Good morning. Here’s what’s happening:

Market moves: Bitcoin and ether’s prices moved little with Christmas only three days away; layer 1 and scaling system tokens rally.

Technician’s take (Editor’s note): Technician’s Take is taking a holiday hiatus. In its place, First Mover Asia is publishing the second in a series of stories on the year in cryptocurrency markets by CoinDesk markets analyst Damanick Dantes and Managing Editor of Markets Brad Keoun.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Bitcoin (BTC): $49,008 +0.3%

Ether (ETH): $4,017 -0.06%

Bitcoin, the largest cryptocurrency by market capitalization, remained around $49,000 during U.S. trading hours on Wednesday after a failed attempt to break through the key $50,000 threshold. At the time of publication, bitcoin was down slightly. Ether was also in the red but not far off where it began the day.

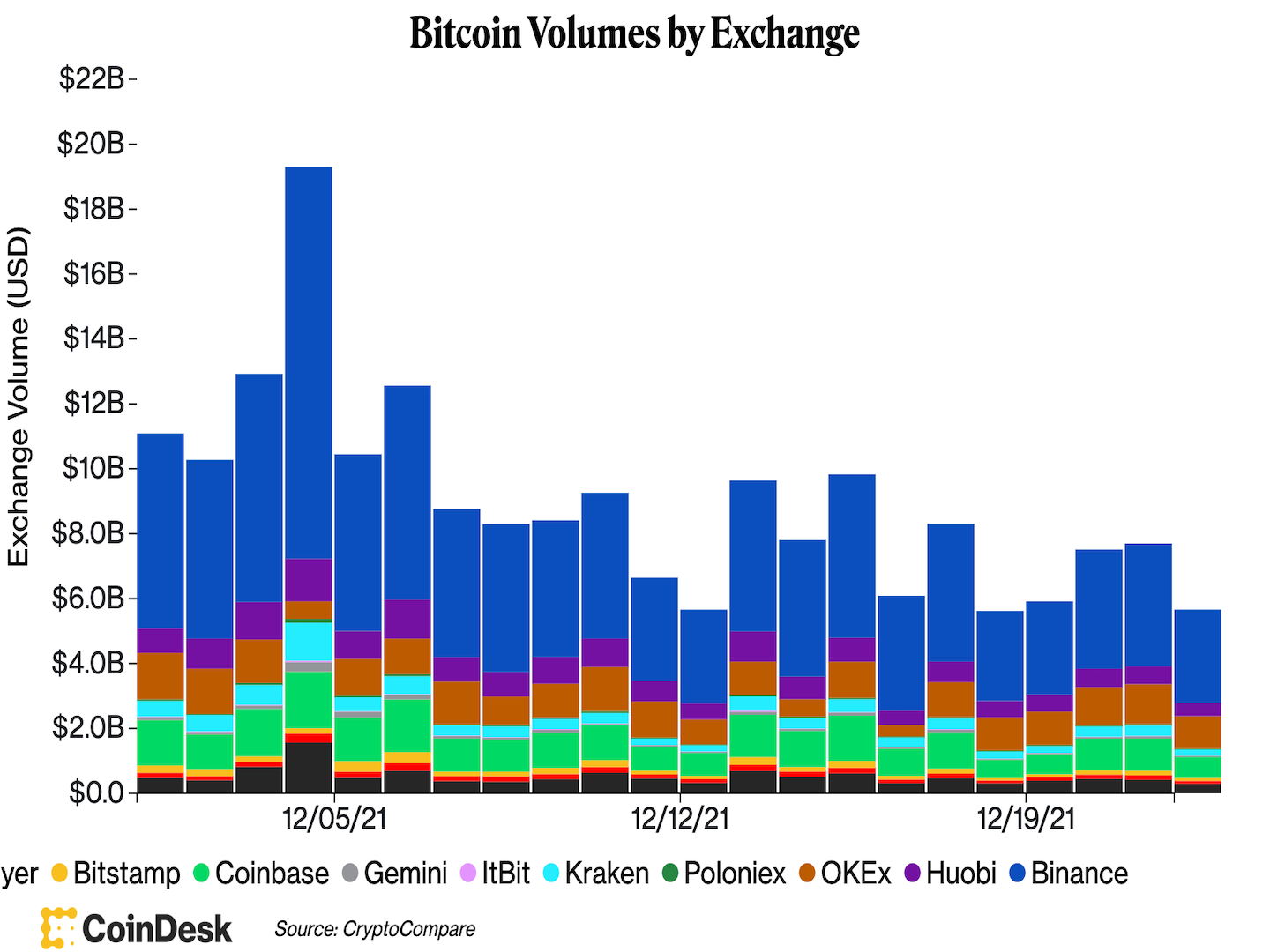

The small price movement on bitcoin and ether came with continued low trading volume across major centralized exchanges, according to data compiled by CoinDesk, as the market heads into the year-end holiday season.

