In the last week of October, there was a curious new cryptocurrency that burst onto the scene: Squid Game, or SQUID for short. Based on, but not officially affiliated with, the Netflix sensation, its whitepaper promised a reward pool that would grow as the number of participants grew and a series of games inspired by the show involving SQUID tokens.

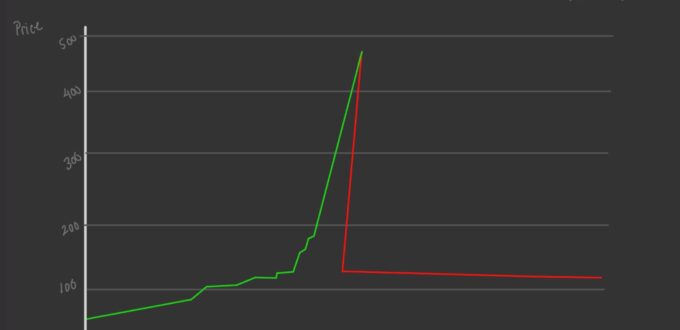

The past year saw themed cryptocurrencies like Dogecoin and Shiba Inu achieve exponential, albeit temporary, growth driven primarily by market hype. Squid Game was perfectly placed to emulate their success by capturing the excitement around its namesake. And it did! Squid Game grew to $1, then $10, then $100, all while capturing more people giving into their feelings of FOMO (fear of missing out). It peaked at a valuation of nearly $3,000, tremendous growth in the space of a week.

Sound too good to be true? It was. Within 10 minutes, it all went awry. The creators took the $3.36 million invested into the coin until Nov. 1 and vanished. The coin was reduced to a valuation of less than a third of a cent in value; the holders were left gaping at the speed and scale of the “rug pull.”

In hindsight, there were red flags throughout SQUID’s short lifetime. The value of SQUID never went down. There were also complaints about people being unable to sell any tokens. This was initially attributed to the anti-dump mechanism described by the creators. It also never had any connection to the Netflix show. Despite all of this, many people blindly bought into SQUID trying to chase the next big thing.

Squid Game perfectly encapsulates everything that’s wrong with the fast-growing cryptocurrency market. Cryptocurrencies are mostly driven by market excitement. A problem arises when those feelings aren’t backed by sound fundamentals.

I’ve already mentioned Dogecoin a few times in this piece, and it’s worth delving into it for a bit. Dogecoin was created back in 2013 as a joke, meant to poke fun at the then-speculative cryptocurrency market. Unlike Bitcoin, whose value in large part derives from its limited supply, Dogecoin could technically have an infinite supply. Until the start of 2021, its value never went above a cent. Yet, in the aftermath of the r/WallStreetBets GameStop saga, Dogecoin started rising inexplicably, so much so that celebrities such as Elon Musk took notice with his tweets, further fueling its growth. After peaking in May, it started falling again, settling now at around a quarter dollar.

Cryptocurrencies, even the more well-known and sound ones, are extremely volatile. Cryptocurrency advocates will tell you about how their decentralized nature prevents any central entity from influencing the valuation of the currency. However, in their current form, they are still easily manipulated. Elon Musk, for instance, tweeted his reservations against Bitcoin’s environmental impact. The damage was immediate. Bitcoin’s value would dip by more than $10,000 in the coming days. You don’t have to be a Musk-level celebrity either to impact valuations. There are many groups that work to orchestrate pump-and-dump schemes wherein the whole group invests in a cryptocurrency of their choosing at once. This generates a buzz around it that drives other investors to invest in it. As the value of the cryptocurrency rises, more investors flock to it. When the group is satisfied with the growth of the cryptocurrency, they sell their holdings rapidly, triggering a dramatic fall in the valuation of cryptocurrency.

Cryptocurrency’s nature as something that is outside governmental regulations acts as a double-edged sword here. While some praise it for being free of government interference, it also lacks all legal consumer protections. This often means that in the event of a scam, consumers have little to no legal recourse.

I’m certainly not going to discourage anyone from investing in cryptocurrency if they so choose. I personally don’t because it doesn’t align with my risk tolerance. There’s a certain level of volatility with even the more stable cryptocurrencies, so it is crucial to do your research before investing. Only invest as much as you can afford to lose. And never blindly “hold” on a quest to send prices to “the moon.” You might get the rug pulled out from under you.

Siddharth Parmar is an Opinion Columnist and can be reached at sidpar@umich.edu.

No Comments Yet