- Crypto twitter is speculating about Paris Hilton’s involvement in Shiba Inu, the competitor of Dogecoin.

- The American celebrity recently became a Bitcoin and Ethereum investor, demonstrated interest in the Shiba Inu metaverse.

- Analysts reveal bearish outlook on Shiba Inu, identifying a descending triangle pattern in the meme coin chart.

Shiba Inu price could plummet lower as analysts predict further bloodbath in the meme coin. Popular American celebrity Paris Hilton has shown interest in endorsing Dogecoin’s competitor Shiba Inu.

Paris Hilton is bullish on Shiba Inu?

Paris Hilton, an American celebrity, socialite and actress, recently expressed interest in cryptocurrencies. Hilton owns Bitcoin and Ethereum and recently demonstrated her interest in the Shiba Inu metaverse.

Crypto Twitter is speculating about Hilton’s endorsement of the Shiba-Inu-themed meme coin. The debate regarding Hilton’s support of Shiba Inu coin was sparked by a Marcie Jastrow’s tweet. Jastrow is a former top executive from Technicolor who recently joined Shiba Inu to work on the project’s metaverse. Jastrow’s tweet cryptically mentioned “11:11”. Hilton posted a tweet with the same number and invited followers to make a wish.

ShibArmy started speculating about Hilton’s potential endorsement of the Shiba Inu coin’s metaverse. Hilton has dabbled in the crypto ecosystem and digital assets. The celebrity dropped a series of autobiographical non-fungible tokens (NFTs) dubbed “Paris: Past Lives, New Beginnings” on the Origin Story marketplace in early 2022.

Influencers notorious for charging large sums of money for endorsement

Before Hilton’s story, a list surfaced online revealing how much major influencers charge for promoting cryptocurrency projects. The spreadsheet dropped big celebrity names like actress Lindsay Lohan, who charges $25,000 for a shill tweet and $20,000 for a retweet. Lohan apparently offers a $35,000 package deal for two tweets and one retweet. The vast majority of names on the list offer a service in which their followers won’t be made aware that the tweet is a part of paid promotion.

Shiba Inu price could nosedive

Meanwhile, the Shiba Inu price chart keeps being the subject of technical analysis research. Analysts have identified a descending triangle pattern. According to Eno Ikenna Eteng, Shiba Inu coin price is at a vulnerable support level and struggling to hold. The leading crypto analyst believes the evolution of this pattern in the Shiba Inu chart implies a bearish continuation of the trend.

In this case, Shiba Inu price could plummet to its all-time low of $0.000000507 soon. A breakdown of the daily chart marks the completion of the descending triangle, and it would open doors to a bloodbath, and a potential drop to $0.00000550.

The analyst identified a bounce is likely if Shiba Inu breaks past $0.00001202, in a move which would invalidate the triangle pattern.

SHIB-USD chart

Ethereum whales continue Shiba Inu accumulation

Despite the bearish outlook on Shiba Inu, largest Ethereum wallet addresses have continued accumulating the meme coin. The 100 largest Ethereum whales are yet to shed their holdings and hold over $5 million in Shiba Inu tokens.

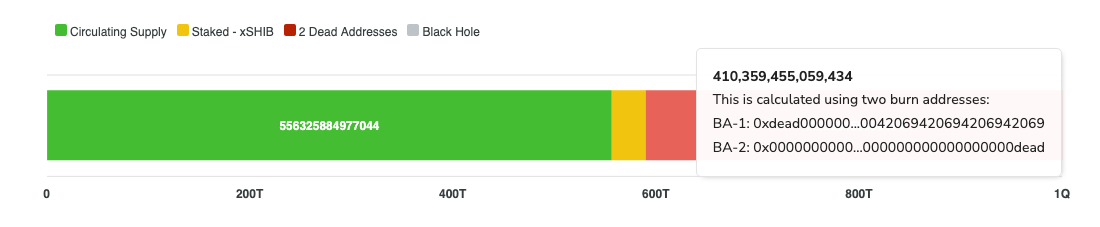

The overnight spike in Shiba Inu burn rate has been identified as a key driver of interest from large wallet investors. 410.36 trillion Shiba Inu tokens have been destroyed so far, based on data from the Shibburn portal.

Shiba Inu burnt supply

How Shiba Inu price can validate the bearish outlook

FXStreet analysts believe Shiba Inu price could validate the bearish outlook through the triangle pattern. Descending triangles are considered a bearish indication for a any asset price. Analysts argue that a 26% downswing could be triggered, with a potential drop to $0.0000074.

Akash Girimath, crypto analyst at FXStreet, argues that hitting a bottom could drive major buying and accumulation of Shiba Inu, though, fueling a recovery in the meme coin. For more information, watch this video:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

No Comments Yet