David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Crypto, shares the fund’s regular take on what’s happening in the fast-changing and volatile cryptocurrency space.

For our final chat with Apollo for the year, the focus landed on a crypto sub-sector that’s relatively new to us – NFT finance, or NFTfi (which also happens to be the name of a specific NFT lending/borrowing platform).

NFT finance is, very basically put, the combination of NFTs and DeFi. And it’s a niche that’s seeing a crop of protocols begin to emerge that aim to increase the liquidity, yield and overall financial utility of NFT assets.

One NFT finance project that Apollo Crypto is particularly bullish on (having made a seed-round investment in November), is called NFTPerp. And that’s essentially a perpetual futures decentralised exchange for NFTs.

Among others to watch, Apollo’s David Angliss also mentions Sudo Swap, an AMM for NFTs; NFTX, which facilitates the tokenisation of NFT collections; Uniswap (the popular DEX/AMM is now incorporating NFT aggregation functionality across multiple marketplaces); and Insrt Finance, which provides NFT yield vaults.

We’ll cover NFTPerp in a bit more detail in a sec, but one thing Angliss was keen to emphasise is that, even though NFTs have suffered a serious decline this year, there is a lot going on with this technology and a hell of a lot in development that provides a potentially exciting narrative for 2023.

“There’s been loads of innovation in the NFT space over the past 12 months,” the analyst noted. “But NFT technology converging with DeFi, in particular, is really exciting to see.

“There’s a recent [members only] Delphi Digital NFT report that attests to this and covers the bullish thesis for NFTs really well,” he added, before sharing the document with Stockhead.

The report is indeed incredibly detailed and we can’t share it all here unfortunately. But if you’d like to know what some of Delphi Digital’s independent “institutional-grade” crypto/blockchain researchers are expecting from the NFT sector, skip to the end of this article where we briefly cover that.

What is NFTPerp?

“NFTPerp is a protocol that essentially allows users to speculate (go long or short) on the floor price of NFT collections, and with any amount in ETH” explains Angliss, adding:

“Imagine having direct exposure to the Bored Ape Yacht Club, for example, without having to fork over 60 ETH to buy an NFT.

“This will enable many more people to participate in the economy. Conversely, the ability to hedge NFT exposure will make it less risky for investors to own NFT assets and bring in large, sophisticated players.”

As NFTPerp wrote in one of its explainer articles:

“There is no way to short NFTs at the moment. NFT traders can only buy low and hope to sell high. (And Ape holders don’t have a way to hedge their position.)

“Potentially, a lot speculative trading volume can be captured.”

Can leverage be used with NFTPerp? Yes, confirms Angliss. Traders can long or short NFT collections using NFTPerp with as little as US$5 and can use up to 5X leverage. If they’re “degen” enough, that is.

Making money from NFTs in bear markets

One of the most compelling parts about this concept is that it provides traders and NFT enthusiasts alike with an opportunity to make money from the sector no matter the market conditions – bull or bear.

“It’s a really good point about this,” says Angliss. “It will help traders and collectors to stay active and engaged with NFT collections using a combination of long and short strategies when there’s low and high price volatility.

“It also means that if you really are a big believer in a particular collection but are priced out of buying the asset, then you can still long the project and benefit from its potential success.

“When certain derivatives DeFi projects launched into the market, they did exceptionally well (for example dYdX and GMX). So there’s no reason why a protocol that offers similar services, but focused on NFTs, can’t do just as well.”

How are NFTPerp’s floor prices tracked?

As NFTPerp explains it, with perpetual futures, you don’t need real NFTs as collateral. And so the perpetual futures contracts simply track the floor price of the underlying NFT collection.

That’s done via a virtual AMM (automated market maker) which receives real-time spot-market price information from a Chainlink oracle.

“We define our True Floor Price as a tamper-proof NFT price oracle with robust statistics and backed by sales between real buyers and sellers in a given NFT collection,” writes NFTPerp.

It’s super early days for the NFTPerp protocol, which is currently in its beta-testing phase and open to anyone interested who joins the project’s Discord community.

