In November last year, I bought some Ethereum.

Before the crypto critics start hating on me – I bought £30, and it was just an experiment to see what it did.

At the time, there was a lot of talk about how it was going to take off that week, then that month, then maybe next month.

Of course, had it done so, I would’ve wished I’d bought more. As it was, though, the value of Ethereum dropped – quite dramatically, and seemingly as soon as I’d invested in it.

It wasn’t just Ethereum, either. The value of most better-known cryptocurrencies dropped by varying degrees.

For anyone who has no idea what I’m talking about here, Ethereum is the second most popular digital token, according to Investopedia.

It is also the second-largest cryptocurrency by market capitalisation, so comparisons are often drawn between it and its more famous counterpart – Bitcoin.

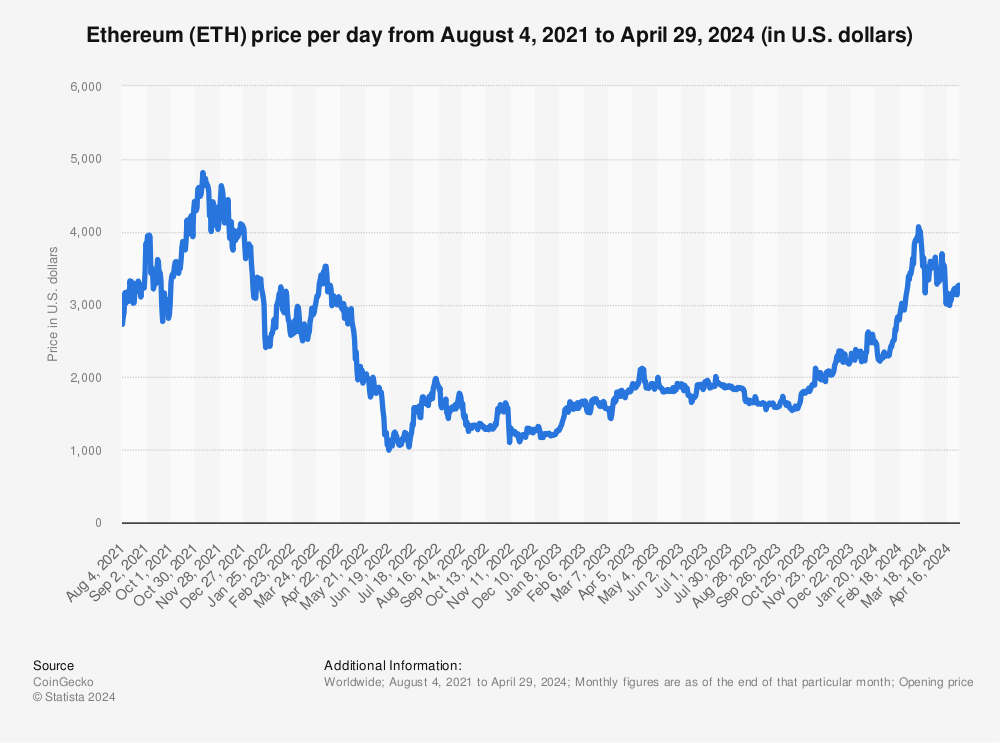

Ethereum went live in July 2015, with a token launch price of 31¢ (around 27p).

Similar to a growth stock, in its first few years it rose steeply to hit nearly $4,430 in November 2021 – the point at which I bought my £30 (*insert eye raise emoji here*).

I almost feel as though I doomed the market because it plummeted to $1,100 in June this year, before regaining some ground to trade at around $1,450.

I’m not even going to pretend I understand the world of cryptocurrency. For one thing, it took me a while when I first joined Money Marketing to get out of the mindset of ‘crypto’ referring to ‘cryptosporidium’ – a parasite which would sometimes get into the water supply and wreak havoc for water companies.

I’m not sure most of the people who rave about cryptocurrency on social media fully understand it. And I think that’s one of the issues. Unlike a growth stock, people don’t really know what it is they’re investing in.

What I do know is that, at the time of writing, the £30 of Ethereum I originally bought was worth £14.60. This is constantly changing, so that price will no doubt be out of date by the time this article is published.

It has recovered somewhat since it fell to about £7 in June this year. But it’s a far cry from the ‘crypto boom’ I expected, and it made me lose interest in my small amount of Ethereum.

I’m not the only one, it seems.

Last month, CryptoMonday – a crypto community based in Germany – found that the volume of Ethereum-related tweets has fallen by more than 65% since the beginning of 2022.

Apparently, they peaked in the week ending on 23 January with 670.31 thousand tweets. But by 31 July, this number had dwindled to 232.33 thousand.

The organisation’s chief executive Jonathan Merry believes the drop could signify that interest in the crypto asset is waning.

He noted that Ethereum’s price has been struggling to break out of its recent slump, further fueling concerns about the health of the Ethereum ecosystem.

