Block 1: Key news

- Russia, Iran consider launching gold-backed stablecoin

Iran’s central bank is considering the possibility of creating, with Russian participation, a digital token to facilitate trade in the Persian region, according to a report citing the head of the crypto industry organization in the Russian Federation. Stablecoin could be accepted as a means of payment in international settlements, said Alexander Brazhnikov, executive director of the Russian Association of Cryptoeconomics, Artificial Intelligence and Blockchain (Racib), in an interview with the Vedomosti business daily. Russia and Iran, both under Western economic and financial sanctions, have turned to crypto-assets as a way to circumvent the restrictions.

- Société Générale uses Decentralized Finance (DeFi)

As a reminder, in the summer of 2022, MakerDAO, a decentralized finance platform backed by the Ethereum blockchain added the bank’s digital asset-focused subsidiary, Societe Générale – Forge (SG-Forge), to its vaults with a credit limit of $30 million in DAI stablecoins. The vault is backed by €40 million in bonds in the form of “OFH tokens” – securities in the form of tokens issued on Ethereum and backed primarily by Moody’s AAA-rated real estate loans – making the loans over-guaranteed. So Société Générale’s crypto arm used its vault by borrowing $7 million in stablecoin DAI. A strong sign of the presence of traditional finance entities in decentralized finance.

- Genesis files for bankruptcy

“Genesis could be on the verge of filing for bankruptcy as early as this week,” Bloomberg reported earlier this week. The cryptocurrency lender, which is ultimately owned by Digital Currency Group, found itself in a perilous financial position after suffering from exposure to a number of previous bankruptcies. Not only was Genesis hit hard by the demise of Three Arrows Capital (3AC), but it was stripped of $175 million after the collapse of FTX. It now owes $900 million to 340,000 Gemini Earn customers, and there was no indication that a settlement had been reached. Withdrawals have been suspended at Genesis since November – a move that often serves as a harbinger of impending bankruptcy proceedings. The company filed for bankruptcy yesterday, reporting that it has more than 100,000 creditors and debts of between $1 billion and $10 billion.

