On March 11, 2021, Football Index ceased trading.

Its collapse cost many of its users thousands of pounds and prompted a UK government review, which detailed multiple failures of UK regulators to keep tabs on the product and protect consumers, as well as failures of the company itself.

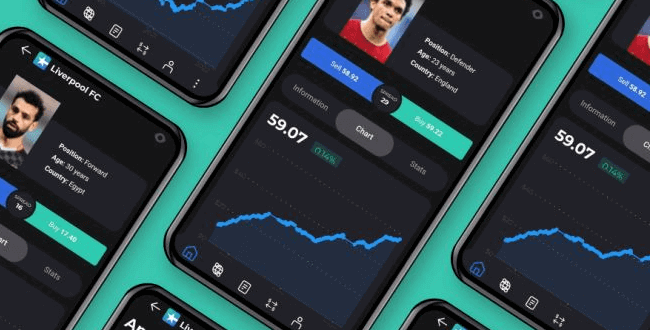

On Football Index, users could buy and sell “shares” in real-life footballers, just like someone might do in a company’s stock.

If the value of the footballer went up — for example, if they signed for a big club or went on a scoring run — their share price went up. But as well as being dictated by player performance on the pitch, share prices were also affected by the whims of the market.

When it suddenly came crashing down, it caused utter chaos.

Seven days later, a new website appeared called AllStars Trader.

It offers users the chance to buy and sell virtual footballers to make cash.

Its sister website, AllStars Digital, boasts the opportunity to “monetise human performance through real-time tradeable products based on sports stars”, based on the controversial technology of cryptocurrency and non-fungible tokens (NFTs).

A LinkedIn post for AllStars Trader says “we look at your favourite footballers as a tradeable asset, there (sic) value goes up and down based on their performance”.

As you can see in the image below, players have a buy and sell price, and you can track how those prices have changed over time.

Akash Gharu is the chief product officer at AllStars Trader and the product and operations chief information officer of Adrix, the firm that provides data for the AllStars product.

Gharu previously worked as the chief technical officer (CTO) of Index Labs, the parent company of Football Index, from July 2019 until December 2020, shortly before the firm’s collapse.

His LinkedIn profile described his role as: “Senior technology leadership for a pioneering brand, Football Index, in their 5th year of operation; moving from startup to hypergrowth (globally). Supported a very ambitious business strategy.”

Gharu told The Athletic: “At no point was I a director or a shareholder. I left the business some 120 or so days as an employee before it failed. At no point did I have any influence over the board or its decision making.

“AllStars Trader was originally trading as Vita Markets. In March 2021, it was rebranded as AllStars Trader led by a new head of marketing. So the launch appears to coincide with the demise of Football Index. There is no other correlation.”

Gharu describes himself as a “critic” of the Football Index business model and explains that his new ventures are a “completely different product” to the Football Index shares, which were technically “three-year bets”. Football Index was also regulated as a gambling website by the UK Gambling Commission, while AllStars Trader is a “trading website”.

Rather than focusing its attention on the British and Irish markets, AllStars Trader appears to be targeting Nigeria.

LinkedIn posts show the company is holding in-person events in multiple provincial cities, like the one pictured below, as well as seeking out recruits via social media networks Telegram and WhatsApp.

“We hold physical education and training seminars in Lagos,” Gharu said. “Clients are welcomed to the office. We also perform Zoom calls for new traders wanting to learn more about the trading experience.”

What is AllStars Trader?

AllStars Trader offers virtual “shares” in footballers, which go up and down depending on on-field performance, and can be traded to make real-world cash. They are bought using an online portal, like the one pictured below.

The prices of these players are based on indices created by Adrix. The operators of this system say it operates in real-time, “providing a genuine benchmarked product that reacts to news, performance and future potential in the same way as traditional company stock”, interrogating “millions of unique data points” to create indices that “reflect human success”.

However, AllStars Trader works on a contract for difference (CFD) model — a type of financial product allowing traders to profit (or lose) from a price movement without owning the underlying asset.

So if you buy when that asset is £1 and it goes up to £1.50, you make 50p. Crucially, you never own the underlying asset — as you would if you were buying shares, for example.