(CoinDesk/CryptoCompare)

Meanwhile, tokens associated with layer 1 protocols and scaling systems, including MATIC and LUNA, were market stars on Wednesday. The two coins have generated strong 30-day returns, despite a recent broader market sell-off.

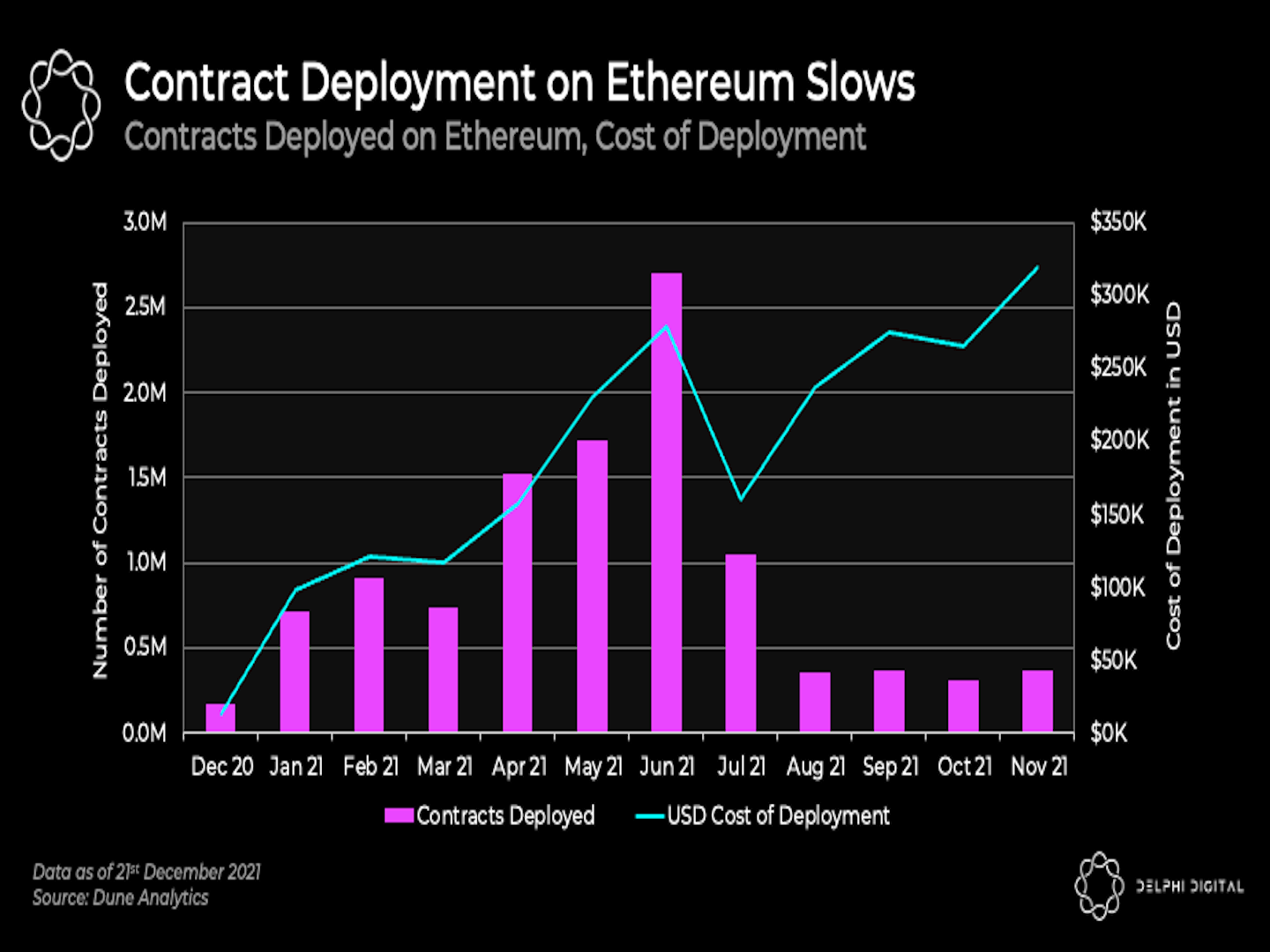

The recent rise of of these protocols comes as the growth of smart contracts deployed on Ethereum have paused, crypto research boutique firm Delphi Digital wrote in its newsletter on Wednesday.

