Marathon Digital Holdings Chairman & CEO Fred Thiel joins Yahoo Finance Live to discuss bitcoin mining regulation, mining using renewable energy, crypto climate concerns, working with grid energy sources, and crypto ETFs.

Video Transcript

– Bitcoin on the run over the past five days, attempting to have a lovely February in the face of a dismal January that it did have when it touched $33,000. For more on Bitcoin and crypto price moves that we’ve been tracking, let’s bring in Yahoo Finance’s Rachelle Akuffo. Welcome to the team– a hearty welcome, Rochelle. So put this crypto move in context for us.

RACHELLE AKUFFO: Well, Brad, thank you for that warm welcome. Now, as you mentioned, that five-day run has Bitcoin walking a little bit taller on Monday. It’s posting its longest rally since September. And it’s also jumped past its 50-day moving average for the first time in nearly three months.

Now, throughout the day, Bitcoin has been hovering between $42,000 and $44,000 territory for most of Monday. It’s currently above $44,000. It’s up 6% for the day.

Now, as is usually the case, altcoins, including Ethereum, the second-largest cryptocurrency, also tracking multi-week highs and tracking this bullishness. And then, of course, the main tokens, including Shiba Inu, catching the wave, up 46% at one point today.

Now, keep in mind that despite the positivity, Bitcoin is still a far cry from its record high of $69,000 that we saw back in November. It seems like forever ago with all the volatility. But then that was also followed by the so-called “crypto winter,” where Bitcoin lost as much as 50% of its value.

– Rachelle, it’s great to have you on with us. What factors are at play here driving this price action?

RACHELLE AKUFFO: Well, so a couple of things in play– first of all, investors do seem to be willing to take on some of these riskier assets, hoping to capitalize on the dip and really play this long game with crypto, even in the face of volatility. You also have some economists looking at what we saw with the US job numbers completely blowing expectations out of the water. And we also saw, of course, Amazon’s earnings beat, which lifted some of that Meta moodiness that we saw after Meta failed to deliver.

Now, we also have some of these Non-Fungible Tokens, or so-called NFTs, that continue to gain popularity. We saw them gain popularity first with artists and then with celebrities and now increasingly with athletes, especially in the run-up to the Super Bowl. And since NFTs are secured by Ethereum’s blockchain, that’s also helped Ethereum soar higher.

Now, it might also have helped that Tesla in its SEC filing on Monday announced it was holding close to $2 billion in Bitcoin at the end of 2021. So– and that’s even despite the volatility and some losses, but still holding there.

Now, we do know that this kind of rally does tend to bring out the more optimistic side of people, some of these six-figure predictions for Bitcoin. And it has, along with some sort of varying predictions as to when that’s actually going to happen. Some are saying $100,000 by the end of the year, others saying $200,000.

We saw that in a note to investors, FSInsight told investors that Bitcoin could hit $200,000 in the second half of the year. We also saw that Sean Farrell at Fundstrat says by the end of 2022–

Now, his argument is follow the money. He’s looking at venture capital investors, who’ve poured $30 billion into crypto and blockchain-related companies in 2021. Now, that is a record. And it’s nearly four times the record that we saw of $8 billion back in 2018.

– Yahoo Finance’s own Rachelle Akuffo, excellent breakdown there. We’re going to continue to check in on some of the crypto price action. And we’ll continue the conversation here with our next guest as well.

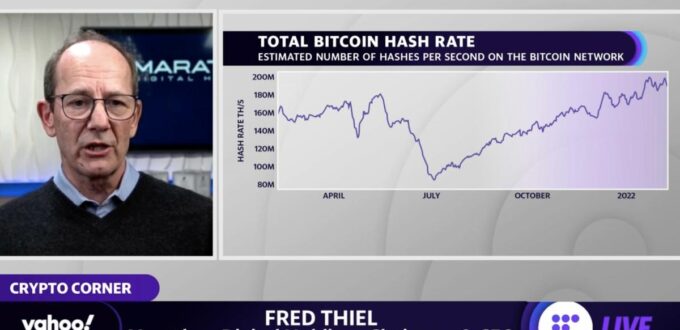

Many miners out there trying to cash in– and has the process and the practice improved to be more environmentally sustainable? Joining us now, we’ve got Fred Thiel, who is the chairman and CEO of Marathon Digital Holdings. Fred, great to have you here with us on the day. Perhaps we lead off this conversation with mining. It’s even caught the attention of Washington, DC, given the climate impacts. Have changes regulators are looking for been determined just yet, though?

FRED THIEL: No. I don’t think it– regulators have determined any changes. I think, you know, the great thing with the US regulatory environment is there are lots and lots of people who are regulating the space, or attempting to– the CFTC, the SEC, the Department of Treasury. And, you know, the group that seems to be focused on mining right now is more, really, a group of people concerned regarding the energy use of proof of work as a technology. Proof of work is what secures the Bitcoin blockchain and makes it the most secure blockchain out there. North American Bitcoin miners are predominantly using renewable energy.