Ethereum price, August 2021 to August 2022

One of the reasons for the dramatic swings in the Ethereum price over the past month is an upcoming merge upgrade, in which the current ‘Ethereum mainnet’ will merge with the ‘beacon chain proof-of-stake system’.

Without going into too much detail, ‘proof-of-stake’ will apparently be more efficient than the current ‘proof-of-work’ system. And it has the potential to cut the network’s energy consumption by around 99.95%.

It also sets the stage for future scaling upgrades, including ‘sharding’ – which it is hoped will improve Ethereum’s scalability and capacity.

Traders are currently trying to gauge how the merge will affect the crypto market as a whole.

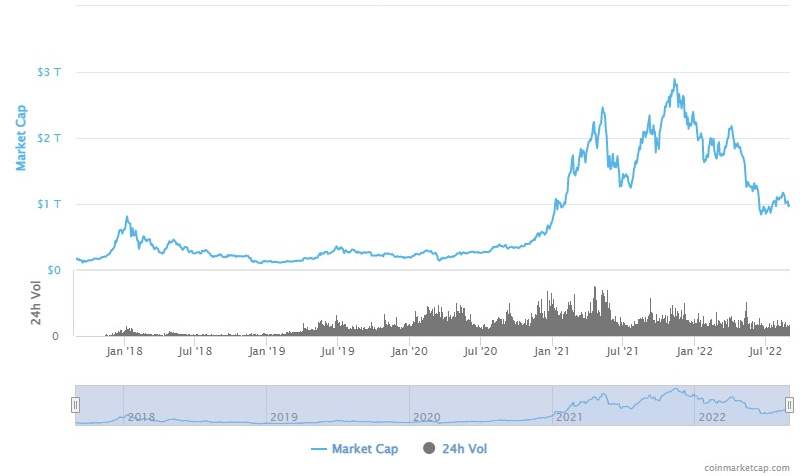

Other cryptocurrencies are struggling to perform as well.

On Monday 29 August, it emerged that Bitcoin had fallen 7.3% over the past week, to below $20,000, while top altcoins fell 5% (Cardano) and 15.7% (Solana). Altcoins are supposedly ‘improved’ versions of the cryptocurrency they derived from because they ‘aim to plug perceived shortcomings’.

CoinMarketCap – a website which tracks the performance of different cryptocurrencies – found the total crypto market capitalisation was down 6.6% for the week, to $952bn.

Total cryptocurrency market cap, August 2017 to August 2022

At the same time, the Cryptocurrency Fear and Greed Index was down to 24 points, from 29 a week earlier, putting it back in ‘extreme fear’ territory.

The Fear and Greed Index was devised by software platform Alternative.me to gather the emotions and sentiments surrounding crypto from different sources and crunch it into one number. At its height, the number of points hit 95.

It is constantly changing, as reflected in the Fear and Greed Index graph below, which will update daily.

Crypto is constantly in the news, and often the reasons are not good.

One of the much-publicised issues is that it isn’t currently regulated by the Financial Conduct Authority.

There have been countless instances where celebrities and well-known organisations have been slammed for promoting crypto.

Arsenal Football Club was recently faulted by the Advertising Standards Agency (ASA) for promoting crypto assets, without properly disclosing the risks associated with them.

The adverts – which appeared on the club’s Facebook page and website – were for fan tokens.

One of the concerns of the ASA was that the adverts did not make it clear that these tokens were crypto assets.

They were criticised for being “irresponsible because they took advantage of consumers’ inexperience or credulity and trivialised engaging with and investing in crypto assets”.

This incident led some to question why the ASA has more of a say than the FCA.

“If it should be anyone cracking down on Arsenal, it should be the FCA not just the ASA,” says Ian McKenna – director of the Financial Technology Research Centre.

“To encourage football fans to such a high-risk form of investment during a cost-of-living crisis is totally irresponsible. The club are abusing the loyalty and passion of their fans.

“Extending the FCA’s powers to full regulate crypto is long overdue, the government should act urgently to address this situation before more people are exploited in this way.”

Crypto regulation is apparently coming, but an article in the Financial Times earlier this week suggested a divide has emerged in EU and UK crypto regulation.

“The UK will start by regulating a few specific crypto assets and service providers, while the EU is pretty much going for the whole lot,” wrote Matthew Elderfield – a former alternate chair of the European Banking Authority.

A lot of advisers I speak to say they wouldn’t touch crypto with a barge-pole (I’m paraphrasing – sometimes what they actually say is much ruder than that). They consider it worse than gambling.

There are many who believe it to be a fleeting fad which will fall quickly and gracelessly out of fashion.

When I first joined Money Marketing, I was inclined to disagree. Although whether you consider me qualified to make that call after reading this is up to you. Some of the Money Marketing team still believe we will see a crypto boom.

But certainly it’s not the first thing most people are going to be rushing out to buy considering the cost-of-living crisis.

My feeling now is that all this crypto hype is a case of all mouth and no trousers. But I would be very happy to be proved wrong and see the value of my Ethereum skyrocket.

No Comments Yet