Premium

Premium9 min read . Updated: 24 Aug 2022, 04:00 AM IST Leslie D’Monte, Prasid Banerjee, Ranjani Raghavan

- Exchanges are facing ED raids and investors are struggling to withdraw money from their wallets

NEW DELHI/MUMBAI : A senior executive from an Indian fintech is in a bind, as about ₹20 lakh of his money is “stuck” in cryptocurrencies. “For the past month, many exchanges are not allowing users to withdraw crypto from their wallets,” rued the executive, who did not want to be named. Even exchanges not in the cross hairs of authorities like the enforcement directorate (ED) “have either stopped users from withdrawing crypto, or at the very least alerted them about long delays in executing the trades,” said the executive, who is an Indian citizen based in Dubai.

A 22-year-old engineering student from Bengaluru, who also runs a small digital marketing firm, is in a similar muddle. The student, who did not want to be named, had invested around ₹6 lakh in cryptocurrencies till date, “along with contribution from some friends”. He has gradually begun moving the holdings from Indian crypto exchanges to international ones to avoid paying the tax deducted at source (TDS). To save more money, he also moves the cryptocurrencies (mostly bitcoin and ether) from international exchanges to a peer-to-peer (P2P) platform, where he exchanges them for e-commerce gift cards.

View Full Image

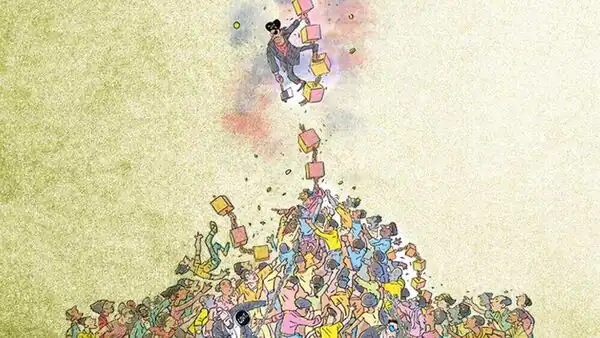

Till even the beginning of this year, the crypto story in India was riding high on a wave of curiosity and interest, celebrity ads and influencer-speak. Like the two people cited above, a little over 100 million people in India had gone on to own assets in the form of digital currency. But the gloom and uncertainty now is a striking contrast, as the government tightens scrutiny, trade volumes crash, and stories of crypto frauds and ED raids take the shine off the industry.

View Full Image

The grey areas

While the Indian government and the Reserve Bank of India (RBI) have warmed up to the use of blockchain—the underlying distributed ledger technology (DLT) for native cryptocurrencies and non-native crypto tokens—they remain uncomfortable with unregulated cryptocurrencies.

Native cryptocurrencies such as bitcoin and ether are issued directly by the blockchain protocol on which they run, and hence the term ‘native’. Non-native crypto tokens are created by platforms that build atop blockchains for a specific purpose. These include utility tokens (to pay for a product or service of a company), governance tokens (where holders have voting power in decisions about new feature proposals and changes to a project’s governance system), security/equity tokens, reward/loyalty tokens (like Web3 tokens to reward contributions to the development of the platform), non-fungible tokens or NFTs (digital certificate of ownership of a unique asset on the blockchain), and even stablecoins like tether (backed by fiat currencies like the US dollar). For example, social crypto token GARI, backed by Bollywood actor Salman Khan, was launched in October 2021 to help Indian creators monetize their content over a short video application, Chingari. The company claims to have over 1 million active wallet users.

RBI, which is mulling its own central bank digital currency—a legal tender issued by a central bank in a digital form—does not trust native cryptocurrencies. It has its reasons. While there are an estimated 20,000 cryptocurrencies in circulation, only 1,500-odd coins are regularly traded. The others are dismissed as ‘shitcoins’, which are mostly used to cheat people. On 10 January, for instance, the ED conducted several raids to unearth a massive crypto scam involving a fake crypto called Morris coin that was floated to dupe millions of investors in Kerala, Tamil Nadu and Karnataka of over ₹1,200 crore.

View Full Image

RBI has long been suspicious of crypto. In 2018, it banned all entities regulated by it from dealing in virtual currencies. The Supreme Court quashed this order in 2020. But the apex bank said that banks and financial institutions could “continue to carry out customer due diligence processes” such as know your customer (KYC), anti-money laundering (AML), combating of financing of terrorism (CFT) checks, and “ensure compliance with relevant provisions under Foreign Exchange Management Act (FEMA) for overseas remittances”. Banks took the cue and tightened the screws on crypto transactions routed through them, even as the government mandated that proceeds from the sale of cryptocurrencies will be treated as income (30% tax rate) by tax authorities, and investors will pay additional 1% TDS on crypto transfers. But merely taxing a virtual asset does not make it legal tender. The government listed the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, in the winter session of Parliament in December 2021, but it is yet to be tabled.

The WazirX tangle

Meanwhile, some crypto exchanges continue to flout rules. On 28 March, the Central Goods and Services Tax (CGST) authority recovered ₹95.86 crore from 11 crypto exchanges that collectively evaded ₹81.54 crore in GST, minister of state for finance Pankaj Chaudhary said in a written response to a question in the Lok Sabha. Traders in cryptocurrency pay a GST rate of 18% in India.

On 6 August, ED conducted searches on one of the directors of Zanmai Labs Pvt. Ltd, which operates the cryptocurrency exchange WazirX, and froze the exchange’s bank balances worth ₹64.67 crore in a money laundering investigation. The ED, among other things, alleged that “…No physical address verification was done (read: KYC), and neither was there any check on the source of funds (read: off-chain transactions) of their clients”.