Data compiled by Delphi Digital shows the number of smart contracts deployed each month has dropped significantly from earlier this year.

(Delphi Digital)

“The rising costs of deploying contracts has likely played a key role in pushing developers to alternatives networks,” Delphi Digital wrote. “Whether this can eventually pick up on Ethereum-centric layer 2s [companion systems] remains to be seen.”

Hello, Market Wrap readers! During the final two weeks of 2021 we’re using this space to recap the year’s most dramatic moments in cryptocurrency markets – and highlight key lessons from this fast-evolving corner of global finance. Over a series of eight posts starting on Dec. 20 and running through Dec. 30, we’re recapping what shook crypto markets this year. (For the latest crypto prices and news headlines, please scroll down.)

On Monday, we recounted how even as bitcoin staged a powerful price rally to the start of the year, some institutional investors began to question the sustainability of the trend. Today, we’ll show how, during January and February, coordination and posts on social media fueled even more demand for bitcoin and other cryptocurrencies, delaying an immediate price correction.

As bitcoin (BTC) soared in February, social media, particularly Twitter, appeared to take on an expanded role in cryptocurrency markets, with prices pumping in response to tweet after tweet. It became clear that investor appetite for risk remained strong despite earlier concerns about rampant speculation.

Tesla CEO Elon Musk and then-Twitter CEO Jack Dorsey tweeted away to push bitcoin higher from $40,000 in January to nearly $57,000 in February. The viral effects of social media pushed retail traders into full-on buy mode, with bones thrown to the doggy-themed joke token dogecoin (DOGE) that added billions of dollars to that cryptocurrency’s market value.

On social media, some traders banded together in an effort to keep crypto prices elevated – similar to the way retail traders in traditional markets had coordinated to roil stocks like GameStop.

For example, Musk, ranked by Forbes as the world’s richest person, added the #Bitcoin hashtag to his Twitter profile, contributing to an immediate 11% BTC price rally. Shortly afterward, Jack Dorsey also added the #Bitcoin hashtag to his twitter profile.

The bitcoin endorsements by Musk and Dorsey went viral, inspiring a league of traders who dismissed the cautionary warnings of more experienced investors. It all seemed like a lot of fun. And bitcoin was not the only cryptocurrency to advance.