And I think there’s a lot of misconceptions in the US today regarding energy use. Many people don’t realize we actually generate about 14% more energy than is consumed in the US. And 10% of the time, for example, in Texas, energy is negatively priced, meaning the energy companies have to pay people to take it because they have excess energy.

We’ve built out a lot of renewable energy in the US. And it produces power at a time of day when most consumers aren’t using it, which is the middle of the day. And Bitcoin miners provide this great baseload customer for renewable energy providers.

We are focused predominantly on attaching to the power grid behind the meter, so to say, at the point of power generation, which allows us to be curtailed or shut off whenever the grid needs the energy. So we act as a type of battery, you could say, a buffer, so that the energy companies are getting paid for energy when consumers don’t want it and don’t pay for it. And then when the consumers need it, we voluntarily shut off. And you can see most of the news regarding the recent cold weather in Texas– the vast majority of miners voluntarily said, hey, you know, shut us down. We don’t– you know, we’re– we want to provide the energy to the grid so that people don’t lose electricity.

So the US energy market is very different from the European one. And I think it’s a question of education. People really need to learn about energy, how it works, the fact you can’t store it very easily, you can’t ship it long distances. And the only reason the consumers would ever go without power is typically a grid-related issue, not a power generation or a– because a Bitcoin miner is operating issue.

– Fred, this is Emily. Thanks so much for joining us. What specific regulatory action or oversight would you want to see come out of Washington to regulate this climate impact of Bitcoin mining for your company or for others in the industry, of course, as well?

FRED THIEL: Well, I think it all depends on what do you want the regulators to do. So if you want the regulator– if the goal is that the US grow its renewable energy generation, then regulators should incentivize Bitcoin miners to focus on renewable energy sources. Why? We provide huge baseload consumption to the power generators, the renewable energy generators, which allows them to invest in more capacity.

Here’s the problem. In California, there is so much renewable energy capacity that the grid tells the operators to shut down to the tune of about 1.4 terawatt-hours last year alone. Had that energy been used by Bitcoin miners when consumers don’t need it because they were told to shut it off, it would have produced almost $700 million of revenue that could have gone to the energy producers.

So there’s a huge amount of incentive for renewable energy producers to work with Bitcoin miners. And I think if the regulators were to simply say, hey, here’s an incentive for renewable energy to be used for Bitcoin mining versus fossil fuel, I think that could go a long way to, additionally, moving the transition.

But you have to realize if the power generators don’t have an incentive to build more energy-generating capacity, they’re not going to. And so if we want this country to move away from fossil fuels, which predominantly generate what’s called baseload energy, then they’re going to have to build out a lot of renewable energy, which today is not profitable for the energy providers to do. So you have to create an incentive.

So we’re very focused on becoming fully carbon-neutral by the end of this year, much faster than most companies in the United States or in the world. And we’re well on track to being that. And we look forward to being a very active proponent of deploying lots of renewable energy. And you’ll see, you know, announcements from us throughout this year on what we’re doing in that area. And we’re very happy to play our part in that.

– Certainly. A big day in mining news, as well, particularly as we were able to confirm earlier the Valkyrie Bitcoin miners ETF– that going to be listed on the NASDAQ, and particularly not directly Bitcoin-touching. But it’s really going to look at the companies that are leveraging mining or get the majority of their revenue or profits through mining. And so what is the significance of yet another type of exposure into the companies that are doing the most on the mining front being available to and via a traditional asset class, if you will?

FRED THIEL: It kind of gets back to Warren Buffett’s famous quote that, you know, I don’t invest in gold, I invest in gold miners. Why? Well, the gold miner has a very large amount of gross margin in their production that you don’t get when you buy spot gold as an investor– same thing with spot Bitcoin. It costs Marathon a little over $6,000 to produce a Bitcoin when Bitcoin is trading today at around $44,000 a Bitcoin. That’s a very profitable business.

And we don’t sell our Bitcoin. So we hold it. So we’re constantly accumulating more and more Bitcoin. We’re the fifth-largest holder of Bitcoin of publicly traded US companies today. And we continue to hold. We’re a very lean operator. We’re very asset-light. And with the profit margins that that cost of production affords us, we become a very attractive stock as we grow our production capacity. And we’re growing about seven-fold this year, our capacity, from a perspective of the amount of exahash that we’re producing or our– think of it as our compute power. And so it becomes a very interesting proxy for Bitcoin because you get the benefit of the profit margin of the producer as opposed to just the incremental value in the spot market price of the underlying commodity.

– Fred, we got to have you back on to continue this conversation. We got to leave things there on the day, though. Fred Thiel, who is the Marathon Digital Holdings chairman and CEO– we appreciate the time here, Fred.

No Comments Yet