On Thursday, US President Joe Biden said the US and its allies would impose “devastating sanctions on Russia. He said the country would cut off Russia’s largest bank, Sberbank, to its financial system and impose “full blocking sanctions” on various other banks and their subsidiaries. The sanctions also targeted several Russian elites who have “enriched themselves at the expense of the Russian state”.

No SWIFT kick: Crucially, though, Biden said the measures would not extend to cutting Russia off from the SWIFT network — a payments system used across the world — in response to European officials. Doing so would have effectively prevented the Russian state and its oligarchs from being able to transact anywhere in the world.

Crypto route: Cutting Russia off from SWIFT would almost certainly cripple its economy – which it’s sometimes called “the nuclear option”. But even if the US and its allies were to take this drastic step, Russia would still be able to mitigate some of the impact of the sanctions with cryptocurrencies, various experts have claimed.

“If a wealthy individual is concerned that their accounts may be frozen due to sanctions, they can simply hold their wealth in Bitcoin in order to be protected from such actions,” Quantum Economics founder and CEO Mati Greenspan told Bloomberg this week.

Yes, but: Evading sanctions isn’t as easy as turning all your dollars into bitcoin (as you might have guessed). That’s because it’s hard to actually buy anything with cryptocurrencies, which fluctuate wildly.

What’s more, the oil trade, which accounts for a huge share of Russia’s economy, is denominated in US dollars.

And to this the real threat that cryptocurrencies, if widely adopted, could pose to the already battered Russian rouble and you quickly start to realise that this is far from a perfect solution.

Iran playbook: There are ways Russia could theoretically mitigate the pain of sanctions. One is by copying what Iran, another oil exporter, has done. The country, which has been under a near-total US embargo for decades, has figured out how to take some of the bite out of sanctions by turning to bitcoin mining, according to a report by analytics firm Elliptic.

The report estimates that 4.5% of all bitcoin mining takes place in Iran (as of May 2021), allowing the country to circumvent trade embargoes to some degree. Iran’s state-controlled power generation company revealed in January 2021 that up to 600 MW of electricity was being consumed by bitcoin miners, Elliptic said.

Crypto push: So will Russia use crypto to dampen the impact of sanctions? They’ll certainly give it their best shot. On February 18, the country’s ministry of finance introduced a cryptocurrency bill in parliament, pushing forward with a plan to regulate these digital assets.

It did so over the objections of the country’s central bank, which has suggested punishing crypto trading and issuance with fines up to 500,000 rubles ($6,360) for individuals and one million rubles for companies, the Tass news agency reported.

Written by Zaheer Merchant in Mumbai.

OTHER TOP STORIES BY OUR REPORTERS

The BharatPe saga

BharatPe cofounder Madhuri Jain

Madhuri Jain sacked: In a new twist in the ongoing BharatPe saga, the company fired its head of controls Madhuri Jain on charges of ‘misappropriation of funds’, we reported on February 23. Jain, wife of BharatPe cofounder Ashneer Grover, had overseen finances at the $2.8-billion company since October 2018.

Quote: “As per your query, we can confirm that the services of Madhuri Jain Grover have been terminated in accordance with the terms of her employment agreement,” a spokesperson for the fintech firm said.

Grover attacks board chairman: Meanwhile, Grover wrote to the company’s board on Tuesday afternoon, informing it about an ‘expletive laden’ communication between himself and group product head Bhavik Koladiya that allegedly took place in the presence of board chairman Rajnish Kumar.

Grover said that the involvement of Kumar in the ‘episode’ confirmed his apprehensions that “the entire façade of the alleged governance review is riddled with premeditation, bias and prejudice”.

Kumar responds: In response, Kumar told ET the allegations would have have no impact on the company or his reputation.

“Ashneer is being immature. There will be no impact of this on the company or myself. Everyone knows my credibility and these comments won’t change that,” he said.

