These days, the capital markets are facing a huge level of scrutiny. Ever since the COVID pandemic, new retail investors and traders have brought investment dynamics into the spotlight.

In this article, we’ve gathered some of the most discussed topics among retail investors and trader communities and made some connections.

FTX

Sam Bankman-Fried co-founded Alameda Research, a company that acted as a quantitative trading firm, in 2017. A few years later, Bankman-Fried decided to start the cryptocurrency exchange, FTX, to fund Alameda Research’s initiatives.

Figure 1: Bankman-Fried decided to start the cryptocurrency exchange, FTX, to fund Alameda Research’s initiatives.

Forbes

Within a few years, FTX had become one of the top three largest crypto exchanges in the world. At one point, it was even the largest by volume, with over 1 million users.

However, the criminal misuse of its customers’ funds causes a major crisis that many experts have compared to the notorious Enron scandal.

FTX was once endorsed by celebrities like Tom Brady and Stephen Curry. But now it has been shut down for selling unregistered securities. And Bankman-Fried has been thrown into jail.

According to some legal experts, FTX was taking part in an investment fraud that pays existing investors with funds collected from new investors and constitutes a…

Ponzi Scheme

This type of scheme was named after Italian con artist Charles Ponzi, who tricked victims into believing that their profits were coming from a legitimate business.

Figure 2: Ponzi scheme was named after Italian con artist Charles Ponzi.

Creator: Bettmann | Credit: Bettmann Archive

A Ponzi scheme can make up for the fact that a business is unsustainable, because new investors continue to contribute extra funds. Therefore, nobody knows the assets are non-existent assets as long as most investors do not demand an immediate return on their contributions. One of the most notorious Ponzi scheme cases came to light precisely because of this.

With the collapse of the markets in 2008, a massive Ponzi scheme was exposed due to a large number of people attempting to withdraw their investments earlier than a certain Wall Street firm had planned. This firm was headed by…

Bernie Madoff

The Bernie Madoff investment scandal broke when the financial advisor admitted that his entire fortune consisted of a mega-elaborate Ponzi scheme involving billions of dollars.

Figure 3: Bernie Madoff admitted that his entire fortune consisted of a mega-elaborate Ponzi scheme.

AP Photo

Madoff, who was arrested, claimed to have incurred liabilities of about $50 billion. However, he was not the only one involved in the illegal scheme. One arm of his business was run by members of his family, who ran one of the biggest market makers on Wall Street at the time.

A few decades ago, Madoff was the forerunner of a practice that consisted of paying brokers to execute his clients’ orders, which many called “a legal kickback.” Through this, Madoff achieved distinction as one of the largest dealers on Wall Street, trading about 15% of transaction volume.

The practice endorsed by Bernie Madoff is known as…

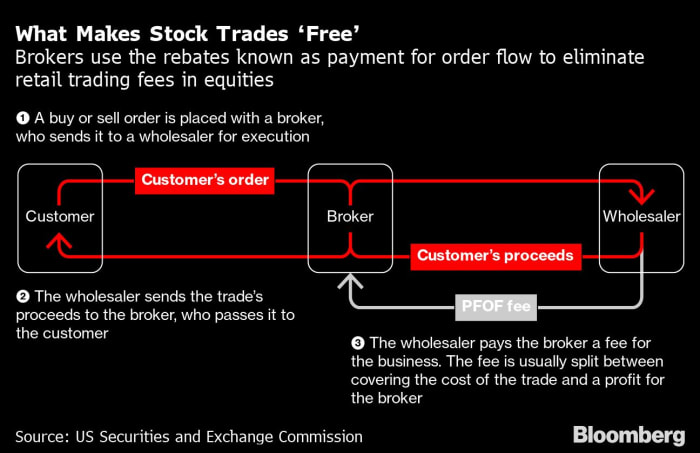

Payment for Order Flow (PFOF)

This compensation between brokers and market makers is viewed favorably by some market participants and unfavorably by others. This practice is legal in the United States, although in countries like Canada, the U.K., and some others, it is not allowed.

Figure 4: Brokers use the rebates known as payment per order flow to eliminate retail trading fees in equities.

Bloomberg | US Securities and Exchange Comission

Bernie Madoff explained the practice by making the following analogy: “If your girlfriend goes to buy stockings at a supermarket, the racks that display those stockings are usually paid for by the company that manufactured the stockings. Order flow is an issue that attracts a lot of attention but is grossly overrated.”

Some pro-PFOF experts argue that PFOFs help foster low-cost trading and provide more efficient execution. For example, this practice made commission-free brokers possible.

The anti-PFOF crowd believes that the practice fosters conflicts of interest. Payment for order flow may cause executable orders not to be executed because they are routed through market makers that are paying the highest amount to the broker. And this may provide less clarity for retail investors than for institutional investors.

Market makers pay brokers the right to fulfill small orders from retail investors by profiting from the bid-ask spread and distributing a portion of that profit to brokers. Thus, some of the major e-brokers that offer commission-free trading have the vast majority of their revenue almost coming from payment for order flow.

These brokers include E*Trade, Webull, and…

Robinhood Markets

Trading platform Robinhood Markets (HOOD) – Get Free Report had one of the most talked-about initial public offerings (IPOs) of 2020 when it debuted on the stock market. As part of the broker’s “democratize finance for all” mission, it offers commission-free trades to its clients.

Figure 5: As part of the broker’s “democratize finance for all” mission, Robinhood offers commission-free trades to its clients.

Shutterstock

In January 2021, Robinhood and some other brokers got into a controversy with retail investors after restricting the trading of some stocks that were being targeted by socially mobilized investors.

The reasons for this restriction included the failure to meet collateral requirements. This was brought to light thanks to scrutiny from the House Committee on Financial Services.

As revealed by the committee’s year-long investigation, during the Meme Stock Market Event, commission-free broker Robinhood exhibited problematic business practices involving inadequate risk management and a culture in which it prioritized its growth over the stability of the markets.

However, at the height of the meme craze in 2021, many theories emerged on social media platforms regarding the hedge fund Citadel and the…

6. GameStop Short Squeeze

In January 2021, video game retailer GameStop‘s (GME) – Get Free Report stock climbed nearly 2,000% to an all-time high. The event caused major financial consequences for short sellers. At the time, about 140% of GameStop’s outstanding shares were being sold short.

Figure 6: In January 2021, video game retailer GameStop’s stock climbed nearly 2,000% to an all-time high.

Getty Images

However, the short squeeze was triggered mainly by retail investors using online forums such as Reddit. The event later became the subject of a Netflix documentary, Eat the Rich: The GameStop Saga.

One of the major hedge funds that had sizable short positions in GameStop at the time was Gabe Plotkin’s Melvin Capital. During the height of GameStop’s short squeeze, the fund received a $2 billion investment from Citadel.

Through the GameStop short squeeze, Ken Griffin, who runs the Citadel hedge fund and Citadel Securities – one of the largest market makers in the U.S. – was also thrust into a payment-for-order-flow controversy with commission-free broker Robinhood.

Because Robinhood had halted the trading of GameStop shares, users of the platform alleged that Citadel Securities may have instructed Robinhood to do so. This ended up involving the two parties in a hearing held by the House Financial Services Committee.

Ken Griffin denied any misconduct. And in November 2021, a U.S. District Court dismissed a class action suit against Robinhood and Citadel, ruling that there was no evidence that the two had colluded.

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting the Wall Street Memes)

No Comments Yet