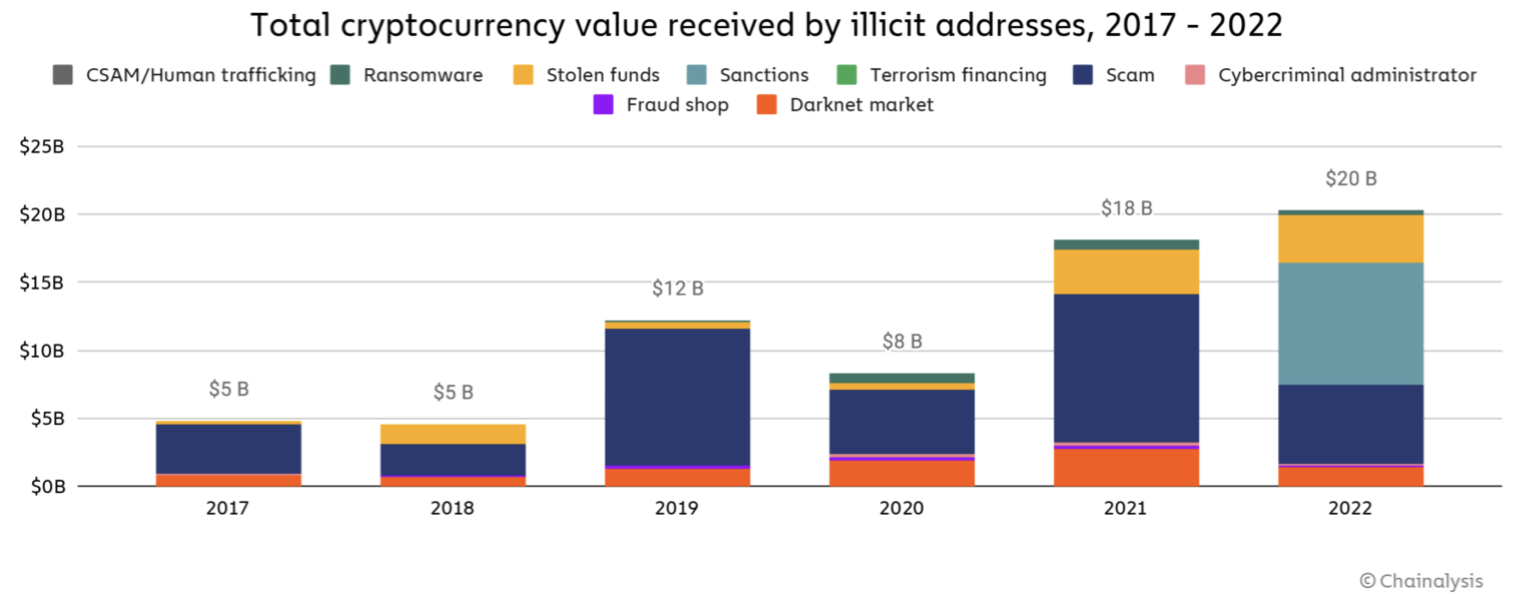

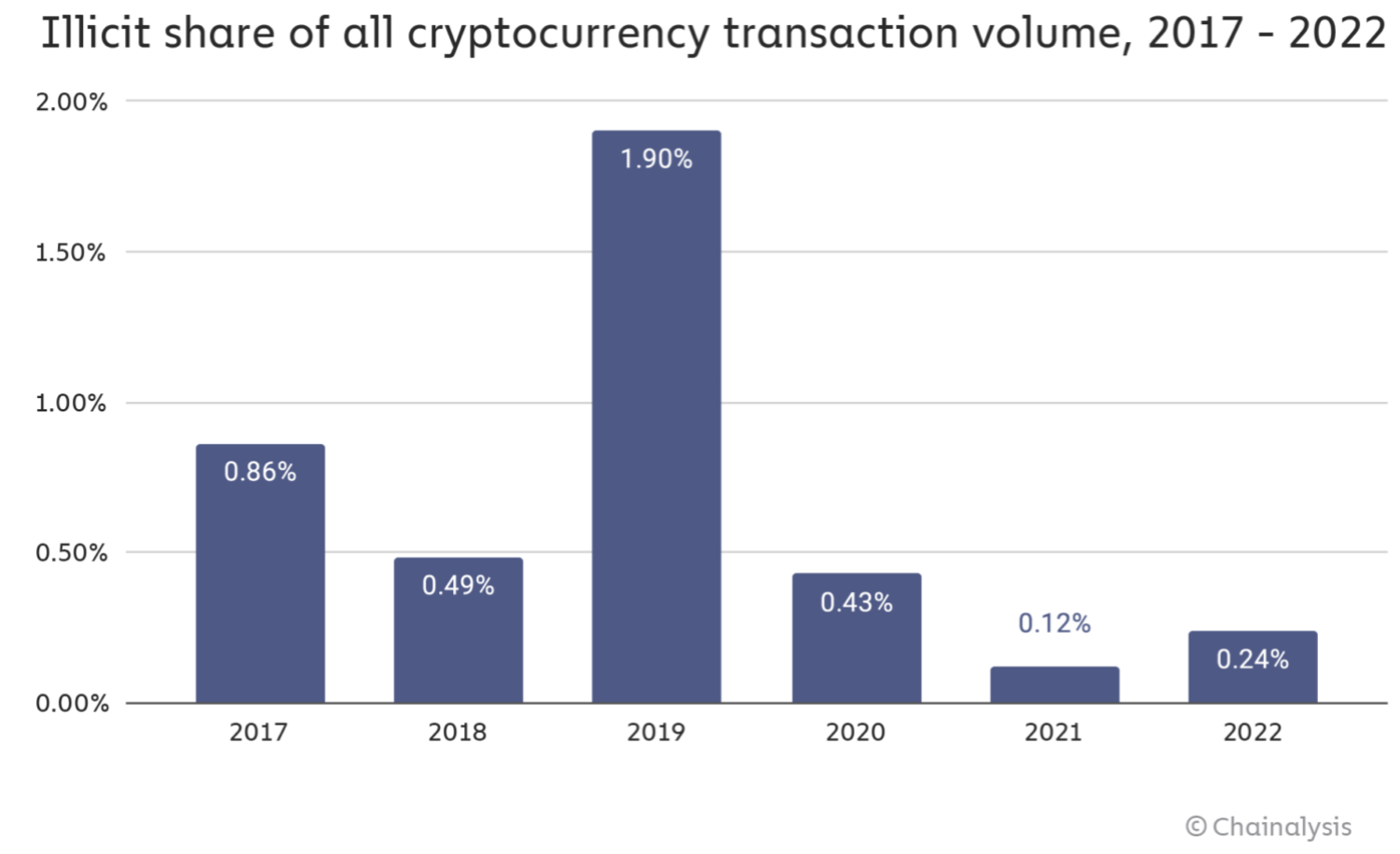

- 0.24%: this is the volume of illicit cryptocurrency transactions in 2022

According to a recent Chainalysis study, illegal financial transactions involving cryptocurrencies in 2022 have increased for the second year in a row, reaching $20.1 billion (digital assets had facilitated $18 billion worth of criminal prosecutions in 2021).

Volume total des cryptomonnaie transféré par des adresses illicites

Chainalysis

Percentage of illicit transactions to total volume

Chainalysis

On the other hand, this data does not take into account the entirety of all illegal activities outside the blockchain. Typically, frauds related to companies that collapsed in 2022 such as Three Arrows Capital, FTX or even Celsius are not fully taken into account in the analysis. Also, simple cryptocurrency transactions that involve a drug payment, for example, appear as a single transaction on the blockchain, so it is difficult to quantify all illicit transactions. Nevertheless, this gives an overall trend of on-chain fraud that is still relatively low compared to some fiat currencies.

Block 2 : Crypto Analysis of the week

After a chaotic year on the side of the cryptosphere, going through the disastrous performance of digital assets, then the massive arrests of 3.0 fraudsters and finally the collapse of many platforms (Three Arrows Capital, Celsius, FTX, Genesis…), among others, the crypto-industry is back at the World Economic Forum in Davos. So was this event an opportunity for the players on site to restore the image of crypto-currencies with billionaires, bankers and heads of state?

So it’s already happening with a ubiquitous presence of crypto industry players in Davos, from official signs, city stores, cafes, yoga studios, the cryptosphere’s promotional event spaces were everywhere. Representatives from Tether, the issuer of the leading stablecoin (a widely used crypto currency pegged to the U.S. dollar) in terms of capitalization, USDT, even handed out free pizza at a conference. A little light on the cryptosphere’s image, you might say.

