Happy 2022! Grab that cuppa and settle in as we look back at the best explainers, investigations and analyses that Unwrapped delivered weekly to your inbox in the crypto-crazy, IPO-crammed, Musk-tastic year that was 2021.

Crypto scams and K-pop fans

Members of South Korean K-pop band BTS.

In February, we investigated a bizarre scam involving fans of K-pop band BTS, who call themselves ARMY. “What TF is happening with ARMY Twitter…”, a BTS fan had tweeted a few weeks earlier. That tweet was part of a thread which, in screenshot after screenshot, revealed what she believed was a plot to infiltrate the internet space of her fellow BTS fans—and then scam them senseless with phishing attacks.

NFTs are all the rage. Here’s why.

We first wrote about non-fungible tokens (NFT) in late February, days before Beeple’s now-famous NFT-backed jpeg sold for $69 million at a Christie’s auction, sparking a global craze. Fungible simply means interchangeable. NFTs are thus a type of crypto asset in which each token is unique. This makes them useless as a currency, but extremely useful as incorruptible certificates of authenticity for, well, anything.

Zomato’s IPO playbook

Zomato’s cofounder and CEO Deepinder Goyal

After a hugely successful IPO, Zomato made a bumper debut on Dalal Street on July 23. After the stock closed at Rs 125.85 on the Bombay Stock Exchange, 65.59% higher than the issue price, we took a close look at Zomato’s IPO playbook and what helped make the food delivery firm’s listing a roaring success.

Ecommerce seller beware

In mid-August, the Supreme Court said an investigation by India’s competition regulator into Amazon’s and Flipkart’s business practices could go ahead. A few hours later, Amazon announced it would discontinue its joint venture with Catamaran Ventures next May. We delved deep into the issue to understand why Amazon decided to pull the plug on the partnership.

Crypto ETFs explained

There was a lot of buzz around cryptocurrency exchange traded funds (ETFs) in October, amid reports and rumours that the US Securities and Exchange Commission (SEC) was set to approve the launch of one or more bitcoin ETFs. We delved into EFTs—and specifically crypto ETFs—to explain why this was termed a “watershed moment” for the crypto industry.

A Diwali bonus for bourses, courtesy startup IPOs

At the end of October, we gave you the lowdown on three big startup IPOs that followed Zomato’s—those of Nykaa, Policybazaar and Paytm. While the first two performed beyond expectations, Paytm’s IPO—the largest in Indian corporate history—turned out to be a dud.

NFTs and their uses beyond art

In November, the NFT craze hit new heights as a host of celebrities—from Eminen and Paris Hilton to Amitabh Bachchan and Salman Khan—launched their own NFT-backed digital collectibles. But NFTs can be used for much more than just certifying digital art pieces and collectibles, we wrote. In fact, using NFTs only for these is the equivalent of using the internet only to send email.

India at crypto crossroads

In early December, when rumours abounded that the government would introduce the crypto bill in the winter session of Parliament, we reported that it was also looking to amend income tax and disclosure norms to include terms such as cryptocurrency.

“There is a recommendation to add the words cryptocurrency, crypto assets or digital currency in some parts of the Income Tax Act,” one of the persons said. “This would mean that those filing tax returns will have to specifically disclose their income from cryptocurrency investment or trading,” a person aware of the development told us.

Twelve times Elon Musk moved markets in 2021

Tesla CEO Elon Musk

On December 10, Elon Musk tweeted that he was considering quitting his “jobs” and becoming an influencer full-time. He was joking, of course, and thank god for that. Because even as a part-time influencer, the world’s richest person managed to move markets at least once every month last year.

