Bitcoin’s (BTC) price rebounded on Wednesday, rising 2% in early morning trading and soaring over 10% following the announcement by the Federal Reserve that it was raising interest rates by 0.75 percentage point.

Much of the talk on Wednesday in both cryptocurrencies and traditional financial markets revolved around the Fed. Its rate hike matched expectations.

This article originally appeared in Market Wrap, CoinDesk’s daily newsletter diving into what happened in today’s crypto markets. Subscribe to get it in your inbox every day.

The Fed “dot plot,” which is the projection of each Fed’s official’s prediction for the federal-funds rate, implies that the rate will increase to 3.5% by the end of this year. The Fed has three more meetings this year (September, November and December).

In traditional equity markets, the S&P 500 and the tech-heavy Nasdaq climbed 1.34% and 2.44% respectively as investors viewed the rate increase positively. The Dow Jones Industrial Average rose by less than half a percentage point.

Ether’s (ETH) price rose 16% on the day, partly on the rate decision. Meanwhile, the Ethereum blockchain successfully implemented a “shadow fork,” or test software update, two days earlier than expected. The test puts Ethereum a step closer to its much anticipated shift from a proof-of-work network to a more environmentally friendly proof-of-stake one.

Altcoins traded higher on Wednesday, as well, with MATIC rising by 9.3% (following the prior day’s 11% decline) and SOL jumping by 5%.

●Bitcoin (BTC): $22,748 +8.9%

●Ether (ETH): $1,601 +16.8%

●S&P 500 daily close: 4,023.61 +2.6%

●Gold: $1,732 per troy ounce +0.9%

●Ten-year Treasury yield daily close: 2.73% −0.05

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Bitcoin Advances as Fed Raises Rates by Expected Amount

Bitcoin rebounded in Wednesday trading, following a rate increase by the Federal Reserve that markets largely anticipated.

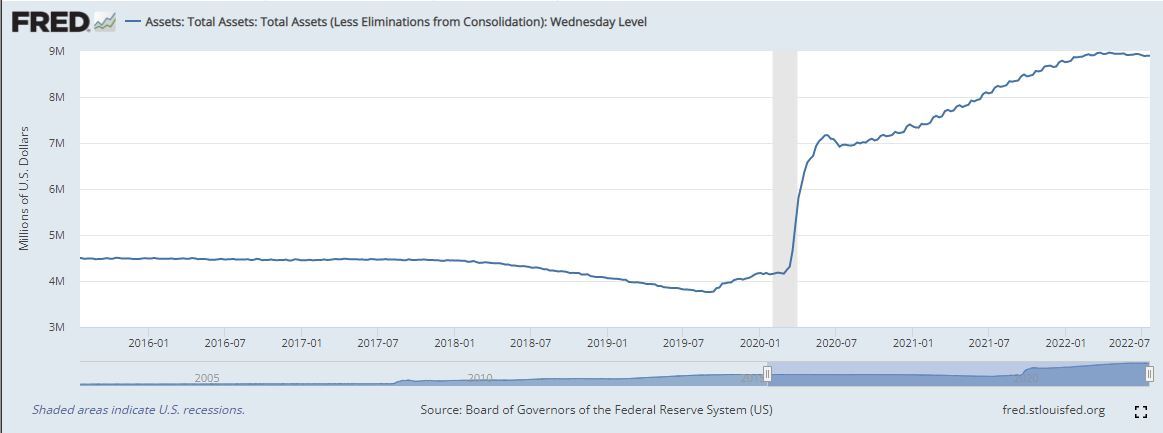

In light of the 75-basis point hike by the Federal Open Market Committee, the U.S. central bank’s comments on May 4 about the size of its balance sheet are particularly noteworthy.

“We intend to significantly reduce the size of our balance sheet over time in a predictable manner by allowing the principal payments from our securities holdings to roll off the balance sheet, up to monthly cap amounts,” the Fed said at the time.

The monthly cap was $30 billion for Treasurys and $17.5 billion for mortgage-backed securities. One interpretation of the Fed’s statement in May suggests that the Fed’s balance sheet would decrease by $47.5 billion each month. As shown in the chart below, however, that hasn’t been the case, as the balance sheet size remains at about $8.9 trillion.

The size of the Fed’s balance sheet (Board of Governors of the Federal Reserve System)

Additionally, the $47.5 billion amount is labeled a cap, and not a target, and so the reduction of the balance sheet will occur as Treasurys fully mature and subsequently drop off of the balance sheet. Investors may also consider Fed Chairman Jerome Powell’s statement that:

“Our balance sheet decisions are guided by our maximum employment and price stability goals. And in that regard, we will be prepared to adjust any of the details of our approach in light of economic and financial developments.”

Ultimately, the Fed has the goals of price stability and maximum employment in mind, but also has to determine the pace and manner in which it achieves those objectives.

The Fed’s policy affects risky assets like stock and cryptocurrencies. As seen in the chart below, the correlations between BTC, the S&P 500 and the Nasdaq Composite remain tight.

Bitcoin/U.S dollar (TradingView)

On a technical basis, the increase in BTC prices came in conjunction with a sharp uptick in RSI (relative strength index) to 56, which indicates increasing momentum.

-

Ethereum’s Mainnet Tenth ‘Shadow Fork’ Goes Live Ahead of September Merge: Developers focused this time on testing key releases similar to the ones in the upcoming Goerli merge – the final testnet hard fork before the real Ethereum Merge. Read more here.

-

Algorand CEO Steven Kokinos Departs, Interim Replacement Named: The blockchain technology company appointed Sean Ford to replace Kokinos for the time being. Read more here.

-

Biggie Smalls’ Estate Goes Crypto: Non-fungible token (NFT) marketplace OneOf is releasing its first collaboration with the late rap legend’s estate called “Sky’s the Limit.” The collaboration lets NFT holders vote on licensing for one of the late rapper’s famed freestyles. Read more here.

-

Listen 🎧 : Today’s “CoinDesk Markets Daily” podcast discusses the latest market movements the relevance of the world’s richest man.

Biggest Gainers

Biggest Losers

There are no losers in CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

Sign up for First Mover, our daily newsletter putting the latest moves in crypto markets in context.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

DISCLOSURE

Please note that our

cookies, and

do not sell my personal information

has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies. CoinDesk is an independent operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

No Comments Yet