No matter if it’s 2014 or 2024, when it comes to crypto, Bitcoin has always been and will likely always be the first cryptocurrency people think of. Especially during times when the crypto market is going up — a lot of people start getting FOMO and thinking, ‘What if I invested $100 in Bitcoin 1, 5, 10 years ago?’

Whether you want to build a diversified portfolio with Bitcoin as one of the risky assets or simply stock up on the world’s largest cryptocurrency and (possibly) make a quick buck, it can be useful to know how to invest in BTC. In this article, I will talk about it as an asset, the ways to invest in Bitcoin, and try to answer the question, “What if I invest $100 in Bitcoin today?”

Key Takeaways: How to Invest in Bitcoin

- Bitcoin is the world’s largest cryptocurrency, and its value is driven by a variety of factors, like scarcity and potential for high returns.

- Investing $100 in Bitcoin can be profitable as long as you do it at the right time or make regular investments.

- Investing in Bitcoin offers high potential returns, liquidity, the prospect of being at the forefront of digital currency evolution, and a hedge against inflation due to its capped supply.

- However, risks include price volatility, a lack of regulatory framework, susceptibility to digital threats, and the absence of guaranteed returns.

- If you want to buy Bitcoin instantly, you will need a secure crypto wallet, a reputable cryptocurrency exchange, and a payment method, be it fiat money or another crypto asset.

What Is Bitcoin?

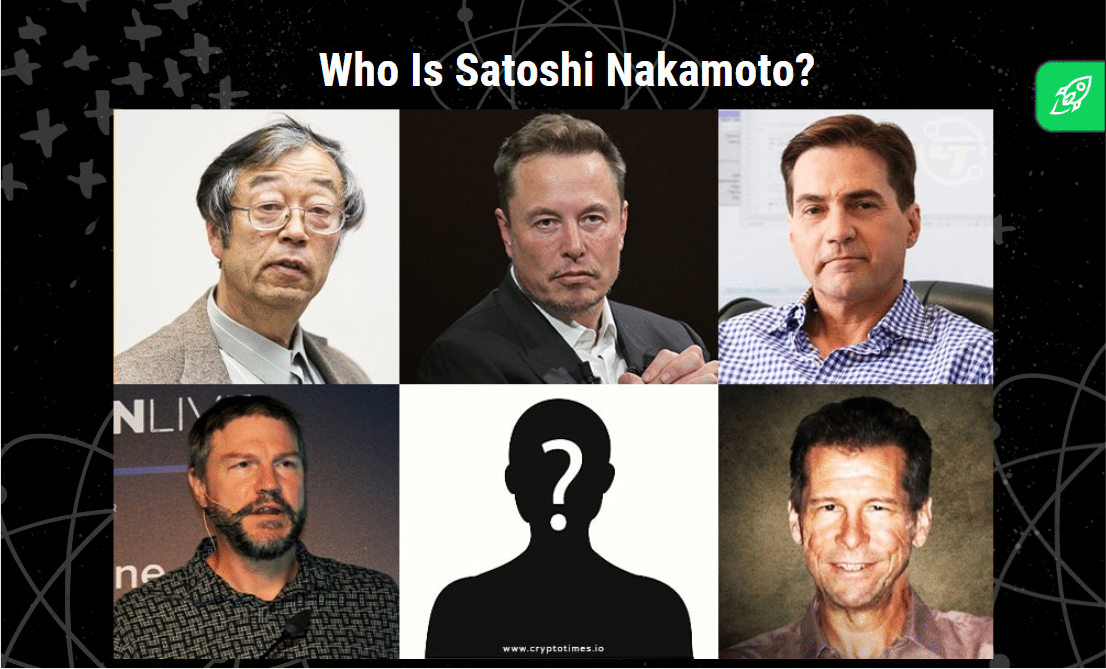

Bitcoin, often denoted as BTC, is a digital or virtual currency. It’s like an online version of cash that was invented in 2008 by an unknown person or a group of people who used the name “Satoshi Nakamoto.” Bitcoin started as a paper published on the internet, outlining the concept of a “peer-to-peer electronic cash system.”

