While many of the challenges that crypto faced in 2022 were compounded by global economic headwinds relating to high inflation rates and the fallout of Russia’s war in Ukraine, many more projects collapsed because of a severe lack of foresight from their owners.

Following the furor of 2021’s bull runs, the reputation of crypto has been scarred by scams, Ponzi schemes, and a lack of sufficient investor protection. However, as prices improve and new optimism arrives on the market in 2023, here are five essential actions that must be taken to ensure that crypto learns from the mistakes of the past.

1. More Intelligent Regulation

One of the most significant lessons learned from 2022 was that there needs to be a synergy between decentralization and regulation that protects investors.

The high-profile collapse of a major exchange, FTX, was a damaging event for investors and the crypto ecosystem. As rumors swelled around the exchange falling into trouble, FTX struggled to find liquidity to cope with masses of investor withdrawals.

In the days that followed, FTX alleged it was hacked by somebody using “on-chain spoofing” to steal $500 million in crypto assets from wallets.

The fall of FTX wasn’t the only high-profile collapse in 2022, with other projects like LUNA, Celsius, and BlockFi all causing investors to lose their wealth and confidence in the market.

With this in mind, if cryptocurrency is set to go mainstream, the landscape must be regulated more effectively. Although decentralization is a core principle of cryptocurrency and close to the hearts of the industry’s biggest investors, regulatory measures must evolve to protect the interests of all users should it be serious about attaining a mainstream audience.

2. Learn From the Mistakes of the Last Bull Market

2023 began with a new wave of optimism across the cryptocurrency market. Rallies pushed both bitcoin and many altcoins higher, and many hoped to see price rallies similar to 2021.

