Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

If you look up the word “meme” in the dictionary, it’s a humorous image, video, or piece of text that is copied, usually with slight variations and spread rapidly by internet users.

Meme coins aren’t too different from this dictionary definition of a meme—they’re nothing more than cryptocurrencies that memes and internet jokes have inspired.

Should you invest in meme coins? While some are ranked among the top cryptos by market cap, potential buyers should understand that most meme coins offer little value, and a few are outright scams.

Featured Cryptocurrency Partner Offers

Limited Time Offer:

Deposit $100 get $10 (US Only)

Cryptocurrencies Available for Trade

20+

Fees (Maker/Taker)

0.95%/1.25%

Cryptocurrencies Available for Trade

150+

Fees (Maker/Taker)

0.40%/0.40%

Cryptocurrencies Available for Trade

170+

What Are Meme Coins?

Meme coins are cryptocurrencies that have been produced as a lighthearted joke. Nevertheless, some meme coins have ballooned in value, gained multibillion-dollar market caps and garnered celebrity endorsements.

While these characteristics suggest that meme coins offer some underlying utility or value, the truth is that nearly all of them lack anything like fundamental value or unique use cases.

Instead, crypto investors often buy meme coins to be part of a community or for entertainment value. The sole use case for most meme coins is pure speculation.

“Meme coins are designed like any other cryptocurrency, like Bitcoin or Ethereum,” says Brain Hernandez, co-founder of trading and investment platform Structure. “The difference is their existence tends to be centered around a viral moment or funny idea, and their value depends largely on how much momentum that concept can generate.”

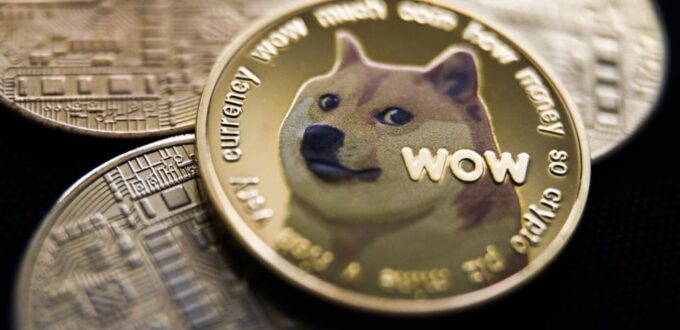

The Original Meme Coin: Dogecoin

The original and most prominent meme coin is Dogecoin (DOGE). Created in 2013 by software engineers Billy Markus and Jackson Palmer, DOGE was branded around a popular meme: the “doge” Shiba Inu dog.

The founders say they created Dogecoin to poke fun at Bitcoin (BTC). The name “doge” is a deliberate misspelling of “dog,” and the founders admit they chose this name to ensure the crypto was “as ridiculous as possible.”

But in what would become a hallmark of other meme coins to follow, Dogecoin began to make a name for itself thanks to a fervent community of users, amassing somewhat of a cult status.

For example, when the Jamaican bobsleigh team qualified for the 2014 Winter Olympics in Sochi, Russia, but could not fund the trip, the Dogecoin community came together to raise around $30,000 for the cause.

The story was picked up by mainstream media outlets, helping to gain further investors and influence.

But it wasn’t until celebrities began endorsing Dogecoin that the price rocketed. The coin’s most high-profile booster is Tesla CEO Elon Musk.

The enigmatic billionaire has continuously promoted Dogecoin. Musk even appeared on a “Saturday Night Live” skit where he referred to himself as the “Dogefather.”

At its peak, Musk’s endorsement propelled Dogecoin to a market cap of $88 billion in May 2021 and became a pop culture phenomenon.

When a celebrity endorsement disappears, these cryptos can come crashing down. Today, Dogecoin’s market cap is only worth a tenth of its all-time high from more than a year ago.

Other Popular Meme Coins

Dogecoin still serves as an inspiration for meme coins. More than 200 such coins have been created since the launch of the original meme coin.

Shiba Inu (SHIB) launched two years ago as the “Dogecoin killer.” The crypto even imitates the Dogecoin branding in so far as using the same Shiba dog. SHIB also saw meteoric growth, rising to a market cap of $41 billion in October 2021.