BIG STORIES BY OUR REPORTERS

Reliance Retail invests $200 million in Dunzo for 25.8% stake

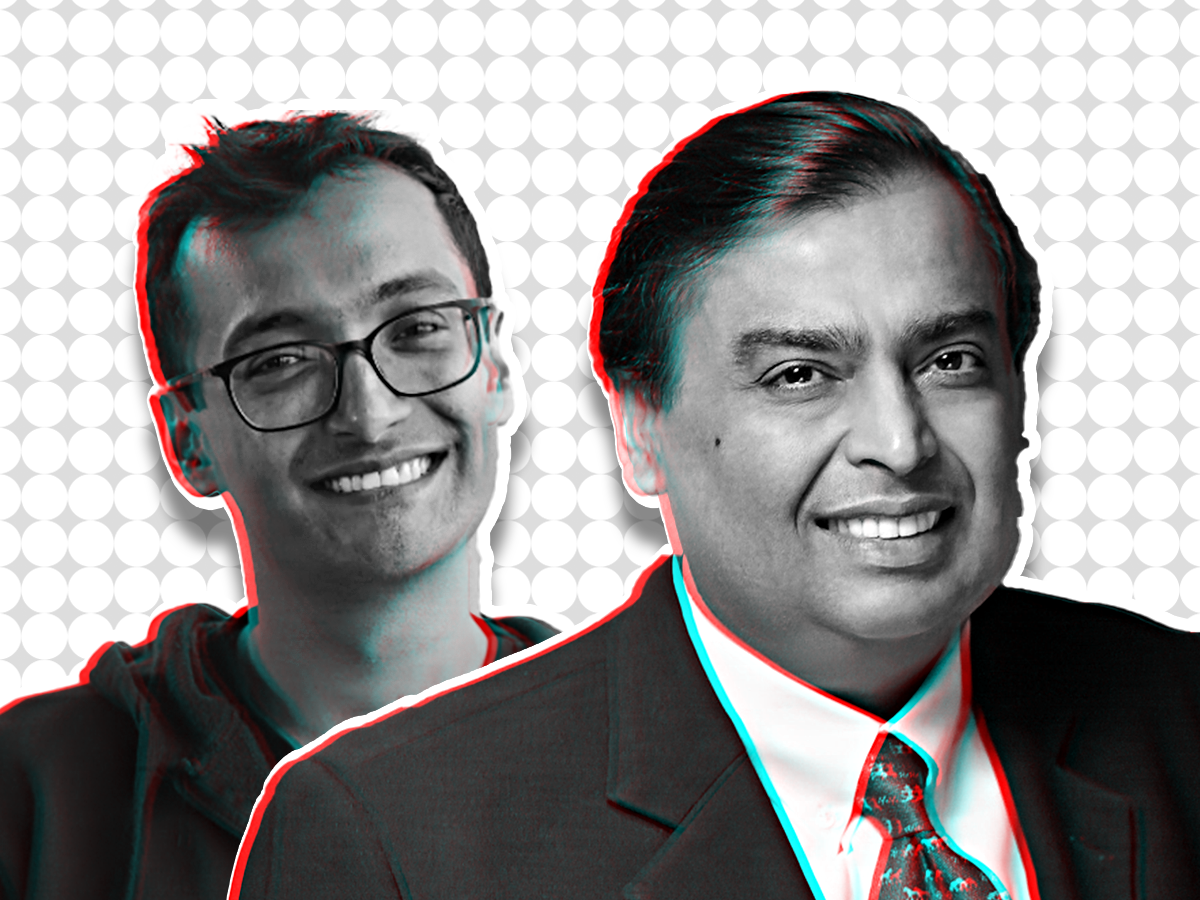

Dunzo CEO Kabeer Biswas and RIL Chairman Mukesh Ambani

Reliance Retail Ventures Ltd. is investing $200 million in Dunzo for 25.8% stake, making the billionaire Mukesh Ambani-led firm the single largest shareholder in the quick commerce startup.

Also read: Unpacking the Reliance-Dunzo deal; Livspace is turning unicorn

- This is significant as it marks the entry of India’s biggest offline retailer into the so-called ‘quick commerce’ space, which is busier than ever.

Dunzo was in stake sale talks with multiple suitors, including the Tata Group, which is aggressively expanding its ecommerce footprint. The talks fell through as the hyperlocal startup was unwilling to cede control to the conglomerate.

Now, RIL has stepped in.

“The idea was to be able to work with a long-term partner on the business. We want to stay as an independent entity and be able to find a way to go public,” Dunzo’s founder Kabeer Biswas told ET, adding that the Reliance team was very “supportive” of these ideas.

According to Biswas, Dunzo is planning an initial public offering in the next three years. Both new and existing investors are aligned with the thought process.

