This is not the first time the world is replacing the older ways to do things. Human progression led to a shift from face-to-face conversations to telephonic, and then instant messages. But the new shift from the real world to a virtual reality world of metaverse is nothing less than a major generational shift.

For a conventional investor, retirement plans, term deposits, precious metal, and stocks were the options to increase wealth. The new generation, led by millennials and generation Z, is looking for new-age options, including virtual assets.

Also read: Top cryptos by market cap that ruled in 2021

From virtual currencies to virtual real estate

Virtual currencies or blockchain-based cryptocurrencies have already become a mainstream investment instrument. Big banks in the US are facilitating crypto sale and purchase for their clients, and S&P Dow Jones is now tracking the movement in prices of Bitcoin and Ether.

But similar to how 2020 was the formative year for cryptos, which then exploded in 2021, the year 2022 can be said to be the formative year for a new investment option – virtual real estate. We may see further movements in this and find both individual and institutional investors picking up land and other facilities like a gas station or a garage in the virtual reality world.

Year 2021 taught investors that every cryptocurrency – no matter its high market cap – is volatile in terms of price. From Bitcoin to Dogecoin, almost every crypto exhibited this unpredictability. Can this drive investors toward the new asset class – virtual real estate? After all, similar to gold, real estate is usually a safer bet in the medium to longer investment horizon.

Why are people trading real dollars for virtual land?

The answer is quite simple. If people can trade dollars on crypto exchanges to buy virtual currencies, can bid in millions to acquire a Beeple artwork or a cryptopunk NFT, it is understandable they can buy a virtual piece of land in anticipation of price appreciation of the asset in the future.

This is the same FOMO (fear of missing out) that prevents a section of investors from exiting the crypto market even when prices are plunging very sharply. FOMO is now making its way into the virtual real estate space.

Virtual real estate deals of 2021

Two deals of 2021 are enough to realize how metaverse real estate is capturing everyone’s imagination.

A piece of land on Decentraland metaverse sold for over US$2.4 million in November, which was soon followed by an over US$4 million property sale on The Sandbox’s metaverse.

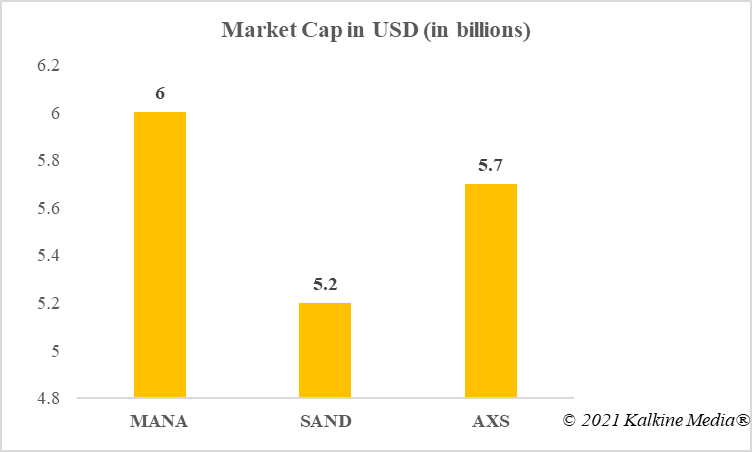

Image description: Market cap of metaverse tokens

Data provided by CoinMarketCap.com

It was a busy year for real-world real estate. House prices in the US, Canada and almost every other advanced economy peaked to new heights in 2021. Analysts had even warned of a housing market crash at the beginning of the year, but even correction could not make its way into the market. Skyrocketing prices of housing assets is one of the reasons why central banks are looking to raise policy rates, which can make mortgage loan a little costlier, thereby reining in the frenzy.

But have high property prices in the real world made people, especially the new generation of investors, explore assets in virtual reality? Bidders are losing in the real world, but in the virtual real estate market, there is something for everyone.

What started with a Canada-based artist’s digital home selling for nearly US$500,000 in March, attained new dimensions with each passing month in 2021.

Also read: These play-to-earn cryptos that may explode in 2022

Make money with virtual real estate

PolkaCity is a project offering virtual asset ownership in the form of non-fungible tokens. A few of the owners of these assets – ranging from gas stations to motor bikes – are said to be minting fortune out of their holding. What happens is other users of the same platform use their services, for example a bike owner would purchase gas or use the ATM of the bank, which becomes a source of revenue for owners.

