Good morning. Here’s what’s happening:

Market moves: Bitcoin ended its two-day winning streak with heavier selling pressure during late U.S. trading hours.

Technician’s take: BTC’s pullback could continue into the Asia trading day; initial support at $35K.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Bitcoin (BTC): $37,031 -4.5%

Ether (ETH): $2,690 -3.8%

Bitcoin (BTC) and the broader crypto market faced heavier selling pressure in late U.S. trading hours on Wednesday, ending the oldest cryptocurrency’s two-day winning streak.

At the time of publication, the largest cryptocurrency by market value is changing hands at $37,031, down 4.5% in the past 24 hours, according to CoinDesk data. Ether, the second-biggest cryptocurrency by market capitalization, was trading at $2,690, off 3.8% for the same period.

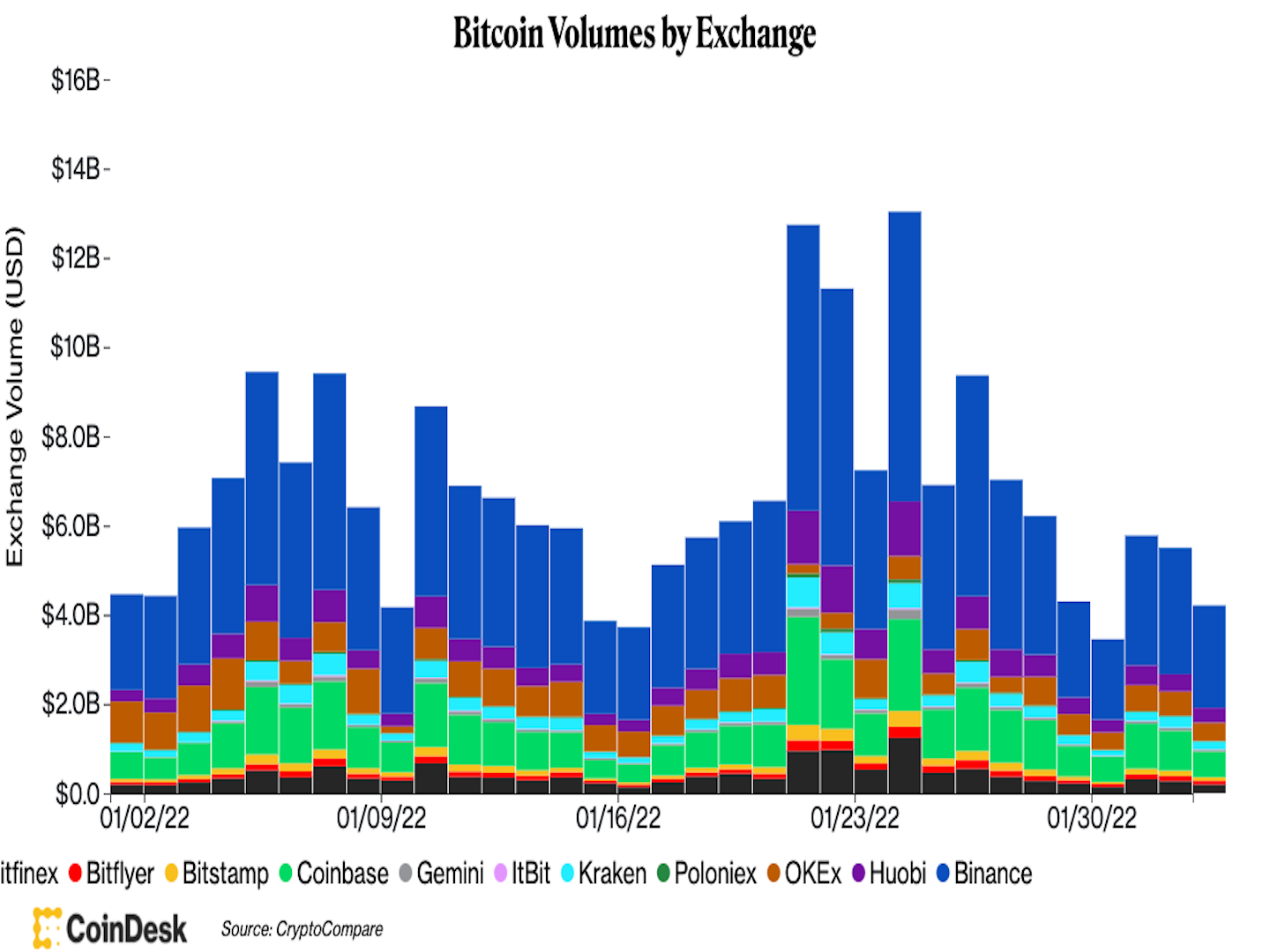

According to data compiled by CoinDesk, bitcoin’s trading volume across major centralized exchanges on Wednesday continued to drop.