The creation of Bitcoin brought to life the idea of cryptocurrency. In simple terms, a cryptocurrency is a decentralized form of currency, existing entirely online, that uses cryptography — a method of protecting information by transforming it into an unreadable format, known as encryption — for security.

Unlike traditional currencies, such as the dollar or euro, which are controlled by central banks, Bitcoin operates on a decentralized network of computers spread around the world. This decentralization means no single institution controls the Bitcoin network. It’s a democratic form of money, so to speak, controlled by the people who use it.

How Much Does It Cost to Buy Bitcoin?

Here’s the current price of Bitcoin.

Wondering what will happen if you invest $100 in Bitcoin today? Check out our Bitcoin price prediction to see how BTC price might behave in the future.

How Does Bitcoin Work?

At the heart of Bitcoin is a public ledger called a blockchain. This ledger contains every transaction processed, allowing the user’s computer to verify the validity of each transaction. This complete transparency helps maintain the integrity of the system.

People known as miners use powerful computers to solve complex mathematical problems that validate each Bitcoin transaction. Once a problem is solved, a transaction is added to the blockchain, and a miner is rewarded with a small amount of Bitcoin. This process is known as Bitcoin mining.

Unlike a traditional bank account, a Bitcoin wallet requires no paperwork. A Bitcoin wallet can be set up in minutes from your computer or smartphone. You can receive Bitcoins in your digital wallet from anyone else who has a wallet. Every transaction made with Bitcoin is stored in the blockchain.

Bitcoin Halving

Approximately every four years, the reward for mining Bitcoin transactions is halved, reducing the supply of new Bitcoins entering circulation. This event is not just a technical adjustment but a significant milestone that often leads to anticipation and speculation within the cryptocurrency community.

Historically, halvings have been associated with periods of price increases, as the reduced pace of new supply can lead to upward pressure on prices, assuming demand remains constant or increases. This phenomenon underscores Bitcoin’s deflationary nature, designed to mimic the scarcity and value preservation similar to precious metals like gold.

You can learn more about Bitcoin halving here.

What Makes Bitcoin Valuable?

There are a few key reasons why Bitcoin is valuable.

- Scarcity. The total number of Bitcoin that can ever exist is limited to 21 million. This artificial scarcity is coded into the Bitcoin algorithm.

- Decentralization. Bitcoin isn’t governed by a central authority, like a government or a financial institution. Its value can’t be manipulated by these entities.

- Utility. Bitcoin transactions can occur between parties without a middleman, such as a bank. These transactions are typically processed faster and with lower fees than transactions of traditional banking systems or money transfer services.

- Potential for high returns. Bitcoin’s value has historically seen high levels of volatility. This volatility creates the potential for high returns, though it also increases risk.

- Anonymity and privacy. While all transactions can be traced using blockchain technology, the identities of people involved in transactions aren’t disclosed.

Bitcoin’s value isn’t inherent, as with gold or oil. In fact, it comes from the belief and agreement of its users and traders. This is true for all forms of currency. What sets Bitcoin apart is its blend of scarcity, utility, and independence from traditional economic systems, making it a unique financial phenomenon.

As a result, however, it can be hard to predict Bitcoin’s price, and quite often, it ends up being dependent a lot on the general attitude of the market. As we have seen before, many Bitcoin holders are prone to panic and have “weak hands,” meaning they tend to sell off their coins when the BTC price starts to decline, driving the entire value of the asset lower.

Is It Worth Investing in Bitcoin Today? Or What Will Happen If You Invest $100 in BTC Right Now

In 2024, the crypto market has reached new all-time highs for major players like Bitcoin and Ethereum. This surge has sparked a wave of FOMO (fear of missing out) among the public, leading many to wonder: What will happen if I invest now? Is it worth investing, or should I wait for a price dip? And what are the overall prospects for Bitcoin?

Let’s imagine you decide to invest $100 in Bitcoin right this moment. What could happen to your investment? Can you still make a significant profit?

If this is your first time investing in Bitcoin, you might need to be patient for your investment to pay off—especially if you buy at the height of a rally. To maximize your $100 investment, it might be more profitable to wait for a moment when the price is relatively low. However, even investing $100 at the peak of a rally can still yield a profit, though it might be modest.

