If this winter’s “Crypto Bowl” made you think the NFL might become too reliant on the techno-lucre, don’t worry. The implosion of cryptocurrency broker FTX and the plunge in Bitcoin this year haven’t created even a ripple in the league’s bond rating.

Ten months after the dominance of crypto-currency ads during the Super Bowl and six months after the NFL opened the door to teams chasing blockchain sponsors, Fitch didn’t even mention the crypto collapse in its latest debt rating for the league, affirming investment-grade scores in its latest review, out Friday morning.

“The NFL structure promotes financial stability and league competitive balance through a high percentage of revenue sharing and potential supplemental revenue sharing. The NFL maintains a robust and stable domestic fan attendance and viewership base,” Fitch said in its note. The agency rates $1.37 billion in debt for NFL Ventures at A+ and $8.6 billion in league-wide credit facilities at A. Those ratings are unchanged from Fitch’s prior evaluations, even though the league increased the amount of debt a team can have to $600 million, from $500 million, at its recent ownership meeting. The additional debt doesn’t hurt the rating “due to the strong visibility of media revenues under the league’s national media contracts,” the agency wrote.

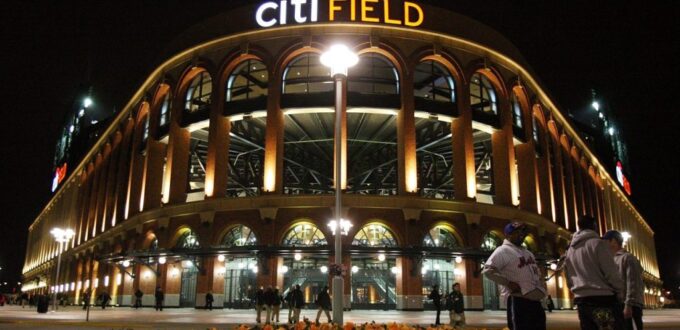

Similarly, strong MLB credit and franchise support helped the New York Mets’ stadium retain its BBB rating from Fitch in a concurrent rating note. (MLB’s debt holding entities are rated A and A- by Fitch.) The Queens Ballpark Company (QBC), the entity that owns Citi Field, saw its rating affirmed for $624 million of bonds issued in 2006. “The Mets franchise operates in the robust, yet competitive, New York City market with strong personal wealth levels and the largest population and deepest corporate base of any metro region in the United States,” wrote Fitch. Tallying 101 wins in the 2022 season, tied for third-most in the league, also helped. “Attendance at the stadium and fan support has shown volatility correlated to on-field performance,” said Fitch.

Citi Field also benefits from the high percentage of naming rights fees backing the municipal bonds used to construct the facility, Fitch noted. While crypto-firm sponsorships are causing problems for the NBA’s Miami Heat, the Mets probably are relishing their decidedly old school finance naming sponsor, Citigroup: It’s the third-largest bank in America, with more than $1.7 trillion in assets.

Perhaps the only negative for the Mets in the Fitch report is the unavoidable comparison to the other baseball team in town. “Yankee Stadium is rated one notch higher than QBC, reflecting the franchise strength of the Yankees and the more stable and robust levels of attendance and ticket revenues.”

The ratings agency also affirmed its rating for the USTA National Tennis Center, home of the U.S. Open, located not far from the Mets in Queens. The Tennis Center holds an A- rating thanks to long-term broadcasting agreements that provide about half of revenues pledged to back its bonds. The other half comes from U.S. Open ticket sales, which have a proven history of steady growth in average ticket prices, the agency noted.

No Comments Yet