The FTX collapse has sent shockwaves to the non-fungible tokens (NFTs) world, too, as celebrity investors like Michael Jordon and Justin Bieber have begun to suffer significant losses in the value of their signature digital collectibles and holdings.

Key Takeaways

- The NFT market is dropping in value amid the market slump brought on by the collapse of the FTX cryptocurrency exchange.

- Several celebrity NFT investors and endorsers have been affected, including professional athletes, performers, and supermodels such as Michael Jordan, Justin Bieber, and Tom Brady.

- The floor prices of all major NFT collections have dropped by significant amounts from their all-time highs earlier in 2022.

Michael Jordan Loses Over 90%

Former NBA star Michael Jordan is the latest victim, as the basketball legend’s “6 Rings” NFT collection had lost more than half of its value by mid-November. He released his own NFT collection in March 2022, with 5,000 non-fungible tokens available to buy. The collection was launched on Solana-based platforms HEIR and MagicEden.

The Solana network, backed by Alameda Research, a crypto trading firm affiliated with FTX that is being wound down, also crashed after the FTX collapse. The native token of the network, SOL, dropped 25% in the past week. This development subsequently hammered the value of Jordan’s NFT collection. In March, each NFT was sold at an average of 16.99 SOL, but the price of Solana dropped dramatically, resulting in a net loss of over 92%.

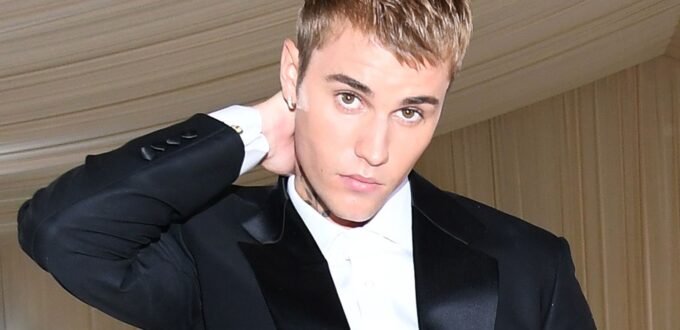

Bieber’s $1.3 million NFT is Now Worth $69,000

Popular singer Justin Bieber is another victim of the NFT slump. In January, he paid 500 ETH or $1.3 million for his Bored Ape Yacht Club (BAYC) NFT, which has dropped to $69,000 as of Nov. 17 amid the crypto and NFT markets’ turmoil. The BAYC collection’s floor price—the price of the cheapest NFT in the collection—is 58.1 ETH (Ethereum’s native token), or about $75,000.

Tom Brady Faces Lawsuit

The collapse of the FTX crypto exchange hit NFL star Tom Brady, who lost big after taking an equity stake in the exchange. Tom Brady and his then-wife, Brazilian model Gisele Bündchen, made a large stake investment in FTX in 2021, after already announcing a partnership with FTX CEO Sam Bankman-Fried in 2020. Now Brady is among celebrities who are facing a class-action lawsuit that was recently filed against FTX founder.

Coachella NFT Stuck on FTX

The celebrity-studded Coachella Music Festival may be facing an even bigger problem. Its NFTs sold for $1.5 million, but they are now “disabled” on FTX amid the exchange’s bankruptcy filing. Users could not withdraw Coachella NFTs and other assets from the platform as of Nov. 17. Coachella’s team has stated that they are actively working on solutions, but the freeze is a blow for their tokens.

The Bottom Line

The FTX meltdown has reduced the worth of well-known collections such as Bored Ape Yacht Club (BAYC) and CryptoPunks. Two weeks ago, the BAYC collection’s floor price was $101, 834 which has fallen to $60, 873. Another blue-chip NFT collection, CryptoPunks, had its floor price at $103, 041 two weeks ago, which has dropped to $79, 769 as of Nov. 17. It’s unclear how long the onslaught will continue, but NFT investors appear to be among the worst hit.

No Comments Yet