If you already have Bitcoin in your portfolio, adding another $100 worth of BTC could be very profitable in the long run. Here’s an example:

During its rally in 2021, Bitcoin hit a previous all-time high of $69K. If you had bought BTC not at the absolute peak but when it was $65K, $100 worth of Bitcoin would have been around 0.0015 BTC. If you had then waited and sold that Bitcoin in March 2024, when it hit $70K, you could have sold it for $105—a small profit, not accounting for inflation. However, if you had also bought Bitcoin for $100 when it was $20K and $30K, your profit would have been much higher.

Many blockchain and Web 3 supporters consider the technology revolutionary, with enormous potential that could lead to a significant rise in Bitcoin’s price. In 2024, events like the approval of spot Bitcoin ETFs in the U.S. and Hong Kong generated significant enthusiasm among financial market participants. Interest in Bitcoin and its underlying technology is growing, especially among institutional investors, and the resulting price increase is drawing attention from the general public.

The Risks and Benefits of Investing in BTC

Before looking at the risks and benefits of investing in Bitcoin, you should first determine whether it’s even worth it for you to invest in BTC — or any other crypto at all.

Many people get sucked into making crypto investments out of FOMO, which often leads to nothing but losses. Before joining the ranks of crypto investors, ask yourself the following questions:

- Why didn’t I buy Bitcoin earlier when it was cheaper?

- Why am I buying it — to hodl or to make a quick buck?

- If it’s the latter, then why do I think I will be able to sell it later at a higher price?

- Do I understand what Bitcoin and the crypto market are?

- Am I OK with the risk? Can I afford to lose all the money that I’m going to invest in Bitcoin?

Your answers to these questions will help you understand whether you should invest in Bitcoin or not.

I would personally advise against entering the Bitcoin markets and crypto market in general if you are vulnerable to gambling. The nature of the cryptocurrency is speculative to a high degree, presenting a high-risk, high-reward dynamic that can potentially harm people prone to gambling addictions. Please remember to be careful and avoid making financial decisions that can cause you to lose all your funds — or, worse, go into debt.

Now, let’s take a look at the actual risks and benefits of investing in Bitcoin.

Benefits of Investing in Bitcoin

- High potential returns. Compared to traditional investments, such as the stock market, Bitcoin and other crypto assets have shown a significantly higher potential for returns.

- Liquidity. Bitcoin trading occurs 24/7 on various cryptocurrency exchanges, providing high liquidity and the ability to trade at any time.

- Future of currency. Many believe that digital currency is the future, and investing in Bitcoin now could yield significant returns as digital currencies become more widely adopted.

- Inflation hedge. With its supply capped at 21 million, Bitcoin could act as a hedge against fiat currency inflation.

Risks of Investing in Bitcoin

- Price volatility. Bitcoin is known for its price volatility. The price can fluctuate widely in a short period, which could lead to significant losses.

- Lack of regulations. The crypto market is still relatively new and lacks the regulatory framework of traditional financial markets.

- Digital threats. As a digital asset, Bitcoin is susceptible to hacking, technical glitches, and other cybersecurity threats.

- No guaranteed return. As with any investment, there’s no guaranteed return. The value of Bitcoin is highly dependent on demand, and if demand falls, the value may plummet.

Become the smartest crypto enthusiast in the room

Get the top 50 crypto definitions you need to know in the industry for free

What You Will Need to Invest in Bitcoin

To begin your cryptocurrency investment journey, you will first need a few things:

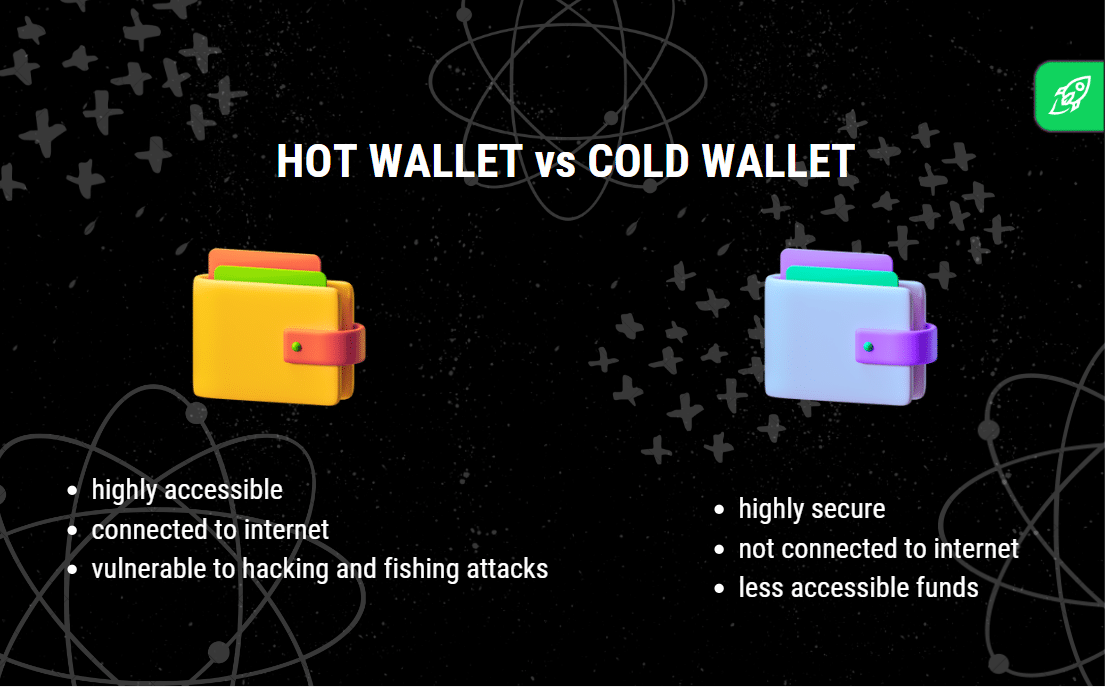

- Crypto wallet. To store your Bitcoin holdings, you’ll need a hardware or a hot wallet.

- Suitable crypto exchange. You’ll need to find a cryptocurrency exchange where you can safely and securely buy and sell Bitcoin.

- Payment Method. Most major exchanges accept different payment methods, including bank transfers, credit card payments, or even other cryptocurrencies.

- Risk tolerance. Crypto investments are volatile assets, and investing in them carries risk. Ensure you have a clear understanding of your risk tolerance before you begin.

Hot vs. Cold Wallets

When it comes to storing your Bitcoin, you have two options: hot wallets and cold wallets.

A hot wallet is connected to the Internet; that’s why it allows you to easily access your Bitcoin to conduct transactions. However, this type of wallet is vulnerable to online threats. Some good hot wallets are Exodus, ZenGo, and Jaxx Liberty.

A cold wallet, also known as a hardware wallet, is a physical device not connected to the internet, providing an extra layer of security. Cold wallets are a good choice if you plan to hold Bitcoin as a long-term investment, though they might not be as convenient for frequent trading or transactions. If you’re looking for a reliable offline wallet, you can get Trezor or Ledger.

Whichever type of crypto wallet you go for, make sure you never share your keys with anyone.

The Best Crypto Exchanges For Beginners

Choosing the right crypto exchange is crucial. Here are a few of the best cryptocurrency exchanges for beginners:

- Coinbase. Known for its user-friendly interface, Coinbase is a great platform for novice users. It offers a wide variety of cryptocurrencies for trading.

- Binance. With one of the largest selections of digital currencies, Binance is a good choice for those looking to explore beyond Bitcoin.

- Changelly. Changelly is a great platform for crypto beginners — it has an intuitive, user-friendly interface and provides users with free guides on all things crypto. Changelly’s fiat-to-crypto marketplace aggregates offers from a wide variety of providers, ensuring you won’t have to scour the internet for the best Bitcoin prices.

When choosing an exchange, factors such as security features, trading fees, and available cryptocurrencies are worth consideration. All platforms offer their own unique benefits, so it could be useful to try a few of them out first with smaller amounts.

Best Ways to Invest in Bitcoin

Investing in Bitcoin can be done both directly and indirectly, and each method suits different investor profiles and carries its own risks.