Grover seeks indemnity: The embattled BharatPe cofounder also sought indemnity from any future action against him in his ongoing settlement discussions with the fintech firm and its shareholders, people familiar with the matter told us.

Crypto corner

Crypto platforms introduce new products as investors explore ways to save tax: As investors explore ways to save tax on their cryptocurrency investments, crypto platforms are introducing new products to help customers earn interest on their crypto deposits or draw loans against them without attracting the new tax. The budget proposed a 30% tax on returns from digital currencies and a 1% tax deducted at source (TDS) on all crypto transactions.

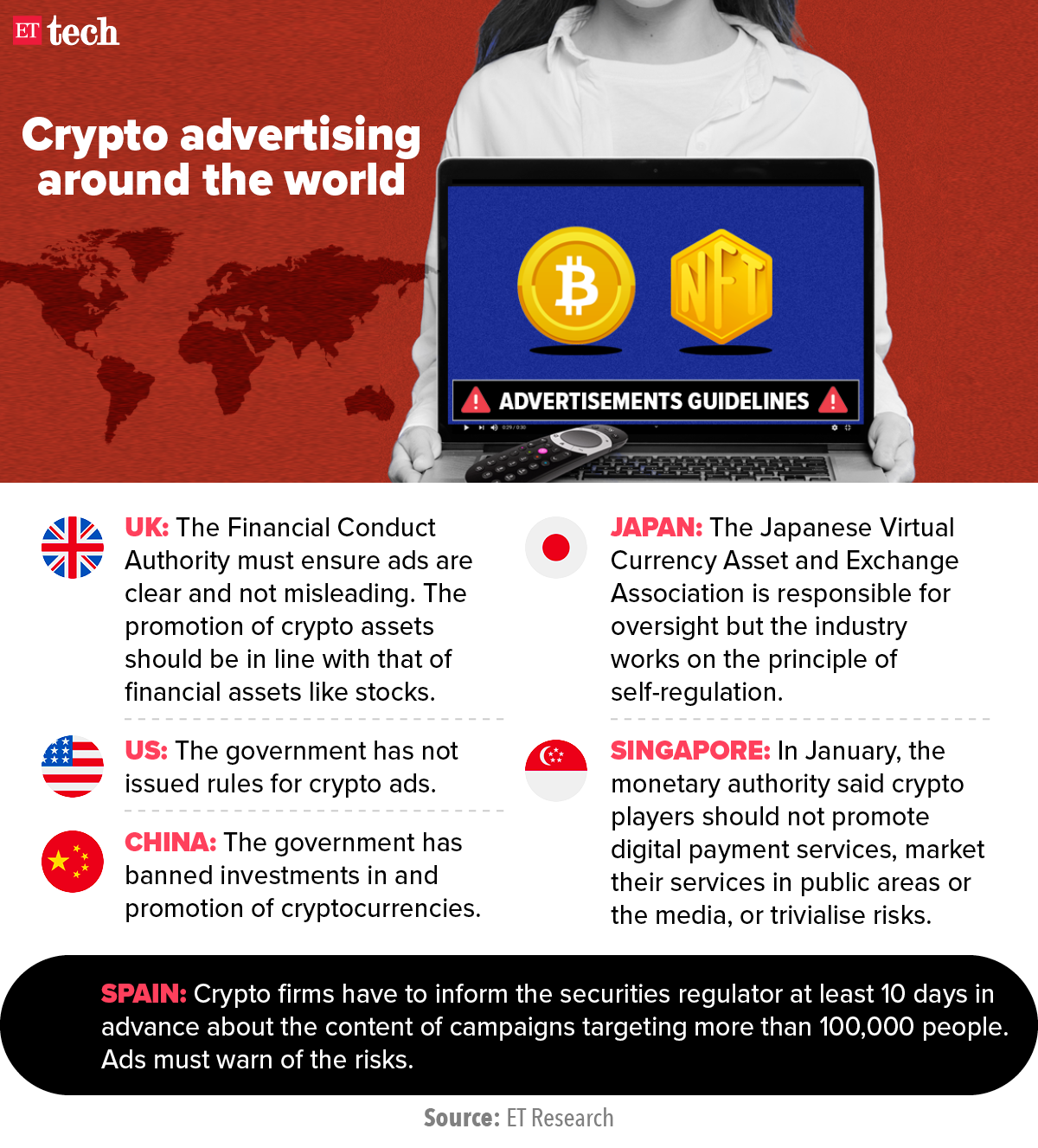

New ad guidelines: The Indian advertising industry’s self-governing body put out guidelines for the promotion and advertisement of crypto and non-fungible tokens (NFTs) amid growing concerns over their sustained targeting of retail investors. The Advertising Standards Council of India (ASCI) said on Wednesday that all virtual digital asset (VDA) products and services should carry the disclaimer: “Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.”

Crypto nosedives: The global cryptocurrency market plunged 11% on Thursday as Russia sent troops to Ukraine in what it termed as a “special military operation” but widely condemned by Western powers as an outright invasion. The most valuable crypto assets have dropped between 10% and 18% since Wednesday as the geopolitical conflict escalated, sending tremors across global markets.

Many new crypto investors were in panic mode as the fourth correction in two months set off fears of a ‘crypto winter’.

Digital fashion: After Bollywood stars and sports celebrities, India’s top fashion designers are now looking at non-fungible tokens (NFTs) as a credible source of income for their digital fashion collections.

Designers including Manish Malhotra, Raghavendra Rathore, Anamika Khanna and Pankaj & Nidhi have already embraced blockchain technology in order to connect with more tech-savvy audiences. Most of them have seen their initial drops of digital artwork sell in minutes on NFT marketplaces.