The Big Interview: Flipkart CEO Kalyan Krishnamurthy

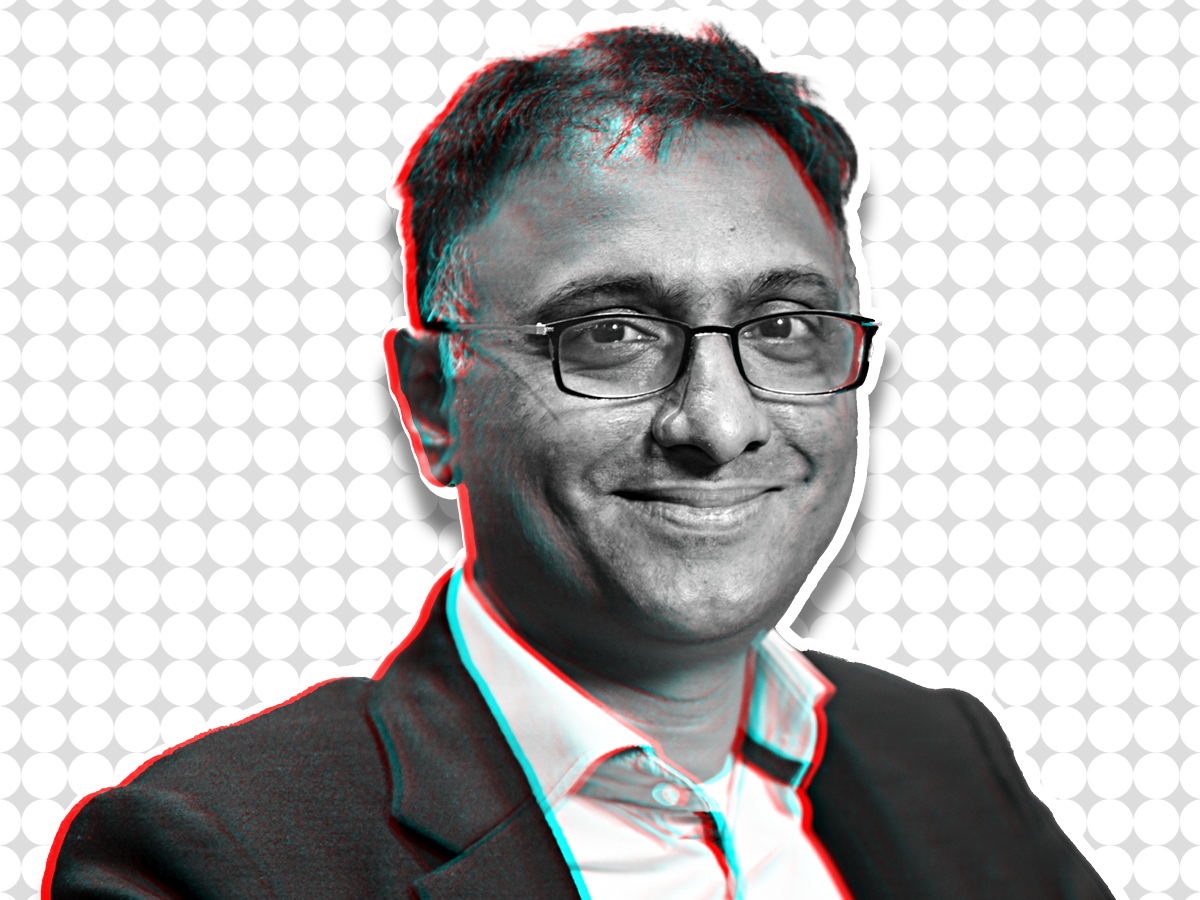

Flipkart CEO Kalyan Krishnamurthy

Flipkart will scale verticals such as grocery, hyperlocal deliveries and its value-focused platform Shopsy, having invested in these areas over the past year or so, CEO Kalyan Krishnamurthy told us in an exclusive interview.

- The Walmart-owned company will double down on these bets and also move forward on healthcare and travel, in which it made strategic investments last year, instead of diversifying further this year.

On the company’s IPO plan, which ET has reported is planned for this year, Krishnamurthy said, “We have not had a discussion with the company board on the IPO so far and are not ready to share a specific timeline.”

From the Crypto World

IndiaTech asks FM for clarity on crypto taxes: IndiaTech, an industry association representing tech startups, has written to Finance Minister Nirmala Sitharaman, asking her to lay down specific rules for taxing crypto assets in her upcoming Budget speech.

In its letter, parts of which ETtech has reviewed, IndiaTech asked the government to tweak existing laws further and suggested that crypto-assets be named formally in tax laws. It also sought clarity on the method of taxation and the disclosures required.

“The Budget should ideally offer coherent rules on direct taxation and the GST council should detail the applicability of taxation else there will be confusion. Basically, the line of thinking is that we shouldn’t be waiting for a bill alone and the Budget should begin the process,” Rameesh Kailasam, president and CEO of IndiaTech, told ETtech.