Circle, the issuer of the world’s second largest stablecoin, USDC, doubled its investments to mark its presence in Davos. Beyond their presence in the windows of The Promenade where Circle’s building carried the slogan “Solving Real World Problems”, the speech focused on topics such as trust and accountability while calling the post-Luna-3AC-Celsius-FTX-Voyager-Genesis period a “great reset”. But many remain skeptical about the crypto topic, including members of the government and traditional finance.

“This feels like a last gasp for crypto,” said Jason Furman, an economist at Harvard University and former adviser to President Barack Obama. “It’s like an ad I saw in a magazine saying the housing market has never been hotter. You know, these people paid for that ad six months earlier, and by the time it came out, it was just wrong. It’s the crypto at Davos,” he added. Hilary Allen, a law professor at American University, took a slightly less threatening tone, but still without much glimmer of optimism. ” What the crypto industry really wants is to be established – to be integrated with traditional finance, to be regulated, but on its own terms. There was less discussion of Sam Bankman-Fried than one might expect. The 30-year-old fallen wunderkind has become an all-purpose bogeyman, the one not to be named except as a cautionary tale. In the end, judging by the conversations at Davos – where the word “tokenization” was uttered with remarkable frequency by people ranging from finance ministries to buy-side firms – the general message was this: A lot of people want to own and control their data, including their assets, and blockchain isn’t just about memecoins and scams.

Oh yeah, and the orange Mercedes with the bitcoin logo belonged to Michael Chobanian, the founder of Kuna, which is the name of a Ukrainian cryptocurrency exchange.

