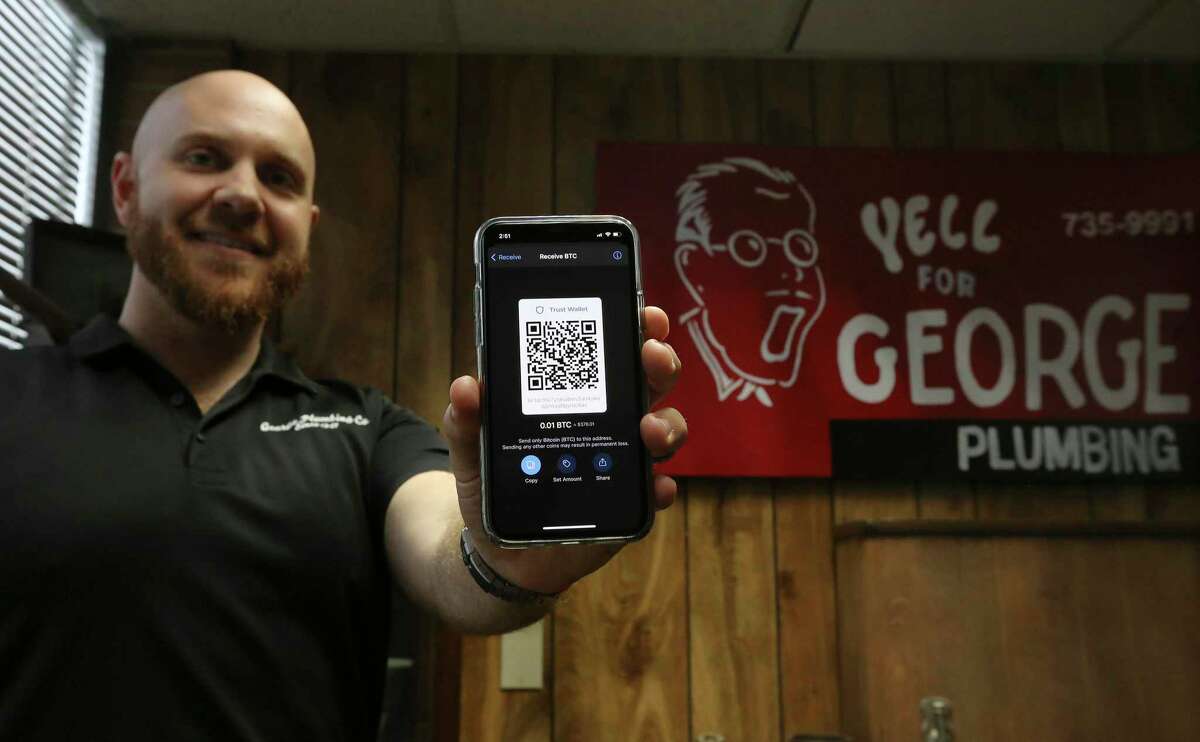

Clay Saliba, the general manager of George Plumbing Co. in San Antonio, surprised customers when he began offering services in exchange for cryptocurrency seven years ago.

With a bachelor’s degree in business from Texas State University, he’d started working for his father a few years earlier, when Bitcoin came on the scene. It was, and remains, the best-known cryptocurrency — the digital money bought and sold without the involvement of governments or their central banks.

Saliba taught himself the ins and outs of crypto — like blockchain, the digital ledgers that record each time the currency changes hands over the internet. He admires how a far-flung community of bitcoin miners use powerful computers to authenticate cryptocurrency transactions.

A third-generation plumber, Saliba said trade workers are good at adopting new technologies. In his line of work, however, that traditionally has meant buying cutting-edge gadgets such as the latest cameras for scoping pipes.

“I saw crypto as another way to set us apart from other plumbers and capture a slice of the market that other people weren’t in yet,” he said.

Most of his customers still prefer paying their bills with cash or credit cards, not Bitcoin or Ether, another popular cryptocurrency. But he said many of them “are aware of crypto and understand crypto, though it’s still more of an investment mentality and not about everyday spending.”

Still, he’s not giving up on accepting crypto. He believes the policy will pay off as more customers get comfortable paying for goods and services with digital currency.

Saliba is part of a small but growing community of enthusiasts in San Antonio who use Bitcoin and other digital currencies to buy goods and services — in addition to investing in high-risk crypto. The market value of these currencies is volatile, sometimes swinging wildly up or down.

It can be lonely here for true believers.

