Good morning. Here’s what’s happening this morning:

Market moves: Bitcoin edged toward $58,000 as altcoins and other layer 1 tokens recovered from seven-day lows.

Technician’s take: Momentum is improving as oversold readings appear on the chart.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Bitcoin (BTC): $57,550 +1.82%

Ether (ETH): $4,346 +5.93%

Bitcoin struggled to move above $58,000 during U.S. trading hours on Tuesday, while alternative cryptocurrencies (altcoins), including ether and other layer 1 tokens recovered to above their seven-day lows.

As a result, the bitcoin dominance chart, which shows the extent of the crypto’s dominance over the rest of the market, continued to signal a bias toward altcoin exposure, according to TradingView, down to roughly 42.31% from October’s high at 47.41%.

Bitcoin dominance chart (TradingView)

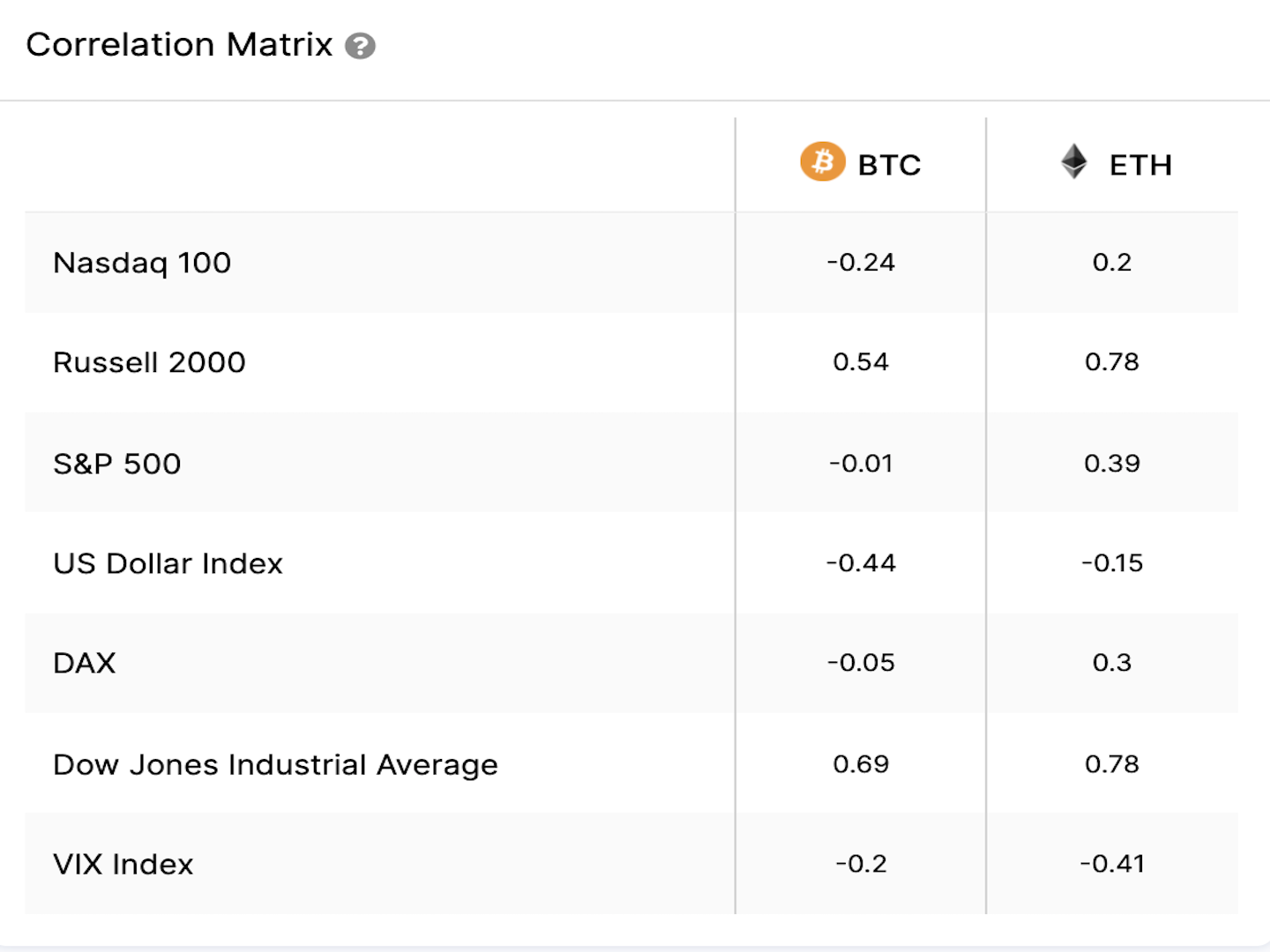

Lucas Outumuro, head of research at blockchain analytics firm IntoTheBlock, noted a stronger correlation between the stock market and ether than between stocks and bitcoin.

30-day correlation coefficient between bitcoin/ether and traditional assets (IntoTheBlock)

“Bitcoin is struggling to consolidate as an inflation hedge but is also not following risk assets, which may be leaving some investors uncertain,” Outumuro said. “Ether has been more closely correlated to stocks, which suggests investors [are] treating it more like a risk-on trade.”

On the traditional markets, technology stocks moved the S&P 500 lowered on Tuesday, which could have a negative impact on the crypto market on Wednesday.

Bitcoin four-hour price chart (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) appears to be oversold, which could support a brief rise toward the $60,000-$63,000 resistance zone.

The cryptocurrency has held short-term support at about $56,000 as selling pressure has stabilized.

The relative strength index (RSI) is rising from oversold levels, similar to what happened on Oct. 27, which preceded a price recovery. On the daily chart, the RSI is approaching oversold levels for the first time since late-September.

Further, bitcoin’s correction from an all-time high of nearly $69,000 appears to be exhausted, which could encourage buyers to return. Momentum is improving into the Asian trading day, although resistance at around $63,000 could limit further upside over the short term.

8:30 a.m. (HKT/SGT (8:30 a.m.): Japan Manufacturing PMI (purchasing managers index)

8:40 a.m. HKT/SGT (12:40 a.m.): Speech by Michele Bullock, the Assistant Governor (Financial System) at the Reserve Bank of Australia

“First Mover” hosts spoke with Crypto.com CEO Kris Marszalek as crypto exchanges go on a sports sponsorship binge. Katie Stockton, Fairlead Strategies technical analyst, shared her insights on market movements. Plus, Lukas Enzersdorfer-Konrad, Bitpanda chief product officer, explained the new partnerships with French mobile financial services super-app Lydia to facilitate access to digital asset investing for everyone.

Damanick is a crypto market analyst at CoinDesk where he writes the daily Market Wrap and provides technical analysis. He is a Chartered Market Technician designation holder and member of the CMT Association. Damanick is also a portfolio manager at Cannon Advisors, which does not invest in digital assets. Damanick does not own cryptocurrencies.

Subscribe to Crypto Long & Short, our weekly newsletter on investing.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

No Comments Yet