Bitcoin Car Davos

Photo: Arjun Kharpal – CNBC

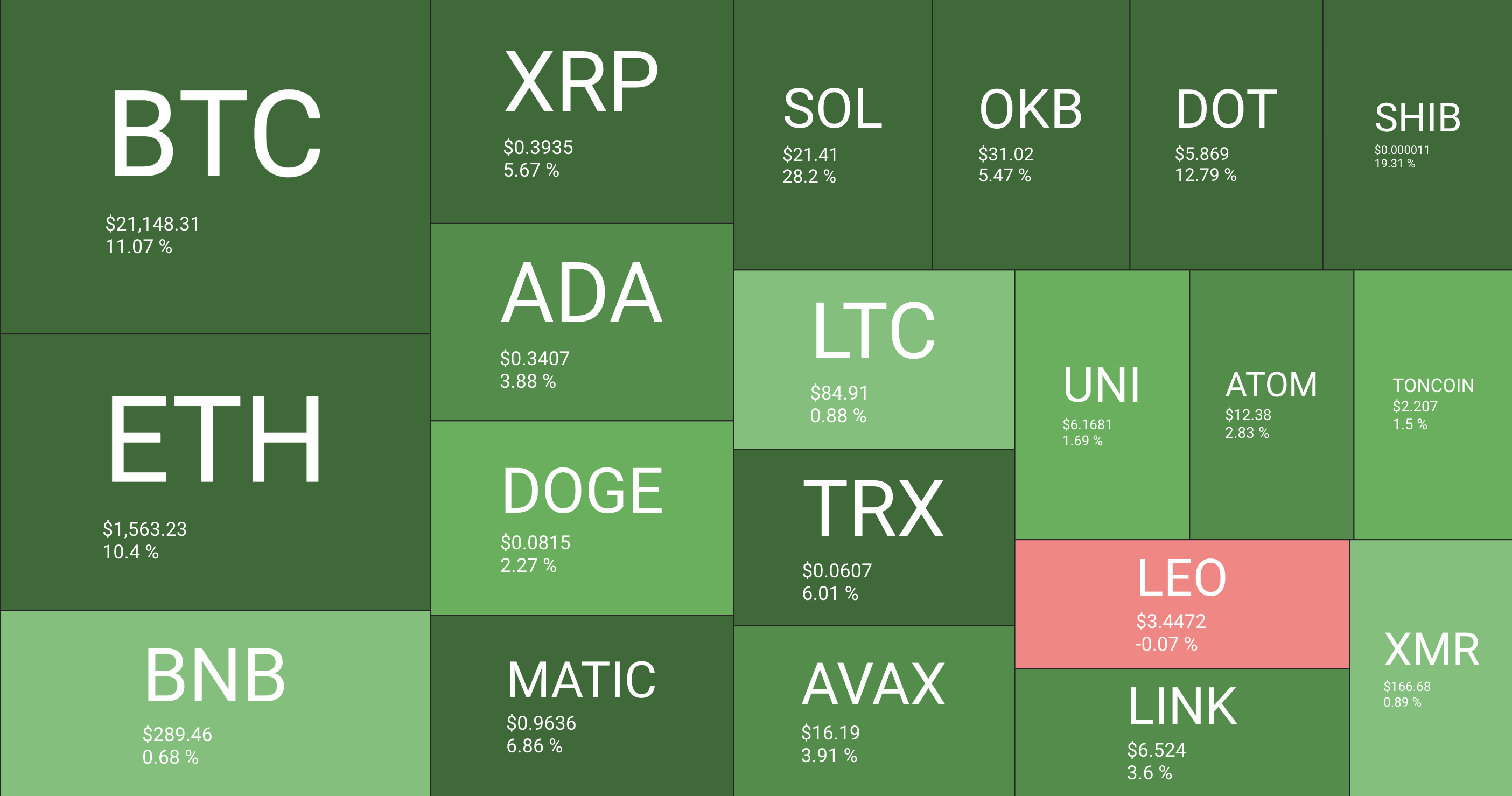

Block 3: Tops & Flops

The evolution of the Top 20 cryptocurrencies in terms of capitalization over one week.

(Click to enlarge)

Quantify Heatmap

Block 4: A few things to read:

Metaverse owners create new class system (Wired)

AI is not the new crypto (The Atlantic)

Crypto-currencies are in crisis, but they aren’t going away (The Conversation)

No Comments Yet