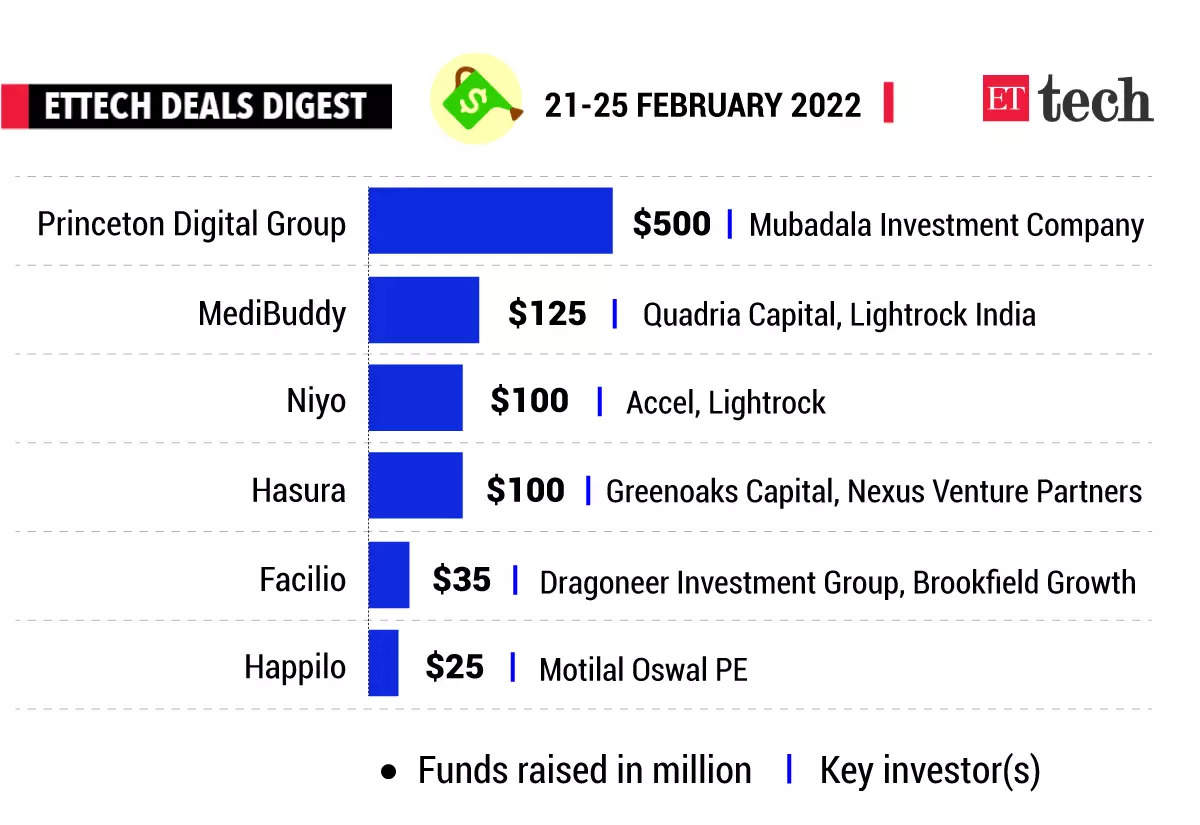

ETtech Deals Digest

IvyCap Ventures raises Rs 1,608 crore

IvyCap Ventures has mopped up Rs 1,608 crore ($214 million) from institutional investors in the first close of its third fund. Banks, insurance companies, mutual funds, family offices and government institutions have come on board the fund, an IvyCap executive said. State Bank of India, Life Insurance Corporation of India, and HDFC Life are among the sponsors of the Mumbai-based fund, said people in the know.

AngelList India’s Utsav Somani launches Galaxy

At a time when a growing number of established entrepreneurs are setting up their own investment funds to back startups, AngelList India’s Utsav Somani has launched a vehicle called Galaxy with a corpus of $45 million that will enable early-stage startup founders, typically at the seed to series-A stages to invest in young companies. Once selected in the programme, each founder will be handed out $1 million to invest in startups and if the first few bets are promising they will have access to $2 million each, Somani, founding partner of Galaxy, told ET.

Chargebee acquires Numbers

Subscription management platform Chargebee said on Thursday it has acquired collections management platform Numbers and launched Chargebee Receivables. The acquisition comes on the heels of the recent additions of Brightback and RevLock to Chargebee and a new round of funding co-led by Sequoia and Tiger Global.

Curefoods acquires franchise rights for Sbarro