GST probe may set precedent for crypto taxation: Even as the indirect tax department initiates probe against several crypto exchanges for escaping GST liability, it may have also set a precedent around the categorisation of crypto assets for taxation.

What awaits India on the crypto front in 2022? A surge in interest from investors—both risk and retail—made 2021 the year of cryptocurrency in India, much like the rest of the world. It also pushed regulators to take note.

The government listed the cryptocurrency bill for consideration in both the budget and winter sessions of Parliament last year, but decided not to table it both times. Now with the budget session approaching, India’s nascent crypto industry is watching developments closely.

Web3 tools to take centre stage in 2022: Web3, which promises to empower creators and reduce dependence on large social media platforms, may start to become a reality in 2022. That’s because Indian content creators are set to embrace blockchain-based tools as they race to develop their own brands and find alternative ways of making money, experts told us.

Ecommerce Picks

What Indian ecommerce will look like in 2022: Younger, more nimble players are challenging dominant incumbents Walmart-owned Flipkart and Amazon India in the Indian ecommerce universe. The new kids on the block are expanding deeper into the country to net users and push them to transact online, opening up new frontiers for the industry.

Amazon’s marketplace unit clocks 49% growth in FY21: Amazon Seller Services, which runs the Amazon India marketplace, reported revenue from operations of Rs 16,200 crore in FY21, up 49% from Rs 10,847.6 crore in FY20. Losses stood at Rs 4,748 crore, down from Rs 5,849 crore in FY20. The numbers were sourced through business intelligence platform Tofler.

Flipkart India units post robust revenue growth: Two key units of Flipkart’s India business—Flipkart India and Flipkart Internet—reported growth of 25% and 32% in revenue from operations in FY21, respectively, according to regulatory filings sourced from business intelligence platform Tofler. The first is the wholesale unit and the second is the marketplace arm.

Flurry of orders rings out 2021 for Swiggy, Zomato

Zomato CEO Deepinder Goyal and Swiggy CEO Sriharsha Majety

Online food delivery platforms Swiggy and Zomato hit an all-time high in sales volumes on New Year’s Eve 2021, as people stayed indoors owing to a surge in Covid-19 cases.

Zomato said it clocked over Rs 100 crore in gross merchandise value (GMV) compared to Rs 75 crore it had snagged last year on December 31. Arch-rival Swiggy said orders delivered grew 62%, while GMV went up 61% on Friday, against last year.

Ola Electric’s starting troubles land at FADA’s doors

The purported mismatch in the sales figures of Ola Electric scooters has the president of a national automobile dealers’ lobby concerned. And a bunch of customer complaints that have landed at his doorstep are simply adding to the EV startup’s teething troubles.

According to the Ministry of Road Transport and Highways’ VAHAN dashboard, which maintains real-time vehicle registration data, a total of 439 Ola Electric scooters were registered as of Thursday morning. That compares with the 4,000 dispatches the company claimed it had made in December.

KKR & Co. set to make Livspace a unicorn

KKR & Co. is in advanced talks to lead a $200 million funding round in Livspace in what would be the biggest fundraise by the home-interior solutions firm since inception.

- While $175-$180 million is likely to come from the New York-based private equity major, existing investors are also looking to pitch in. After the investment, KKR and TPG Growth will be the two largest investors in the company.

Once the deal is approved, the company’s valuation would double over what it is currently to $1.3 billion—making the Bengaluru-based startup the latest entrant into India’ coveted unicorn club. A formal announcement is likely in the coming days.

Ex-Myntra CEO’s venture could soon be worth $100 million

Former Myntra CEO Amar Nagaram

A brand new startup is in talks with investors such as Falcon Edge and Accel Partners to raise $25-$30 million in its first round of funding at a valuation of $100 million, several sources told us.

The company, founded by former Myntra CEO Amar Nagaram, doesn’t even have a name yet. If the deal goes through at a $100-million valuation, it will be among the most valuable idea-stage startups ever.

Startups roll out new HR strategies to hire the young

Employees at Meesho can now take a couple of days of ‘celebration leave’ to take a new car for a spin, moving into a new house, or any other milestone. InMobi has rolled out an auto-approved, no-questions-asked leave policy that employees can use at any time.

These startups, and others such as Innovaccer, Licious, and Instamojo, are dropping one-size-fits-all HR policies for customised, new-age policies as they seek ways to better engage with their young employees in a work-from-home world.

That’s all from us this week. Stay safe and get that jab.

No Comments Yet