(CoinDesk/CryptoCompare)

In broader cryptocurrency markets, most alternative cryptocurrencies (altcoin) were also in the red on Wednesday. At the time of publication, some of the day’s biggest losers were tokens associated with the decentralized finance (DeFi) sector, including loopring (LRC), curve (CRV) and solana (SOL), based on data from Messari.

Ether suffered more losses than bitcoin during the late trading after a “potential exploit” of more than 120,000 ether (worth more than $326 million in total) was discovered on cross-chain bridge Wormhole. The popular bridge for connecting Solana and a few other major networks is attempting to negotiate on-chain with the hacker, as CoinDesk reported.

The event is ongoing, with Wormhole tweeting its network is “down for maintenance” as the team looks into the issue.

Bitcoin four-hour price chart shows support/resistance with RSI on bottom (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) failed to sustain a bounce above $38,000, although short-term buyers could remain active above the $35,000 support level. Momentum was starting to fade on intraday charts, which means the pullback could continue into the Asia trading day. At the time of publication, bitcoin was trading at about $37,000.

The relative strength index (RSI) on the daily chart approached overbought territory on Tuesday, which preceded the current pullback in price. Additionally, the 100-period moving average on the four-hour chart, currently at $38,220, continues to cap brief price gains.

Bitcoin remains in an intermediate-term downtrend since November and has consolidated between $35,000 and $38,000 over the past week. Buyers will need to make a decisive move above $40,000 in order to reverse the downtrend.

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia imports/exports (Dec.)

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Jibun (Japan) bank services purchasing managers index (Jan.)

8:30 a.m. HKT/SGT (12:30 a.m. UTC): National Bank ANZ (New Zealand) commodity prices (Jan.)

8:30 a.m. HKT/SGT (12:30 a.m. UTC): National Australia Bank’s Business Confidence (Q4/QoQ)

5 p.m. HKT/SGT (9 a.m. UTC): Markit Economics services purchasing managers index (Jan.)

“First Mover” hosts spoke with CoinDesk sister company Grayscale’s Global Head of ETF Dave LaValle as the company launches its first exchange-traded fund (ETF) that tracks the Bloomberg Grayscale Future of Finance Index. CoinDesk “Money ReImagined” co-host Sheila Warren shared her plan for the Crypto Council for Innovation as she starts her first day as its CEO. Plus, “First Mover” offered insights into India’s crypto policy change from Tanvi Ratna, founder of Policy 4.0.

NFT Platform Pixel Vault Closes $100M Investment: The funding by Velvet Sea Ventures and 01A, the venture capital firm founded by former Twitter CEO Dick Costolo, will help the startup support a range of projects.

“The focus has clearly turned to earnings. We’ve seen strong results from big tech companies. But at some point we might have sentiment turning back to macro data and the [U.S. Federal Reserve] – we think we will oscillate between these two points. For financial markets, this means more volatility.” (Luc Filip, head of investments at SYZ Private Banking to The Wall Street Journal) … “The carnage marks one of the worst starts to a year for fundamental stock pickers in recent memory. It adds to rare losses many growth and technology hedge funds suffered last year, as expectations of higher interest rates hit many of the stocks they favor.” (The Wall Street Journal) … “There is a fairly large supply and demand gap in the Indian [non-fungible token] market. NFT creators here are proliferating while collectors remain nonexistent. Both sides paint a different picture of how they see the NFT opportunity in India.” (Tanvi Ratna for CoinDesk) … “But if you’ve ever had to transact with a Swiss crypto exchange, you probably breathed a sigh of relief upon reading the news, because getting your crypto off a Swiss exchange is a pain in the bum.” (CoinDesk columnist Leah Callon-Butler)

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Damanick is a crypto market analyst at CoinDesk where he writes the daily Market Wrap and provides technical analysis. He is a Chartered Market Technician designation holder and member of the CMT Association. Damanick is also a portfolio manager at Cannon Advisors, which does not invest in digital assets. Damanick does not own cryptocurrencies.

Subscribe to Crypto for Advisors, our weekly newsletter defining crypto, digital assets and the future of finance.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

No Comments Yet