A blockchain is a shared, immutable (cannot be altered), distributed ledger that can track orders, payments, accounts, production, etc. Hence, most courts and law enforcement bodies accept blockchain records as legal proof of transaction histories. A crypto transaction that does not take place on the blockchain is called ‘off-chain’, which cannot be traced unless the parties involved cooperate.

Supreme Court lawyer N.S. Nappinai says news reports of ‘off-chain’ dealings hint possibly “at a ‘hawala’ transaction and prosecutions for money laundering are probably with reasonable cause.” In a press statement, ED also alleged that Zanmai Labs had entered into a “web of agreements with Crowdfire Inc. in the US, Binance (Cayman Islands), and Zettai Pte Ltd in Singapore to conceal its ownership of the cryptocurrency exchange. Zanmai Labs denies this.

Things got murkier when Changpeng Zhao, CEO of Binance, tweeted that his company does not own equity in Zanmai Labs. Nischal Shetty, founder and chief executive officer of WazirX, responded with a tweet: “WazirX was acquired by Binance; Zanmai Labs is an Indian entity owned by me and my co-founders; Zanmai Labs has licence from Binance to operate INR-crypto pairs in WazirX; Binance operates crypto-to-crypto pairs, processes crypto withdrawal”.

Even as the ED investigation is on, the stalemate continues. An employee, who had worked at WazirX since its first day but quit the company recently, said, “The company has been embroiled in controversy every time the rest of the crypto industry has come under fire. As a result, employees have become somewhat immune and do not worry about their jobs.” The person, who did not want to be named, added that “Binance’s involvement with WazirX was minimal. As a result, we operated like an independent company. Even our salaries came from the company’s revenue in India and not from Binance”.

Another employee, who joined WazirX last year, told a different story. “While Binance is claiming it has nothing to do with WazirX now, last year we received Apple Watches and AirPods as gifts from Binance as part of the exchange’s anniversary celebrations in July 2021″. When contacted, a Binance spokesperson responded, “Binance celebrates its achievements and anniversaries with the Binance community, which includes our users and partners. …This does not mean that WazirX employees, or anyone in the community for that matter, are Binance employees. WazirX is run by Zanmai Labs, and Zanmai Labs is not owned by Binance.”

What’s worrying WazirX employees, says the person cited above, is not the confusion over its ownership but “the lack of trading volumes at Indian exchanges since the government started levying taxes on transactions”. Indeed, trade volumes on crypto exchanges have dropped over 50% over the last couple of months. Sathvik Vishwanath, co-founder and CEO of cryptoexchange Unocoin, asserts that “the government should lay down clear rules which we can then accept, failing which it will lead to a lot of misinterpretation on both sides”.

Out of the regulatory mire

India is “still grappling with the form, structure and its very position qua cryptocurrencies”, Nappinai says, but believes it is “important that we take a definitive stance, whatever that may be and do so immediately”. In doing so, she suggests “a nuanced approach”. “The narratives of banning have been equated to the ‘off with their heads’ syndrome. The very stakeholders who are most affected, i.e., investors in cryptocurrency, are being instigated to oppose any form of restraint or regulation. Legal and regulatory frameworks also cannot be built on assumptions that wrongs will be righted later or in a staggered manner,” asserts Nappinai.

Regulatory risks and cyclicality have always been key considerations when investing in centralized exchanges, despite the “extremely profitable business models”, argues Nitin Sharma, co-founder of Antler India and global Web3 lead of Antler, a VC firm keen on the Web3 ecosystem. “Since 2017, I have been an advocate for a strong regulatory framework (as opposed to a ban), in the absence of which all institutional or retail investors end up relying on self-regulation mechanisms, which can often fall short,” he says. He acknowledged that the recent developments “have certainly created more confusion and eroded trust”.

“Investor confidence is shaken,” acknowledges a venture capitalist (VC) who is also on the cap-table of one of India’s crypto exchanges and has invested in cryptocurrencies. The VC, who did not want to be named, believes his firm’s “investment is safe and can survive the crypto downturn”. “These are evolving areas of tech. They are developing so quicky that it is not easy for a regulator,” the investor reasoned, adding, “Eventually, authorities do take a balanced view”.

But will that impact investments in Web3 (those that use decentralized blockchains, cryptocurrencies, and NFTs) companies too? Pareen Lathia, co-founder of Buidlers Tribe, a Web3 incubator, isn’t concerned. “Most VCs and institutional investors are fairly diversified and there is a lot of interest in this space,” he said. Underscoring the need to decouple cryptocurrencies from Web3 tech, he explained, “Crypto exchanges are not even Web3 businesses…Over the last month, DAOs (decentralized autonomous organizations), creator economy, and metaverse startups have seen an uptick in funding. The DeFi (decentralized finance) sector is much more mature and is also receiving significant interest.”

Antler India’s Sharma, too, believes that “as a pre-seed focused global investor focused on a 5-10-year timeframe”, his firm will stay “mostly focused on software, data and middleware startups, creating the essential infrastructure for the new Web3 economy”. Nappinai concludes that while the future of crypto will “depend on what use cases, if any, the government may decide on, with respect to blockchain”, India “has to now lead from the front through legal frameworks that enable instead of being an impediment”.

Catch all the Business News, Market News, Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

Subscribe to Mint Newsletters

* Enter a valid email

* Thank you for subscribing to our newsletter.

No Comments Yet