- Valora lets users send crypto payments via text messages.

- The startup nabbed an investment from celebrity backers including Kevin Durant and Nas.

- Andreessen Horowitz led Valora’s $20 million Series A in July following its spin-out from Celo Labs.

Sending money abroad can be logistically challenging and cost-prohibitive for many. Valora, a peer-to-peer crypto app, is looking to stablecoins as a way to help people avoid hefty transfer and foreign-exchange fees by sending money through its app via text message.

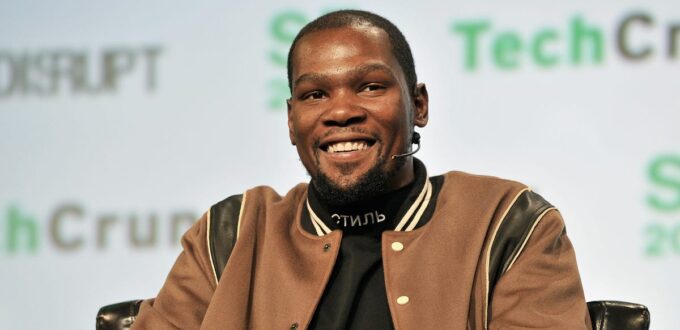

The startup just added a slew of celebrity investors to help grow its user base. The new high-profile backers include NBA all-star Carmelo Anthony, musicians Nasir ‘Nas’ Jones and Sean ‘Diddy’ Combs, YouTuber Casey Neistat, and NBA star Kevin Durant and his manager Rich Kleiman’s Thirty Five Ventures.

The funding, the amount of which was not disclosed, comes following Valora’s $20 million Series A, which was led by Andreessen Horowitz in July.

“With a lot of these investors, they were really keen to help us with this mission of not only reaching their communities and their fans around financial inclusion and financial empowerment, but it was really about how we change the narrative on both crypto and their ability to access opportunity,” Jackie Bona, CEO of Valora, told Insider.

Valora’s app is a digital wallet that allows users to send and receive crypto payments around the world through text messages without the need for a bank account.

The fintech, which was launched in February, was spun out of Celo Labs, a blockchain startup that powers stablecoins cUSD and cEURO.

Users can send three types of digital currencies: cryptocurrency CELO, cUSD, and cEURO. The latter two are stablecoins with values pegged to US dollars and Euros, respectively.

Once received, users can transfer the cryptocurrencies out of the Valora wallet in a number of ways, including cryptocurrency wallets and gift cards.

Stablecoins are viewed as a less-volatile alternative to traditional cryptocurrencies like Bitcoin since they are often tied to a fiat currency.

As stablecoins have increased in popularity, regulators have taken notice. On Monday the Biden administration asked Congress to begin oversight of stablecoins, which if “appropriately regulated,” could provide faster and more inclusive money movement, the administration said.

Bona has a background in product marketing, having led go-to-market efforts at Google, Twitter, and Spotify.

Valora’s new celebrity investors got involved through the Cultural Leadership Fund, a partnership between Andreessen Horowitz and cultural leaders that is run by a16z general partner Chris Lyons.

The fund invests in a16z’s portfolio companies with a goal aimed to “enable more young African Americans to enter the technology industry ,” according to its website. All of the management fees for the fund are donated to nonprofits focused on diversity and inclusion in the tech industry.

“Especially for blockchain technology, it’s a new industry, a brand new technology, and a new financial system that we’re building through it,” Bona said. “And if we don’t get diverse people and diverse voices in the mix, it’s just going to be the same.”

Valora is building for an international market

Valora charges fees that are as low as 0.001 cUSD per transaction and currently has more than 200,000 users, a spokesperson said.

In its first few months, the startup was used by organizations like the Grameen Foundation to send emergency relief payments to people in the Philippines. impactMarket, another organization that uses blockchain to send universal basic income to impoverished communities around the world, uses Valora to pay users in places like Brazil, Ghana, the Philippines, and Zimbabwe.

Many of Valora’s users live in mobile-first markets, where consumers often have access to smartphones before they have access to bank accounts. Valora only requires a phone number to send and receive payments, and users can redeem funds in various ways, depending on the market.

In Kenya, for example, Valora partners with M-Pesa, a digital wallet run by Kenya’s largest cell-phone service provider. In the US, users can transfer their balances to other crypto wallets or through gift cards for merchants like Starbucks, Uber, and Whole Foods.

“One of the opportunities that we see for us in the future is being able to do the on-ramps and off-ramps from crypto to normal money,” Bona said. “But we’re just getting started, and it’s a very hard problem to solve.”

No Comments Yet