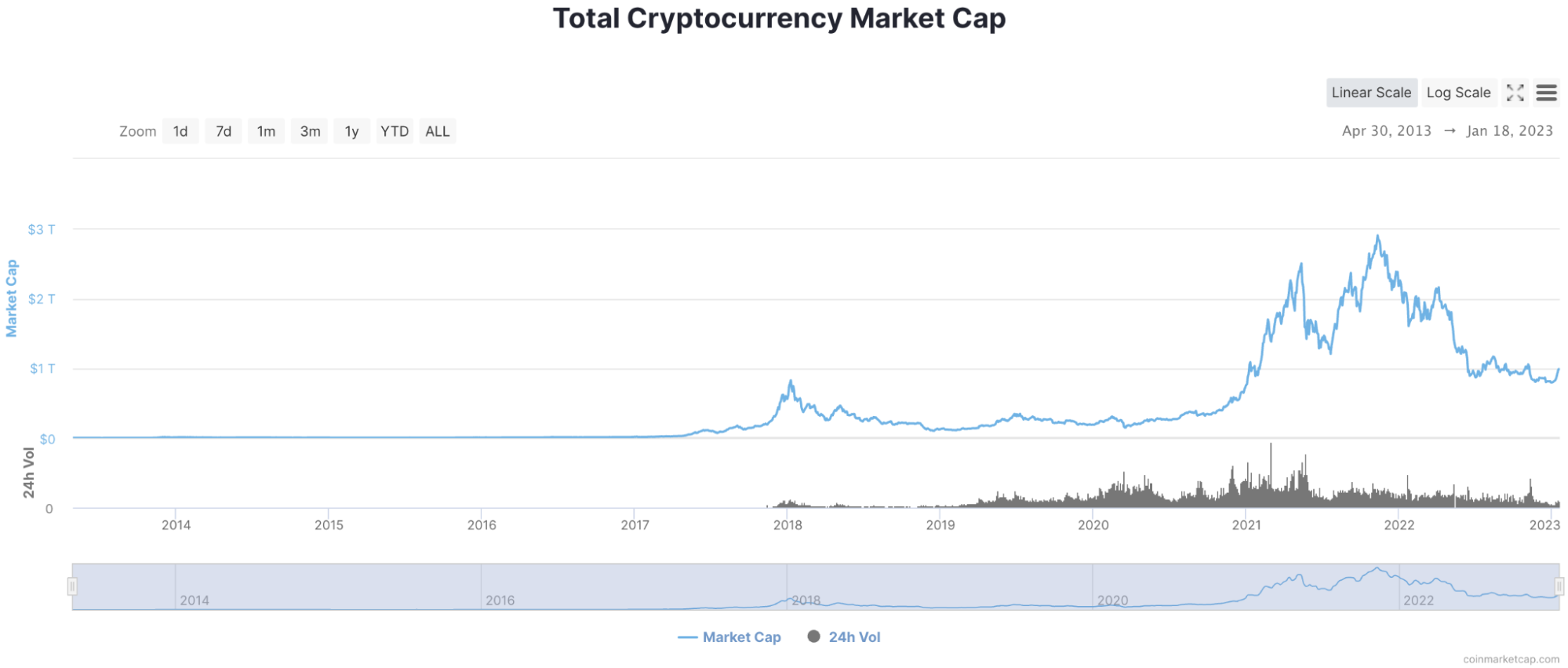

As we can see from the CoinMarketCap chart above, investor optimism in 2021 saw the total cryptocurrency market capitalization reach almost $3 trillion. While there’s a long way to go before this level is emulated again, it’s essential that more is done to ensure that investors aren’t exposed to the mistakes of the last bull market.

Towards the end of 2021’s bull market, investors were increasingly looking for new assets to buy into in the hope that they could gain exponential growth. It’s this rush for new assets to buy that saw the rise of meme coins like Dogecoin and Shiba Inu rise in popularity.

While buying an asset with no functionality isn’t a bad move, investors depend on the meme, gathering momentum as a source of income.

Away from meme coins, we also saw several small-cap Ponzi schemes and rug pulls take place. For example, owners create a cryptocurrency while holding onto a significant volume of the asset, allowing them to fraudulently “pump and dump” its price before leaving other investors holding worthless crypto when they sell their stake.

As we look to leave crypto winter behind and embrace a new era of optimism, there must be a more comprehensive vetting process for new assets entering major exchanges.

3. Improve the Investor Experience

Another key industry drawback revolves around the investor experience when buying, converting, and selling crypto. For hardened enthusiasts, market pairs and executing withdrawals via third parties can be second nature, but these processes can put off new adopters.

The next bull run will be built on a wave of mainstream adoption. Today, cryptocurrency is everywhere, sponsoring major events and marketing directly to millions of individuals.

Chainalysis data shows that, despite crypto marketing being as widespread as ever, adoption rates fell in 2022, suggesting lingering barriers to adoption. To make crypto as accessible as possible, the investor experience across exchanges needs to be seamless and reassuring.

To accommodate more investors in 2023, exchanges must feature new learning resources to help build new confidence among adopters.

4. Continue the Push Towards Carbon Neutrality

Matters of the environment are more important than ever, and rightly so. After Elon Musk (allegedly) caused a Bitcoin crash in 2021 following tweets expressing concern at the cryptocurrency’s carbon footprint, the issue of cryptocurrency mining has rarely gone away.

Today we’re seeing both BTC and ETH make efforts to lower their respective carbon footprints, and these initiatives need to grow across the ecosystem.

As sustainability continues to present itself as a pressing concern across a variety of industries, the spotlight will be on crypto’s carbon footprint more than ever in 2023. The move away from proof-of-work crypto mining is key, but projects must show their environmental commitment to earn investor trust.

5. Influencers Must Take More Responsibility

Some of the biggest losses made within crypto come from inexperienced investors blindly following the adverts posted by influencers. There are countless examples of celebrities and social media influencers promoting assets in thinly veiled advertisements, which only spreads mistrust among newcomers to the market.

Many cryptocurrency projects use social media to build influencer advocacy in the hope that new investors will buy into their assets. In some cases, the influencers paid by these cryptocurrency projects have no idea about the protocol and blindly relay advertisements with the thinly veiled #ad hashtag as a disclaimer. There is little difference between these ill-thought-out “ads” and active crypto shilling.

However, the content seen by the influencer’s followers can be misleading and sensationalist to the point where an #ad hashtag is insufficient. With this in mind, influencers must take on crypto advertising campaigns with greater levels of responsibility for their followers. Otherwise, they risk impacting the financial health of their community and the credibility of the cryptocurrency industry as a whole.

Crypto Must Learn Lessons From the Past

As we move into a fresh new year for the cryptocurrency ecosystem, it’s becoming more pertinent than ever for the industry to learn from the lessons of the past. While the prices of assets have been steadily trending upwards of late, its reputation among would-be adopters could hinder its progress throughout 2023.

By learning from the drawbacks of the past, we can be reasonably optimistic that a bright year is ahead for the cryptocurrency landscape, but only if we see a greater level of responsibility, sustainability measures, and sufficient regulation.

No Comments Yet