Delphi Digital’s major themes for the NFT sector in 2023

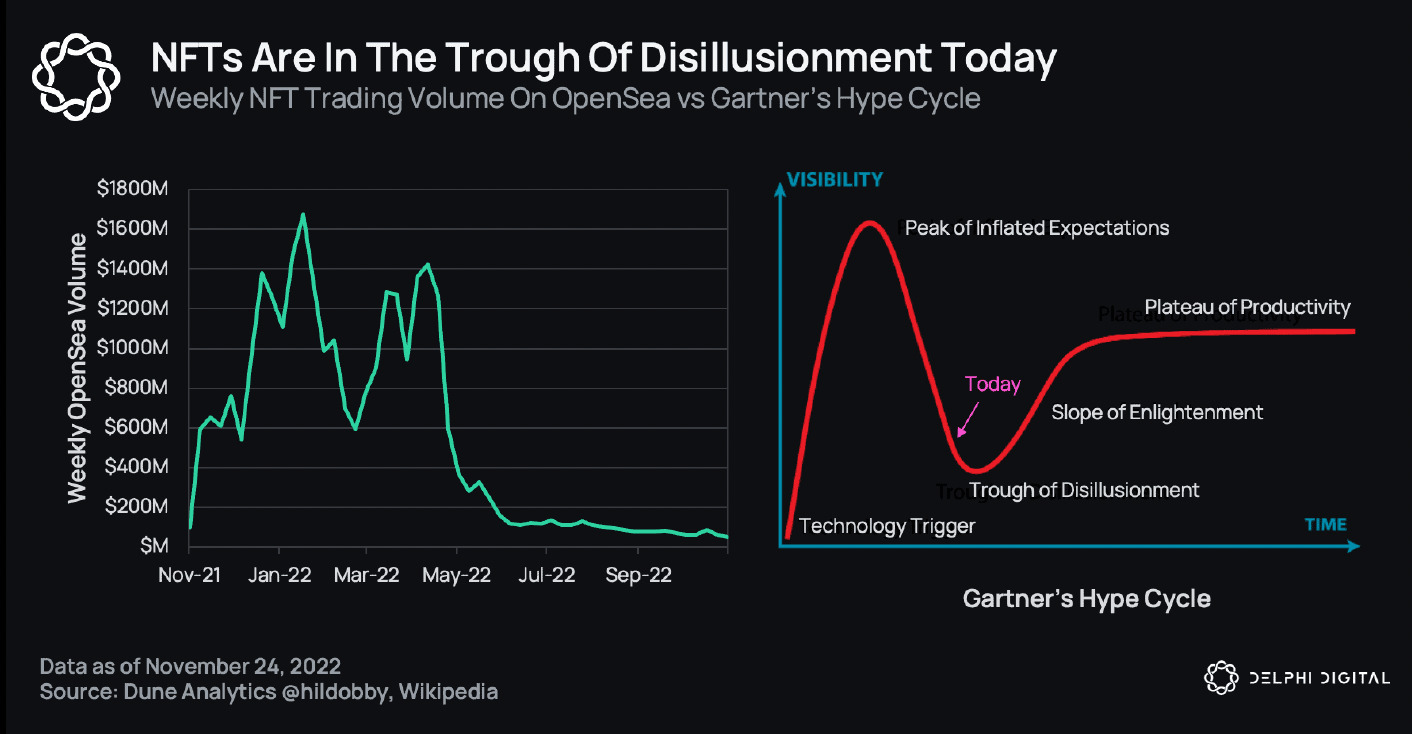

As mentioned further above, it’s been a rough ride for NFTs in 2022. In fact, judging by Delphi Digital’s chart below, the sector has, late last year and earlier this year, moved past a double peak of “inflated expectations” and is currently lying in a “Trough of Disillusionment”. Which doesn’t sound pleasant.

This is in accordance with what’s known as “Gartner’s Hype Cycle”, measured against weekly trading volume on the leading NFT marketplace OpenSea.

However, if the cycle theory continues to play out for the NFT space, it could well pick itself up out of said trough and rise into some “Slope of Enlightenment” upside before too long.

Here then, is what Delphi Digital is eyeing on the non-fungible road ahead…

1. A “Cambrian explosion” for NFT finance

“Greater financialisation unlocks a new level of utility for NFTs. It brings new participants into the space (market markets, lenders, etc.) which are necessary for NFTs to truly become an established asset class,” reads the Delphi report, adding:

“We will look back at 2022 as the year the foundation was laid for NFT finance to take off.”

2. The great unbundling of NFT marketplaces

In short, this Delphi thesis predicts the decline in dominance of OpenSea and its main competitors and the rise of “vertical” specialised NFT marketplaces with focuses such as PFPs, art, virtual land, music and fashion.

3. NFTs to go mainstream

“More brands and big tech companies will integrate NFTs into their business models in meaningful ways, resulting in a flurry of creative use cases for NFTs,” believes Delphi researchers.

“Crypto’s mainstream moment is close at hand. Never before in our history have there been hundreds of millions of potential users interfacing with blockchains. Many people’s first step into crypto and NFTs will be through these Web2 platforms – and some may not even realize they own NFTs.”

4. NFT social tokens will rise

Citing the proliferation of social tokens this year launched as ERC-20s (e.g. football tokens), Delphi sees a shift to NFTs within this particular niche-within-a-niche. It NFTs becoming the preferred social-token medium.

“NFTs are well-suited to be the primary assets used for social flexing and digital identity.

They can also function as a membership pass for token-gated access. The design space and potential for gamification with NFTs are huge.

“A huge wave of creators, celebrities, and sports brands will launch NFTs. This will be larger than anything we have seen thus far.”

5. Demand for “phygitals” will increase

Phygitals… they’re a kind of symbiotic connection between physical items and their digital versions… is that right? Delphi Digital explains the concept well:

“The lines between our digital and physical worlds are blurring. Objects can now exist in the metaverse and the real world, linked through technology. NFTs are the bridge, functioning as an immutable representation of authenticity and ownership in both realms.

“They empower physical items with new utilities, such as unlocking token-gated benefits and unique AR experiences,” continued the report.

None of the information presented in this article represents financial advice.

No Comments Yet