. While many critics have waved off the craze as the latest bubble, the rise of NFTs has baffled many. Global sales volumes of NFTs have galloped to $10.7 billion in the third quarter of 2021, making an eightfold increase from the previous quarter, according to a recent Reuters report that quoted data from market tracker DappRadar. And many Indians are eager to join the digital gold rush.

However, uncertainties around the future of NFTs, challenges around cryptocurrency regulations and lack of awareness of the technology are some of the major hurdles investors face in this space.

NFT is a unique set of data that has to be stored on a blockchain. It can be in different digital ways such as unique art, music or game items. Most of the NFTs are a part of the Ethereum blockchain. They are unique, easily identifiable tokens that are not easy to exchange. They can in themselves be a representation of a digital item or have a physical item be attached to it on exchange.

Artists are the ones who can sell their artwork in the form of NFTs to their audience. For instance, Amitabh Bachan’s NFT auction which includes his father’s poem Madhushala’s recording in Bachchan’s voice and some other unique items have received $9,66,000. Superstar Salman Khan recently announced the launch of his NFTs on marketplace BollyCoin. Fashion designer Manish Malhotra too launched five NFTs of digital sketches of his creations.

However, all the artists are not onboard. While the superstars are busy launching their NFTs, many other artists find it too early to sell NFTs and are unsure if the audience will be willing to invest in these assets which can range anywhere between $50 and $1000. Most of the buyers at this juncture are millennials in their 20s and early 30s along with investors in the space, and the popular categories so far are art, game items and music.

Qyuki Digital Media, which works with online creators, is soon launching an exclusive musical NFT on WazirX with creators like Arjun Kanungo, Sanam, and Sharaddha Sharma. The NFTs are priced at Rs 1 lakh (in cryptocurrency) and the earnings will be sent for philanthropy purposes.

Artist Arjun Kanungo who was a part of this series says that it will be interesting to see how the sale of this NFT goes. He adds that NFTs can become an additional revenue stream but is still nascent since cryptocurrency regulations are still unclear. “This will be a major hurdle as buyers will hesitate to associate with something like that. While cryptocurrencies are phenomenally growing and becoming mainstream, NFTs are an extension of it and are bound to take a few years for the momentum to pick up in India,” said Kanungo.

Abhimanyu Radhakrishnan, MD of Qyuki Digital Media, told Moneycontrol that while crypto-savvy consumers will likely be the early adopters, many of them possibly for purely speculative reasons, artists themselves are still decoding the tech and its long-term legitimacy.

“But the surge in interest has undoubtedly shot up. We are taking it slowly by ensuring all compliances and legalities of rights and royalties in place. We do not plan to focus aggressively on monetisation just yet, but we want to bet on this long term and are thus talking to multiple crypto exchanges & platforms to see how it can be a sustainable activity,” Radhakrishnan pointed out. Qyuki plans to start with music and gradually expand into other categories of NFTs.

“It’s an easy way for many to invest their money earned through cryptocurrencies,” says an artist who is not sure if NFTs will be accepted by the audience and if it will actually support artists.

Noting that this concept is still quite new, Dheeraj Shah, a crypto investor, said, “NFT is a very broad space. It works in a very similar way to how an art market or others would work so at least spend a minimum of 3-4 months doing the initial research. Also, choose a category which you are fond of. For instance, if you like music, look into NFTs in music.” He adds that thinking of it as a collection of valuables instead of investment will help you to choose the right NFTs.

Vijay Pravin Maharajan, founder and CEO of BitsCrunch, a blockchain analytics firm, said that currently, India contributes to around 5 percent of the global NFT space. He adds that determining the exact number is difficult as a lot of buyers use pseudonyms through decentralised exchanges. But globally countries like Canada, Hong Kong, the US and Singapore are quite ahead in the space.

Echoing similar sentiments, Nischal Shetty, founder and CEO of WazirX, says his company launched its NFT as a result of consumer demand, especially from the youngsters. But, he says the technology is comparatively easier to understand than that of crypto and hence the adoption should be faster in this case.

The NFT space got a lot of attention in India earlier this year after Vignesh Sundaresan, a serial crypto entrepreneur and Anand Venkateswaran, who transitioned from the world of media and communications to crypto, took the world of digital art by storm when they bought Beeple’s First 5000 days, a digital NFT-based artwork for $69 million, making it the most expensive NFT (non-fungible token) ever sold.

Even as many NFTs will be launched in the coming weeks and months, it remains to be seen if the momentum will pick up among artists and buyers.

No Comments Yet