Gharu told The Athletic: “For Football Index, the user is buying a betting slip for a market value that other participants of the market determine as the price. If they then wish to end the bet, the user needs to accept the operator’s cash-out value or wait until another participant will pay to take the bet on themselves.

“For AllStars Trader, the user in entering into a CFD based on an underlying index that tracks the footballer’s performance. CFDs are traded as financial instruments the world over. If the user wants to end the position, they simply close.

“So very quickly, the similarities (with Football Index) end, and the differences begin.”

A disclaimer on AllStars Trader’s website acknowledges there is a “high risk” of losing money. It adds: “CFDs are complex instruments and come with a high risk of losing money rapidly due to leaverage (sic). 70% of retail investor accounts lose money when trading CFDs with this provider.”

AllStars Trader is the trading name of Aqua Index LLC, a company based in Saint Vincent and the Grenadines in the Caribbean.

“With an AllStars Trader player index you can buy, sell or hold your favourite sports person,” the website says.

A post by AllStars Trader on LinkedIn compares the footballer CFDs to company stocks. This is a questionable analogy because company stocks are tangible units of an entity that has documented employees, profits and accounts.

“This is no different to Apple,” the post says. “If they perform well their value goes up, if they underperform there (sic) value decreases.”

“The underlying asset is an index which is calculated using a BMR (benchmark regulation) index methodology seen in many traditional products. We have coupled this with robust exchange technology and the whole product has been some two years in the making,” said Gharu.

“We have been able to get the product working with real clients and ensure the win ratio stacks up. We have recorded a 33 per cent pay-out ratio; that is a sustainable model. More importantly, we educate our clients on risk management and avoiding trading mistakes.”

What is AllStars Digital?

Alongside AllStars Trader, another financial product is being offered under the same umbrella.

This one calls itself AllStars Digital. It claims to “monetise human performance through real-time tradeable products based on sports stars”, and involves a new cryptocurrency token called the AllStars Token, which has not yet been launched.

As shown below, the site says the token will offer “VIP access to AllStars trading products” and “access to sporting NFTs including metaverse activations”.

Football has deepening ties to the world of cryptocurrency and NFTs (non-fungible tokens), with clubs including Chelsea, Arsenal and Barcelona signing big sponsorship deals with firms in the sector.

This product seems to have many similarities to the main AllStars Trader one but with the added complexity of trading in cryptocurrency, which is also subject to the price movements of the market.

“There’s a real chance to earn from your passion for your favourite sport,” the website says. “If you believe you know the best performer, you can trade ahead of the game and watch your (profit and loss) grow.

“Look out for rising stars and trade them for a match, a season or for their career. Build your portfolio and share the countless debates with friends and the community.”

The Nigerian connection

AllStars Trader seemingly has little presence in the UK, Spain or Italy, the countries in which football’s biggest stars ply their trade. Scouring social media reveals the firm is targeting Nigeria instead.

Social media images posted by the firm and its staff show major in-person events in Nigeria promoting the company, many in provincial areas including Ilorin, Oluyole and Ado Ekiti.

Davies Babalola, country director for the firm, recently boasted of 350 people at an event in the city of Ilorin, pictures of which were shared on the site as shown here:

One of the guest speakers is Nigeria-born former England international and Crystal Palace star John Salako, who is an ambassador for the company and regularly appears in social media promotions.

The “AllStars Trader Africa” channel on social media app Telegram has more than 8,000 members, including salespeople who offer their services on WhatsApp to encourage people to sign up.

Posts in the group by administrators carry little in the way of disclaimers warning about financial risks, such as in the example below.

Many on social media have posted about the website using alarming rhetoric about making money, without including any of the disclaimers about potential losses that would be required in a highly regulated market such as the UK.

The one below is from a man who describes himself as a “social media influencer”, though it is not made clear whether he was paid for the post.

AllStars Trader says there is a “core-risk warning” on its website footer and in several client documents and pledges to ensure this is pinned to the site for greater prominence.

“We are following the regulations set out in the regions that we operate,” said Gharu. “We take compliance advice from qualified practitioners that have audited our processes.

“AllStars Trader does not set legislation or regulations in Nigeria, or any other territory, and it is up to legislature in each jurisdiction we will operate in to regulate its own market. We will follow all regulations.”

No Comments Yet