Curefoods, a cloud kitchen company that houses brands like EatFit, CakeZone and Great Indian Khichdi, on Thursday announced the acquisition of the South India franchise rights for US-based pizza chain Sbarro. Sbarro is a global pizza brand that specialises in New York-style pizzas and is present in 630 locations across 28 countries, Curefoods said in a statement.

Prime Venture Partners raises $120 million

Prime Venture Partners, an India-focused venture capital fund, has raised $120 million (Rs 900 crore) towards the final close of its fourth fund, the firm said in a release. With this, the firm joins a long list of venture capital investors that have recently raised larger pools of funds to invest in early stage Indian companies.

Can Yulu pull off its expensive post-pandemic pivot?

Joydeb, 21, does not own a bike or even have a licence to ride one. For him, renting a Yulu Miracle 2.0 electric bike and using it to deliver food has become an easy way of earning some money.

The bike cannot cross 25 km per hour, so it doesn’t come under the Motor Vehicles Act. This means riding it doesn’t require a licence – the Miracle 2.0 electric bike is considered a bicycle under the law. But it’s still had its share of legal hassles.

Many like Joydeb have taken to Yulu’s EV as demand for food and essential delivery has skyrocketed amid the pandemic. Yulu’s cofounder Amit Gupta told ET that 60% of the company’s revenue now comes from the delivery workforce and that he expects this to go up to 80% by the end of the year.

On the policy front

Twitter concerned about India’s Data Protection Bill: Twitter has said it is concerned about proposed legislation in India that could impose fines on the company for failing to remove content deemed inappropriate or inflammatory.