Direct Investment:

- Purchasing Bitcoin: Buying and holding Bitcoin via exchanges and Bitcoin ATMs is the most direct method. It suits those comfortable with handling digital assets but involves risks related to Bitcoin’s price volatility and the security of digital wallets.

- Trading Bitcoin: Engaging in buying and selling Bitcoin on exchanges. Suitable for those who are experienced in trading and understand market trends. The risk lies in market volatility.

- Dollar-Cost Averaging (DCA): Investing a fixed amount into Bitcoin at regular intervals. It’s ideal for long-term investors looking to mitigate the impact of volatility.

Indirect Investment:

- Bitcoin ETFs: Exchange-traded funds that track Bitcoin’s value, allowing investment without owning Bitcoin directly. They are convenient for traditional investors but may involve management fees and do not provide actual Bitcoin ownership.

- Bitcoin-Related Companies: Investing in companies that are involved in the Bitcoin ecosystem. This method provides indirect exposure to Bitcoin’s performance with the added risks of the individual company’s performance.

Each method requires careful consideration of the investor’s risk tolerance, financial goals, and understanding of the cryptocurrency markets. Remember, no strategy guarantees success, so it’s important to invest only what you can afford to lose.

Is It Smart to Invest in BTC Right Now?

Investing in Bitcoin requires careful consideration of its high volatility and risk. It is important to thoroughly understand the asset class and approach your investments strategically. While Bitcoin is a common entry point into the cryptocurrency market, it should only be a portion of your overall investment portfolio.

A good (and easy) way to determine whether Bitcoin is worth buying at the moment is to look at market analysis charts like the TradingView widget below. If it shows “Buy,” that means the price of Bitcoin is likely to rise soon, while the “Sell” signal tells us there is a potential for a downward trend to appear shortly.

Please note that the situation can change at any time. It’s important to remember that trying to predict and outsmart the market will always be a gamble, no matter if it’s the crypto or stock market we’re talking about. The former, however, is a lot more volatile. That’s why, when it comes to cryptocurrency investment, it is generally advised to keep your FOMO in check and try investing bit by bit over a longer period of time.

Conclusion

When contemplating investing in any asset, it is always a good idea to consider how it will fit into your existing portfolio. And if you don’t have one yet, think about what other assets — fiat currencies, precious metals, virtual currencies, and so on — you will have to buy up to mitigate the risk and achieve your profit goals.

An easy way to make a foolproof portfolio is to invest in a high-risk, high-reward asset alongside gold or other precious metals. Ultimately, whether you should buy a hundred dollars worth of Bitcoins right now depends on what you think about this coin and crypto in general and its future potential.

Please note that the contents of this article should not be seen as investment advice. Good luck on your crypto journey!

FAQ

Can I make money investing $100 in Bitcoin?

Thinking of investing $100 in Bitcoin? Yes, it’s possible to make money with that amount. While $100 won’t turn into a huge sum overnight, it could still yield decent returns if Bitcoin does well. Starting small in crypto is a smart move, considering its risky nature. Your potential gains depend on what you’re aiming for. Looking for big profits? $100 might fall short. But if you’re aiming for some earnings or just want to experience Bitcoin investment, $100 is a good start.

How much was $100 in Bitcoin 5 years ago?

In 2019, with an average Bitcoin price of around $7,200, an initial investment of $100 would have allowed you to purchase approximately 0.01389 BTC. This would’ve given you around $972 if you had sold that BTC in March 2024, when Bitcoin was $70K.

When should I cash out Bitcoin?

Crypto’s volatility means it’s not great for holding steady value. Seeing your investment fluctuate wildly can be stressful. But don’t let short-term changes push you into selling. Bitcoin, for instance, might have a brighter future. Many say 2024 could be pivotal for its value. When to sell really comes down to your financial aims and the market’s condition. Whether you’re aiming to cash in profits, reduce losses, or use your crypto, it’s important. Just keep in mind the impact of taxes and the importance of good timing.

What is a good Bitcoin wallet?

Read also: Best BTC wallets.

A good Bitcoin wallet is one that balances security, accessibility, and user-friendliness. For instance, the Exodus wallet is highly rated for its sleek interface and support of a vast number of cryptocurrencies, making it ideal for beginners. Another great option is Ledger, a hardware wallet that stores your Bitcoin offline and, therefore, is less susceptible to hacking.

