(Bloomberg) — Bitcoin failed to hold the two-week high registered Tuesday, while advocates from the Winklevoss brothers to the president of El Salvador urged the faithful to remain strong.

Most Read from Bloomberg

-

U.K. Scrambles Fighter Jets to Intercept Unidentified Aircraft

-

Teen Who Demanded $50,000 From Elon Musk Is Now Targeting More Billionaire Jets

-

Omicron Sub-Variant May Cause New Surge of Infections in Current Wave

-

Tesla, Who? Biden Can’t Bring Himself to Say It — and Musk Has Noticed

-

Late Earnings Sink Tech After Stocks Close Higher: Markets Wrap

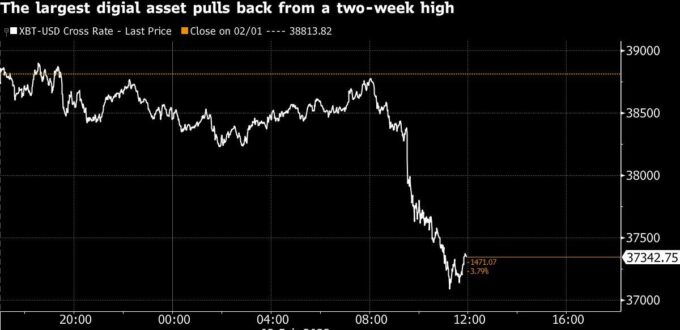

The largest cryptocurrency by market value fell as much as 4.5% to $37,087. It peaked at $39,267 yesterday in New York trading, spurring optimism that it was on a path of recouping the losses that had pushed it down from an all-time high in November. Ether declined as much 5.7% percent.

Bitcoin has struggled to break through $40,000, a price that some technical analysts see as a key level. Bitcoin is down about 40% from its all-time high of almost $69,000 nearly nearly three months ago.

The crypto derivatives market is signaling lingering uncertainty, according to Noelle Acheson, head of markets insights at Genesis Global Trading Inc., who noted that indicators are neutral but trending toward negative.

“The market is very much in wait-and-see mode,” said Acheson. “I am not yet bullish in the short-term. The reason is that the mood can shift very quickly.”

Bitcoin has demonstrated a relatively strong correlation with U.S. stock market indices. However, the two asset classes were moving in opposite directions Wednesday, with the Nasdaq 100 and the S&P 500 higher.

Steve Sosnick, chief strategist at Interactive Brokers LLC, said the correlation between Bitcoin and stock markets doesn’t always hold. He noted that more equities were declining than advancing on Wednesday, although heavy-weight Alphabet Inc. is fresh off of a successful earnings report. Bitcoin is “sort of the more volatile cousin of risk assets right now,” he said.

In the meantime, crypto stalwarts including Tyler Winklevoss, co-founder and chief executive officer of Gemini Trust Co., took to Twitter to assure his 1 million followers.

On Monday, El Salvador’s President Nayib Bukele, who’s push to make Bitcoin legal tender in the Central American nation has made him a crypto celebrity, noted that prices are sure to rise.

Most Read from Bloomberg Businessweek

-

First Black Woman Picked for Fed Draws GOP Fire Over Research

-

Rent Inflation Shows That Landlords Have the Upper Hand Again

-

China’s Local Governments Are at Risk of a Puerto Rico Moment

©2022 Bloomberg L.P.

No Comments Yet