San Antonio isn’t New York City, where Democratic Mayor Eric Adams accepted his first paychecks in Bitcoin and Ether. It’s not Miami, where Republican Mayor Francis Suarez is looking to make the city a cryptocurrency haven for tech moguls. He has embraced a government-sanctioned currency called MiamiCoin to finance municipal spending.

Cryptocurrencies aren’t widely accepted here yet as a form of payment. But drive around the city and you’ll find 69 cryptocurrency ATMs, mostly in gas stations and convenience stores. Cosa Nostra Pizzeria and other eateries take payment in tokens.

And the University of Texas at San Antonio is teaching undergraduates about the currency, offering a three-credit course this semester called Cryptocurrency and Bitcoins.

Tech workers in the city, many of them employed by cybersecurity firms, are hosting and attending meetups to trade tips on investing in the currencies.

Getting started

George Plumbing proprietor Clay Silba is a third-generation plumber who accepts Bitcoin for his company’s services. The company has been accepting cryptocurrency since 2013.

Kin Man Hui /Staff photographerAt a coffee shop in the King William Historic District, Joey Asturias, 24, said he was first exposed to cryptocurrency when he attended Roosevelt High School on the Northeast Side. In 2015, he watched the Sundance Film Festival award-winning movie “Dope,” centered around a self-described geek growing up in a rough Los Angeles neighborhood. Its characters were obsessed with Bitcoin. It was the first film to sell tickets in cryptocurrency.

“Bitcoin felt inaccessible at the time,” Asturias said.

But less than three years later he found himself talking with classmates in a UTSA cafeteria about investing in Bitcoin — selling at the time for just below $6,000 per token — on the investment app Robinhood.

“It was cool to own it,” he said. “It felt exclusive. There was something about the future that seemed exciting.”

Asturias works as a digital content assistant for the San Antonio Spurs, and he’s a project manager for Wide Awake Creative, a small studio that creates pop-up art shows. He still invests in cryptocurrency and spends his profits on non-fungible tokens, or NFTs — blockchain-created digital files that owners can buy and sell like sports cards.

He buys NFTs on NBA Top Shot, an online marketplace for basketball highlight clips. He also likes purchasing the digital tokens to upgrade his video-game characters and outfit them in the latest virtual clothing. He also pours some of his profits into Decentraland, a 3D virtual world popular among his friends.

Taking the leap

George’s Plumbing proprietor Clay Silba is a third-generation plumber who accepts Bitcoin for his company’s services. The company has been accepting cryptocurrency since 2013.

Kin Man Hui /Staff photographerWhile many San Antonians dabble in cryptocurrency, a few are banking on the digitized money for full-time employment.

Brenda Gentry, 46, worked as a mortgage underwriter for insurance and financial service company USAA, earning $75,000 per year. She started investing in cryptocurrency during the pandemic lockdowns of 2020. It took her only six months to make $200,000 — more than she’d put into her 401(k) over the previous decade and enough money to help her parents retire.

Her older daughter, Cynthia, 24, briefly studied computer engineering at the University of Texas at Austin and then computer science at UTSA. But she left school after learning about blockchain technology from her friends. She took a job at USAA before going to work with her mother full time investing in cryptocurrency.

Cynthia’s sister, Imani, 19, graduated from Steele High School in San Antonio in 2020 and worked part time at a Dunkin Donuts store. She attended classes at Northeast Lakeview College and UTSA for a few weeks before dropping out, she said, because she saw how her mother and sister were “making money by investing in cryptocurrency.”

Brenda Gentry’s husband, an Army veteran and current civilian employee at the Department of Defense, supported the trio as they invested in Bitcoin and Ether.

In October, Gentry quit her job at USAA. She’d built enough of a reputation in the cryptocurrency world to start consulting on NFT and decentralized finance, or DeFi, projects with startup companies through her existing Gentry Media Productions firm. She soon generated up to 20 Ethers, or about $50,000, per month.

Gentry, known as “CryptoMom” on social media platforms, has told her story to Business Insider and CNBC. And her brand has exploded. She’s now the owner of BundlesBets.com, a decentralized sports-betting site using the token BUND. So far, she said, she’s made more than $400,000 profit and plans to use the money to buy an acre of land in San Antonio to use for a crypto-mining operation.

“The crypto space is moving so fast,” Gentry said at her home in the suburban city of Cibolo, northeast of San Antonio. “It’s like a religion. People feel strongly for it or against it. They have to accept it for themselves.”

Back from recording a CBS news segment in Los Angeles, Gentry sat in her kitchen and scrolled through her Twitter page on her iPhone. She had more than 38,000 followers. She tweets links to her appearances on shows with crypto-minded podcasters, celebrates people of color investing in DeFi and promotes NFTs as showing “real promise for Black generational wealth.”

