Digital assets have had one of their worst years on record in 2022 with many negative events contributing to their downfall. The recent rally in and is making investors wonder if the asset class has become investable again, and whether its correlation to traditional risk assets will mirror 2022’s.

An asset class plagued by scandals

Bitcoin and crypto assets saw their fair share of scandals and exchange bankruptcies in 2022. Crypto exchanges that were supposedly well capitalized in the months leading up to their demise suddenly found themselves over-levered in the face of aggressive rate hikes in most developed nations.

Three Arrows Capital and Celsius Network were some of the first dominos to fall in the crypto carnage of 2022 when bets on Luna wiped out close to 50 billion dollars in value for their investors. The Regulatory and risk management failures of these two companies should have been the canary and the coal mine for what became the most sensational and unexpected wipeout of 2022: the implosion of FTX.

Although the total value lost from the FTX collapse was lower than that of Three Arrows Capital, 32 billion versus 42 billion USD, the reputational damage to crypto exchanges and the asset class as a whole was far worse as a result of the celebrity endorsements and Pension Plans associated with FTX. This led many investors, sophisticated or otherwise, to ask a very obvious question: can this asset class and the companies operating within it be trusted?

Only time will be able to answer this question, and it is important to know that bad actors exist in all Industries can affect all asset classes. What is perhaps more important, is to focus on the fundamentals which saw crypto’s initial rallies over the years, and to judge whether the current and future environment will provide a similar opportunity for investors.

Bitcoin and Ethereum in 2023

Although past performance is not indicative of future results, sophisticated investors know that history is often repeated. Fundamental and economic factors which led to the popularity of crypto as an asset class can continue to provide support to cryptocurrencies despite the volatility that should be expected from such a new asset.

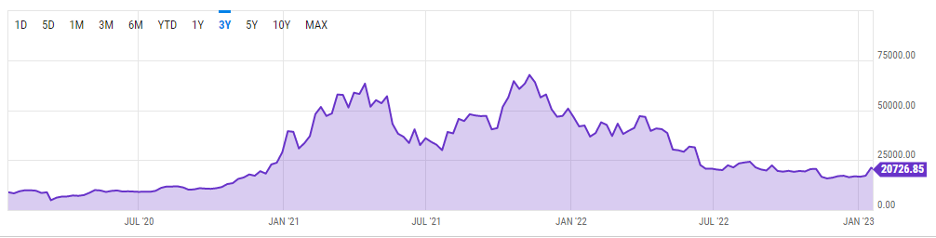

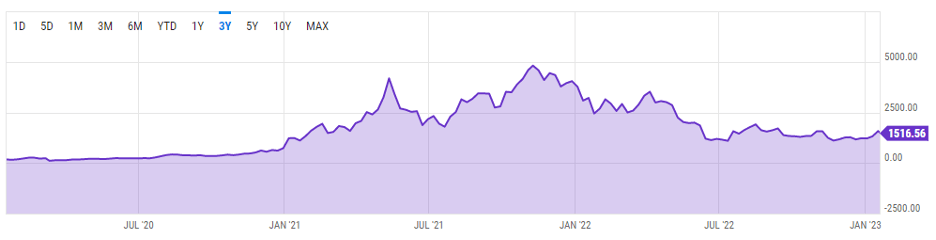

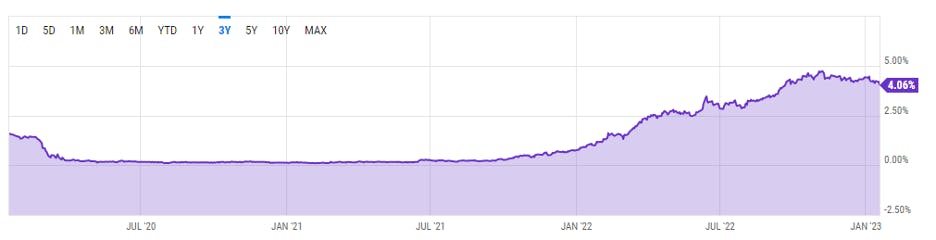

There is no doubt that quantitative easing and relaxed monetary policy were major contributors to the breathtaking rally that cryptocurrencies across the board saw in 2020 and 2021. There is also little indication that we will be returning to an easy money environment anytime soon. The charts below show the relationship between Bitcoin prices and prevailing interest rates over the last three years:

Figure 1: Bitcoin Price (last 3 Years)

Figure 2: Ethereum Price (last 3 Years)

Figure 3: 2-Year Treasury Rate (last 3 Years)

Though the graphs are not overlaid one can easily see that the period between July 2020 and January 2022 is characterized by near-zero interest rates and a steep incline in the price of Bitcoin and Ethereum. Similarly starting in January 2022, we notice a peak in the price of crypto assets and a rapidly increasing 2-year treasury rate. It should come as no surprise that risk assets drop in value as interest rates move up as was clearly seen in the tech heavy NASDAQ but also the S&P 500 which has recently become fairly Tech heavy as well.

What was surprising however was that Bitcoin did not maintain its value better, considering its previous comparisons to digital gold, as well as its supposed status of an inflation hedge. Although it is important to note that gold also exhibited a significant decrease in price despite its reputation for maintaining its value during periods of high inflation.

What can investors expect in 2023 and beyond, considering that inflation has shown a deceleration over the last 3 months of 2022, didn’t end in sight to painful interest rate hikes? If the last 3 years are any indication, we can expect Bitcoin and Ethereum prices to remain somewhat subdued until central banks decide it is time to cut interest rates. For that reason, investors should be careful not to chase short-term rallies, but perhaps it is time to start accumulating a small position in this asset class, if it is compatible with their individual risk tolerance.

An additional consideration to make, is the difference between Ethereum and Bitcoin and their individual use cases. Whereas Bitcoin earned itself a reputation of an inflation hedge (perhaps erroneously so), Ethereum is seen more as a technological platform on which various applications can be built (DeFi). In comparison to Bitcoin’s failed status as an inflation Hedge over the last 3 years, Ethereum continues to attract developers and business models to its platform.

How can Canadian investors gain access to Bitcoin and Ethereum funds?

Fortunately for Canadians a number of Bitcoin and Ethereum funds have been approved over the last 2 years. Firms such as CI Galaxy, Purpose Investments, and 3IQ have some of the largest managed crypto ETFs in Canada which provide exposure to Bitcoin, Ethereum, or a wide range of companies operating in the cryptocurrency space.

CI GALAXY ETFs

For the most part, the CI Galaxy ETFs have among the lowest comparative fees associated averaging around 0.4% and providing both hedged and unhedged exposure to Bitcoin and Ethereum:

CI Galaxy Bitcoin ETF – provides exposure to Bitcoin prices

CI Galaxy Ethereum ETF – provides exposure to Ethereum Prices

CI Galaxy Blockchain ETF – provides exposure to a portfolio of companies operating in the cryptocurrency space either directly, or indirectly

Purpose Investments ETFs:

For investors looking to draw yield from cryptocurrency investments, the Purpose Bitcoin and Ethereum Yield ETFs may be a good choice. The funds generate yield of close to 9% by selling covered call options on the underlying Holdings, and distribute the premiums earned as regular dividends.

The funds charge 1.1% in fees which is considerably higher than the CI Galaxy ETFs. However, this is normal for strategies involving options or other derivatives. One caveat to this type of strategy is that gains are limited by the call options sold and therefore we would not expect a yield ETF to capture the full increase in the price of the underlying cryptocurrency.

Horizons ETFs:

For investors who are not convinced that cryptocurrencies will continue to rise in price, either because of underlying economic conditions, or due to their highly speculative nature, the Horizons BetaPro Inverse Bitcoin ETF allows them the opportunity to bet against the price of Bitcoin through a regulated fund. Due to heavy use of derivatives the fee charged by this ETF is 1.64% however it may be worth the price if crypto assets resume their downward trend in the future.

All of the above options are eligible to be purchased in TFSA and RRSP accounts, ensuring that any profits or income received are not taxable. These sure beats purchasing crypto assets directly on an exchange, and incurring full capital gains taxes upon sale.

This content was originally published by our partners at the Canadian ETF Marketplace.

No Comments Yet