Numerous other meme coins were created in the hope of creating their own communities and sky-high valuations, but this year has seen prices across the market return to earth, with meme coins among the hardest hit.

Dogecoin is down 60% in 2022, Shiba Inu has fallen 64%, while many of the smaller meme coins have gone to zero and are being abandoned.

How Do Meme Coins Work?

Barriers to entry are exceedingly low for meme coins.

The open-source nature of the blockchain technology underlying these cryptocurrencies means that creators can simply “fork” existing cryptos—essentially copying and pasting the underlying blockchain—and launch online while tweaking something as minimal as the name or logo.

“A meme coin is just a cryptocurrency so that they can be created easily with a few lines of code,” explains Tauhid Zauman, an associate professor at Yale School of Management. “The coin can create its own blockchain or live on an existing blockchain.”

According to Zauman, meme coins are usually promoted by their creators on social media platforms to create initial hype and drive up the price. After that, the price may continue to go up if the coin manages to create a strong community.

With the bull market hysteria driving prices vertical across the market, many meme coins were created to try and capitalize on the craze.

Should You Invest In Meme Coins?

For every Dogecoin, there are many other meme coins that have left retail investors heavily underwater.

Even Dogecoin has fallen 91% from its all-time high, while Shiba Inu is off 84%. Both still carry market caps of $8.7 billion and $6.5 billion, respectively.

Unlike Bitcoin, which is capped at 21 million coins, meme coins often have a high or unlimited supply.

There are more than 135.5 billion coins in circulation for DOGE, and every minute a successful miner receives about 10,000 DOGE, worth roughly $660. That’s a staggering contrast in issuance volume compared with Bitcoin, where approximately 6.25 BTC—worth about $143,000—is mined every 10 minutes.

Meme coins also don’t typically have mechanisms like “burns” that remove coins out of circulation either, so the number of coins in circulation keeps rising. Shiba Inu, for instance, has more than 590 trillion coins in circulation, as of the time of this writing.

Shiba Inu and Dogecoin are considered success stories among meme coins. The fact is most meme coins eventually fade away.

“Nobody remembers the names of Dogecoin’s peers from 2013-2014, which now don’t trade anywhere and eviscerated untold amounts of speculator money,” says Jonathan Zeppettini, international operations lead at Decred.

“We tend to only focus on the winners and ignore the fact that those wins are extreme outliers.”

While the evidence appears stacked against meme coins turning into the next Dogecoin or Shiba Inu, the salivating upside and extreme “fear of missing out” were most evident during last year’s bull market hysteria.

But that does not prevent retail traders from trying to strike it rich. It remains important, however, to consider these more as gambles than investments.

“Most meme coins have gone to zero or failed to take off at all,” says Nick Saponaro, CEO of blockchain startup The Divi Project. “Meme coins should be considered a dice-roll and those putting their money into these speculative assets should do so, with the assumption that they will lose everything they invest.”

Are Meme Coins Safe?

While memes are marketed as fun and light-hearted, there can be a dark side to the cryptocurrency editions.

Not only are prices extremely volatile, with many meme coins falling 99% or even to zero in the current bear market, but many accusations of foul play and bad intentions against creators, who are often anonymous.

Zeppettini highlights several incidents where founders have been known to “create new coins, control 100% of the supply right out of the gate, and then focus exclusively on creating hype so they can unload their inventory.”

“Buyers of these tokens can be unsuspecting retail participants who may not fully comprehend the underlying dynamics of the token in question but just sees paid celebrity endorsements on social media or bot-driven activity that makes it seem like the asset is ‘trending,’” he says.

That’s not the only concern. Many meme coins are often held by a small group of people who own large concentrations. According to the data from IntotheBlock, 48% of DOGE is controlled by seven crypto wallets. That number is even more stark for SHIB, where 69% of ownership is concentrated among 15 wallets.

With such a high concentration, a large investor could manipulate the market with their position or send the price of the coin crashing down when they cash out their holdings.

While making money on meme coins is technically possible, it’s not a sure thing. These cryptos are subject to more volatile factors than mainstream cryptos like Bitcoin and Ethereum, and the value of a meme coin can plummet overnight.

No Comments Yet