With this, the company joins Alphabet and Meta Platforms in flagging concerns with the Personal Data Protection Bill, 2019, under which companies would face heavy penalties for non-compliance.

Twitter’s concern: Twitter raised these concerns in its annual 10-K filing with the US Securities and Exchange Commission last week, The filing is part of a report on financial performance required from all publicly traded companies in the US.

MeitY releases draft data sharing policy: All central and state government bodies will have to compulsorily share data with each other to create a common “searchable database”, according to a draft policy document.

Driving the news: The document, released on Monday by the Ministry of Electronics and IT (MeitY), has proposed an India Data Office (IDO) with the idea of streamlining and consolidating data access, and sharing of public data repositories across government and other stakeholders. The ‘Draft India Data Accessibility and Use’ policy is open for public consultations till March 18.

The policy document provides an update to the existing government policies — the National Data Sharing and Accessibility Policy (NDSAP) and the Open Government Data Platform (OGD) India — a government official told ET.

Experts flag lack of laws on govt use of citizen data: Meanwhile, the government’s plan to compulsorily require all its agencies to share data on a common database raises concerns about privacy and monetisation of citizen’s data, legal and privacy experts told ET, since India does not yet have a data protection law.

They said that the Information Technology Act, 2000 covers use of personal data by private corporations but there is no policy to govern use of personal data by the government.

Niti Aayog to roll out battery swapping policy in four months

India’s public policy think tank Niti Aayog plans to roll out a battery swapping policy in the next 3-4 months.

The proposed policy will introduce disruptive business models such as battery as a service (BaaS) and leasing so that electric two-wheeler and three-wheeler customers need not own the battery, which is about 50% of the total cost of such vehicles.

The policy will also provide EV owners flexibility to swap batteries at swap stations within minutes, and charge them at home, people aware of the matter said.

Dream Capital in talks to lead $100 million funding in NFT platform Rario

Dream Capital, the corporate venture capital arm of Dream Sports, is in advanced talks to lead a $100 million funding round in cricket-focused non-fungible token (NFT) startup Rario, three sources told us.

If the deal goes through, it will be one of the largest investments in the NFT sector in India and Dream Capital’s maiden bet in the Web3 space.

Rario was founded in 2021 by Sunny Bhanot and Ankit Wadhwa, amid the global boom in NFTs and cryptocurrencies. It has procured NFT rights to five international leagues and almost 600 international cricketers through its various partnerships. The rights allow Rario to create digital player cards like trump cards that could be potentially linked to games and applications.

Live commerce, beauty among Myntra’s focus areas, says CEO

Personalisation, influencer-led live commerce, beauty and personal care will be the key focus areas for Myntra’s leadership team, its newly appointed chief executive Nandita Sinha said.

Sinha, who was earlier vice-president for customer growth, media and engagement at Flipkart, told us in an interview that Myntra was building and strengthening its team with a focus on fashion and technology. Harnessing internal talent would be a top priority, she added.

Targeting Gen Z: Sinha said Myntra launched Style Squad on Tuesday to draw more Gen Z customers. Style Squad is a cohort of influencers that will promote products from Myntra’s partner brands, she said.

CCI seeks more info to clear $4.7-billion PayU-BillDesk deal

India’s competition watchdog is seeking more information about the proposed $ 4.7 billion buyout of Indian fintech BillDesk by payments major PayU India, according to multiple people in the know. They said the Prosus-backed multinational is seeking advice from consulting firms on the matter. Prosus is the Dutch-listed arm of South African group Naspers.

The deal – pegged as the second-largest buyout in the Indian internet sector after Walmart’s $16-billion acquisition of ecommerce major Flipkart in 2018 — will involve the merger of the payments gateway businesses of two of the country’s largest players.

Curated by Judy Franko in Delhi. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.

No Comments Yet