However, the ultimate choice depends on whether you favor convenience over security or vice versa, as online wallets (like Exodus) allow easy access for Bitcoin purchases, while hardware wallets (like Ledger) provide superior protection for these potentially risky assets.

What is the best way to buy BTC?

The best way to start investing in Bitcoin is by using a reliable cryptocurrency exchange, like Changelly.

What is the best way to buy BTC?

The best way to buy BTC often depends on individual needs and circumstances.

To buy BTC, the first step is setting up a cryptocurrency exchange account on a reputable platform. After completing the necessary verification, you can fund your account with traditional currency. To purchase Bitcoin, you can place either a market order for immediate purchase at the current price or a limit order at a predetermined price.

It’s essential to approach Bitcoin as a speculative investment due to its volatile nature. Invest cautiously, only using funds you can afford to risk.

For enhanced security, especially with larger investments, it’s advisable to transfer your Bitcoin from the exchange to a personal cryptocurrency wallet, either a software wallet on your device or a more secure hardware wallet.

How to start investing in Bitcoin?

Starting your Bitcoin investment journey involves a few steps. First, determine how much you’re willing to invest, keeping in mind that Bitcoin and other cryptocurrencies are speculative and risky assets. Second, set up a secure digital wallet where you can store your Bitcoin. Next, create an account with a reputable cryptocurrency exchange where you’ll make your Bitcoin purchases.

Then, you can start buying Bitcoin, but be aware of the current market trends and how much Bitcoin is worth at the time of purchase. Be mindful when selling Bitcoin, too, as timing is crucial in this volatile market. It’s also worthwhile to consider options like Bitcoin Exchange Traded Funds (ETFs), which allow you to invest in Bitcoin without actually owning it.

Where can I invest in Bitcoin?

You can invest in Bitcoin on various platforms. Cryptocurrency exchanges are the most common platforms for buying and selling Bitcoin. Some popular ones include Coinbase, Binance, and Kraken. These platforms allow you to trade Bitcoin directly and usually support a wide array of other cryptocurrencies. Additionally, certain traditional brokers and stock trading apps are beginning to offer Bitcoin and other crypto assets.

Lastly, Bitcoin ETFs offer an alternative way to invest in the value of Bitcoin without having to manage and secure the digital currency yourself. Be sure to choose a platform that aligns with your investment strategy and provides adequate security measures.

Can I lose money on Bitcoin?

Yes, absolutely. No matter what Bitcoin investing strategies you use or how secure your wallet and exchange are, there’s always a risk of losing your funds. However, you can minimize those risks.

We give a few general tips on how not to lose your money while exchanging crypto in our article on refunds. Spoiler alert: It’s hard to refund crypto and Bitcoin transactions, so make sure to double-check all info you enter when making a purchase!

Can investing in Bitcoin make you wealthy?

Well, it depends on when you’re going to sell Bitcoin and how much it will rise in the future. That said, Bitcoin is no longer at that stage where you can make millions or even thousands of dollars by investing as little as $10 in it — if that’s what you’re after, you will be better off betting on the success of random shitcoins.

However, there’s another way to become wealthy by investing as little as $100 in Bitcoin or any other popular cryptocurrencies: doing it on a regular basis, just like how you’d top up your savings account.

How much Bitcoin should I buy?

If you want to purchase Bitcoin right now, you should only spend as much as you can afford to lose. This is one of the main rules for buying cryptocurrency, no matter if you want to invest $20, $100, or $1,000 in Bitcoin or any altcoin.

The amount you buy will also depend on your investment goals and how much profit you’re hoping to get. You likely won’t see sky-high returns if you buy $100 worth of Bitcoin with your fiat currency. However, remember to keep a cool head and spend responsibly.

How much should I invest in crypto per month?

Investing bit by bit every month is one of the most common pieces of advice you can hear. The actual amount will depend on your income, life situation, appetite for risk, and so on.

Some people invest as little as $20 per month in Bitcoin or other cryptocurrency — the price of a few cups of coffee. This is something you should decide for yourself.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.