She’s bombarded with direct messages from strangers who hope she’ll make them rich — but she only consults with startups and established companies. She posts several tweets a week to warn followers about fake Twitter accounts, bots and con artists pretending they’re “CryptoMom” and giving bad advice to those wanting to buy into “web 3,” the insider term for a blockchain-based internet running on cryptocurrency.

She’s heard of followers who have lost thousands of dollars in recent months after following the advice of online impostors.

“This new market is like a baby,” Gentry said. “It’s not regulated. People are making a lot of money. There’s a lot of scams, too. I got in to see for myself.”

Early adopters

George Plumbing proprietor Clay Silba is a third-generation plumber who accepts Bitcoin for his company’s services. The company has been accepting cryptocurrency since 2013.

Kin Man Hui /Staff photographerCryptocurrency fans in San Antonio — especially those in their 20s, 30s and 40s — say they envision widespread adoption in the near future.

At George Plumbing Co., Allie Perez, 37, the vice president of marketing operations, said customers could benefit from paying for services in Bitcoin rather than credit cards, since there are no processing fees when using cryptocurrency. It’s also easier, and less costly, for the company to process than credit card payments.

“It’s the currency of the future,” she said. “It might be scary now because people are still learning about it. But you don’t have to be a Wall Street day trader to be involved in cryptocurrency. You can be a stay-at-home mom. Look at us. We’re plumbing people.”

Outside the King William coffee shop, Asturias said, “Crypto is getting more inclusive, and we’re seeing it hit the mainstream — it’s right in front of our faces.”

“At this point, I prefer people send me Ether than the U.S. dollar,” he said.

In her kitchen, Gentry thumbed her iPhone to transfer Ether to her mobile wallet on ApplePay. She’s used the app to shop online for items from Bed Bath & Beyond and Whole Foods Market.

“Before, people said crypto is money that doesn’t do anything,” she said as she displayed her receipts.

Crypto city

Some digital currency advocates want San Antonio city leaders to weave cryptocurrencies into local government.

After serving as a U.S. Army aviation operations specialist, Jalen Nelson, 26, moved here from Silicon Valley to live closer to his family. He also brought with him a mission: “To develop a Web3 ecosystem in San Antonio.”

Last year, Nelson sent 2,000 emails to mayors across the country, including to Mayor Ron Nirenberg, asking to speak with them about blockchain technology initiatives. The local mayor’s office never responded.

Nirenberghas remained silent on the matter. The city didn’t return requests for comment as of press time.

Nelson received one reply, from Chris Swanson, the mayor of Two Harbors, Minn., a town built on the iron-ore business with roughly 4,000 residents north of Duluth. Nelson had never been to the North Shore of Lake Superior, but he spoke with Swanson about funding capital projects with crypto.

More recently, Swanson told The New York Times he supported creating a so-called “decentralized autonomous organization” to attract investors. The Two Harbors city council sent the mayor’s comments to the Minnesota Attorney General to determine whether “a violation of the city code, charter policies or state statute has occurred,” according to the

Though the crypto-ideas aren’t playing all too well in small-town Minnesota, Nelson most likely takes solace in Miami and New York.

Both cities are using CityCoins, an open-source platform where investors can generate crypto-based revenue for city projects — and for themselves. CityCoins relies on people mining the digital tokens on their computers. About 70 percent of the coins they created are distributed among investors, with the other 30 percent going to the cities’ crypto wallets and into government coffers.

Since August, Miami has generated millions from CityCoins. Mayor Suarez recently tweeted that the “first-ever disbursement” from CityCoins totaled $5.25 million for the municipality. The city’s wallet currently holds about $17.4 million.

Nelson believes San Antonio also should partner with CityCoins.

“There’s a huge opportunity with the integration of crypto and government,” he said. “It could raise millions of dollars for the city.”

Gentry and her daughters said they know Nelson — many of the crypto proponents here are at least aware of one another — and they admire his mission to convince local leaders to get on board with cryptocurrencies. But they’re not holding their breath waiting for local leaders to act.

Neither is Asturias.

“San Antonio isn’t Miami, Los Angeles or New York City,” he said. “It’s not Houston, Austin or Atlanta. But it’s still a pretty big city. We’re just not as fast with tech.”

As for Saliba and Perez, they too believe a cryptocurrency “revolution” is coming to San Antonio.

“It’s financially responsible for the city and state to add Bitcoin to their balance sheets,” Saliba said.

Perez added: “Or they’ll get left behind.”

eric.killelea@express-news.net

No Comments Yet