-

NASA engineer Hayden Burgoyne spends his nights betting cryptocurrency on stock picks.

-

He’s part of an online tournament hosted by crowdsourced-fund Numerai, Bloomberg reported.

-

“We trade stocks, and we’re doing a better job of it than the best hedge funds,” Numerai’s founder said.

A 32-year-old NASA engineer spends his evenings betting cryptocurrency on stocks he thinks will beat the market – and his hobby has paid off.

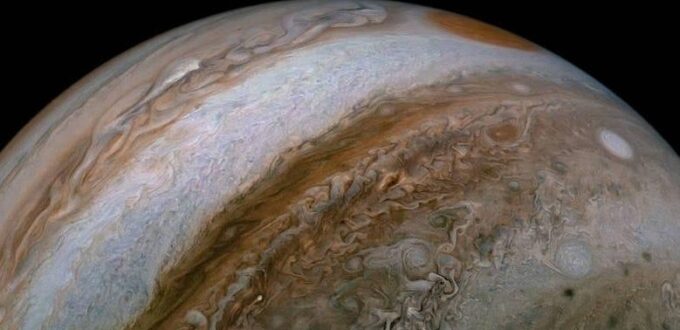

At his day job, Hayden Burgoyne builds the spacecraft set to explore Jupiter’s moons. But at night he picks stocks he thinks will outperform, and he bets cryptocurrency – in an online trading tournament against thousands of others – that his picks will win.

Bloomberg News documented Burgoyne’s nighttime hobby in an article titled “Crowdsourced Quant Backed by Paul Tudor Jones Rides the Crypto Wave” by Justina Lee. He told the news outlet his hobby is “more lucrative than most,” considering it’s paid for both his wedding and honeymoon in South America.

About 3,500 people from all over the world are part of the tournament, organized by San Francisco hedge-fund Numerai, 34-year-old founder Richard Craib told Insider.

The so-called Numerai Tournament crowdsources amateur quants who evaluate market data, stake cryptocurrency called Numeraire on their stock picks, and are rewarded more Numeraire based on their performance.

“There’s so much hype in crypto,” Craib told Insider, but “we’ve actually used it to do something in the real world.”

Craib told Insider the 2 million Numeraire the firm has rewarded thus far are now worth an estimated $90 million, making the digital asset worth about $45 a piece.

Burgoyne, based in Los Angeles County, told Bloomberg he now has 630 tokens staked on his stock bets.

Some have started making the tournament a big part of their income, Craib said. “Some people are staking half a million dollars on their models, so they could make $50,000 in a week if their models did really well,” he said.

In a 2016 Wired article, Craib said he thought of the idea while working for a South African asset management firm where he helped build machine learning algorithms. His firm now provides all its data and allows recruits to build machine learning models “without really knowing what they’re doing.”

“We trade stocks, and we’re doing a better job of it than the best hedge funds,” Craib told Insider.

The crowdsourced fund has beaten many others, considering last year it rose 8% as others struggled, according to a Medium post from Numerai. This year, the fund is up 9% as of August, Craib told Insider.

Numerai has received backing from billionaire Paul Tudor Jones and former Renaissance Technologies executive Howard Morgan, Bloomberg reported.

Read the original article on Business Insider

No Comments Yet