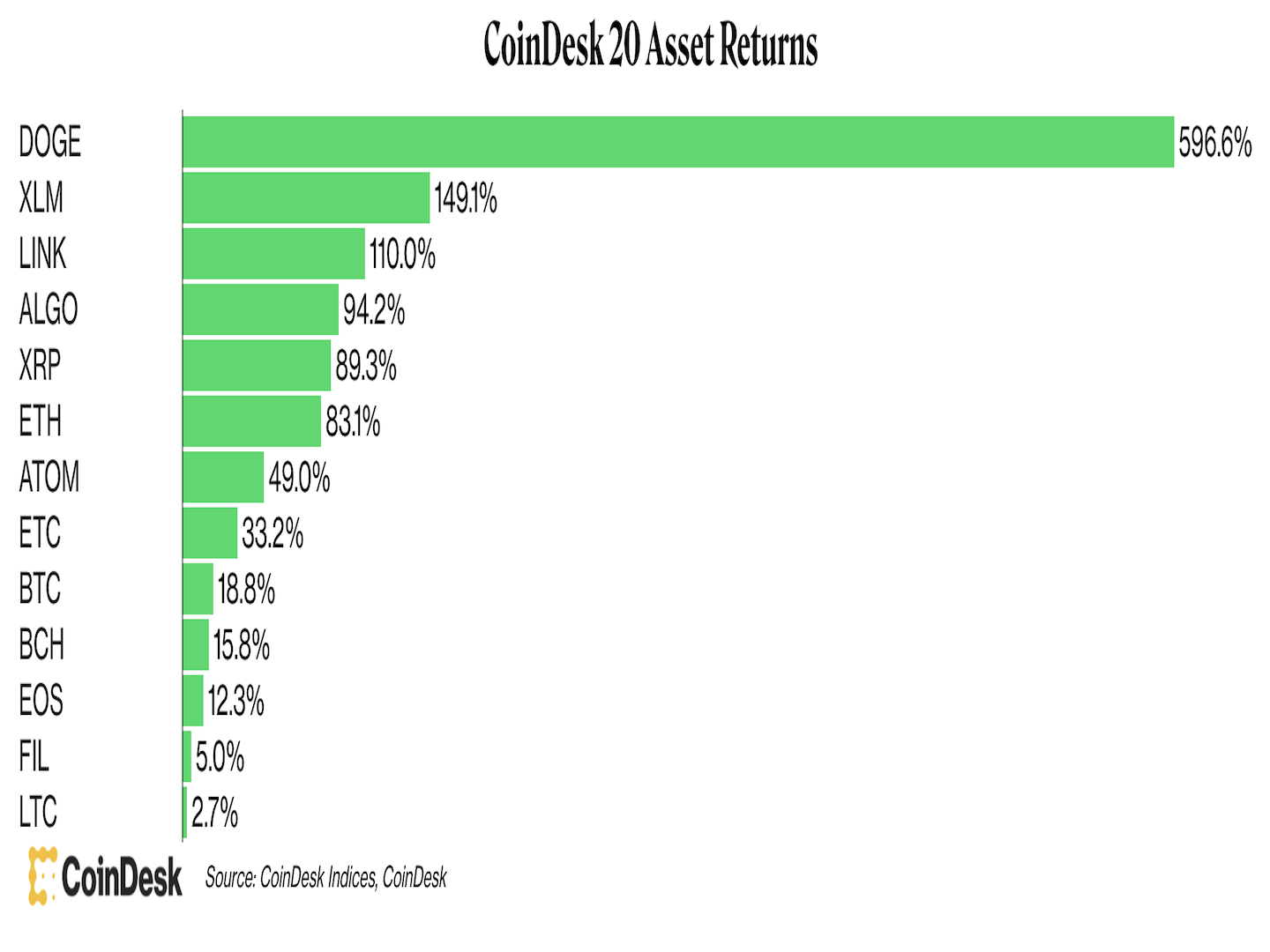

Musk also suggested in a tweet that dogecoin might be “the future currency of earth.” Musk’s involvement in the dog token tribe helped send DOGE mooooning (his word), along with other alternative cryptocurrencies.

Such hijinks kept the crypto party going. Here’s a look at relative performance in January; DOGE vastly outperformed bitcoin in January, as shown below:

January returns (CoinDesk Indices)

How could one man cause such a massive move in crypto markets? CoinDesk’s Edward Oosterbaan explained earlier this month how Musk’s star power was able to sway the price of BTC and DOGE. (Spoiler alert: None of this is all that deep.)

“Musk is far from the only person to move the crypto market for no apparent reason other than making an endorsement,” Oosterbaan wrote. “A sizable portion of the industry from meme coins to NFTs has proven to be highly responsive to celebrity shilling.”

Oosterbaan continued: “High-profile celebrities and Twitter accounts sowing FOMO (fear of missing out) are likely here to stay. The power of social media in the crypto market is testament to the general lack of regulation and maturity, and the inherent liquidity of 24/7, permissionless assets.”

The chart below tracks Musk’s influence on the DOGE price over time, using data from TradingView.

Elon’s impact on dogecoin price (TradingView)

During bitcoin’s swift ascent in January and February, retail traders used social media as a gateway to discover new alternative cryptocurrencies and react to market sentiment in real time.

In just a few tweets, Musk and other popular figures were able to pump and dump coins, leading to significant price gains and losses.

The lesson of this ever-so-bizarre stretch of crypto markets history is that social media was, and still is, a force that’s impossible for traders to ignore.

1 p.m. HKT/SGT (5 a.m. UTC): Japan economic index (Oct.)

3 p.m. HKT/SGT (7 a.m. UTC): Germany import price index (Nov. YoY/MoM)

9:30 p.m. HKT/SGT (1:30 p.m. UTC): U.S. durable goods orders (Nov.)

9:30 p.m. HKT/SGT (1:30 p.m. UTC): Initial jobless claims four-week average (Dec. 17)

“First Mover” co-host Lawrence Lewitinn substituted for Christine Lee. Joining Lawrence was Robinhood Crypto Chief Operating Officer Christine Brown. Starting Dec. 22, Robinhood U.S. customers (not available in Nevada or Hawaii) will be able to customize and send a crypto gift to friends and family from the Robinhood app. Meanwhile, Robinhood has acquired cross-exchange crypto trading firm Cove Markets. Plus, crypto billionaire and FTX CEO Sam Bankman-Fried addressed crypto scrutiny.

Subscribe to First Mover, our daily newsletter about markets.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

No Comments Yet