By this measure, ownership of virtual real estate is not just about capital gains. It is like recurring income for asset owners without having to sell the holding to book profit. This is in contrast to cryptocurrencies where the investor has to essentially sell the holding to book any profit.

Parcels of land are up for sale on multiple metaverse platforms. Investors paying hefty prices for these assets, which exist in the fictional world alone, may be scripting a new chapter in the blockchain-based ecosystem. All metaverse platforms including Decentraland, The Sandbox, and PolkaCity are based on the decentralized ledger architecture of blockchain. Additionally, they also have NFT underpinnings.

How to buy virtual real estate?

It can be as easy as buying a cryptocurrency from a crypto exchange.

Typically, it involves registering on a platform like The Sandbox, selecting the parcel of land or other real estate assets, and paying for the same in cryptocurrency, which can either be the platform’s native token like SAND, or Ether, which is the native crypto of Ethereum’s blockchain.

The purchased virtual real estate exists as NFT, usually on Ethereum’s network. The asset holder either lists the NFT on an exchange like OpenSea to sell it at an appreciated price or holds it to make money if the platform has monetization avenues, like in PolkaCity.

Also read: Bitcoin vs. Ethereum – All you must know before 2021 ends

Where to buy virtual real estate?

Here are three leading platforms.

1. Roblox

From Nike to Paris Hilton, the blockchain metaverse of Roblox has drawn the attention of many high-profile companies and celebrities.

Lately, Paris Hilton announced her move into metaverse, where she will build a ‘Paris World’ using the Roblox platform. Her mansions will be replicated in virtual reality space, and visitors who buy virtual clothing and other assets from here will have to shell out money.

Nike has come up with NIKELAND on Roblox.

2. Decentraland

Decentraland is a typical virtual real estate platform, which lets users purchase and sell land using crypto assets.

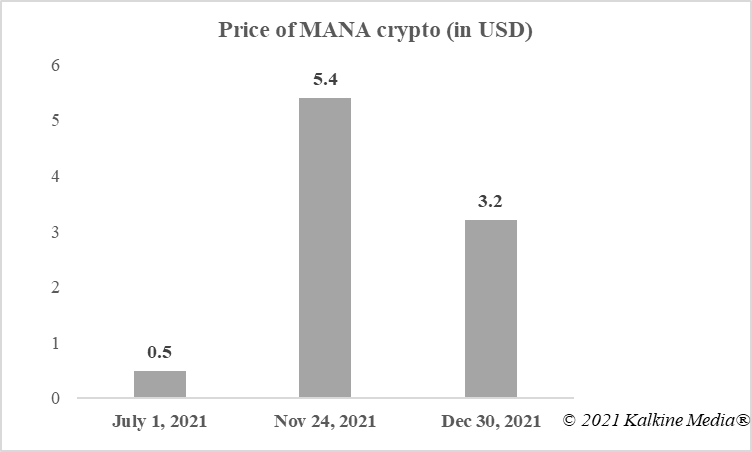

Decentraland’s native token MANA gained when Facebook announced name change to Meta. Times Square’s owners are said to be using Decentraland to celebrate the coming of 2022.

Image description: Price movement in MANA crypto in second half of 2021

Data provided by CoinMarketCap.com

3. The Sandbox

If Nike chose Roblox, Adidas chose The Sandbox to come up with its metaverse. SoftBank, a leading investor in tech startups, has also invested in the platform.

The Sandbox, just like Decentraland, has its native token, termed SAND. SAND also gained at the same time when Facebook’s meta move brought blockchain gaming and metaverse projects into the limelight.

Also read: Cryptocurrencies vs. stock market: What can be the best pick for 2022?

What next?

Things are changing very rapidly. No one could have anticipated the rise of cryptocurrencies, and their becoming a $3-trillion market cap asset class in a matter of a few years. But at the same time, price volatility in cryptocurrencies has remained a matter of concern.

Virtual real estate, which borrows a little from blockchain, a little from NFTs, may become the new love of investors in 2022. These virtual assets help earn revenue through their play-to-earn features. Moreover, since every such asset is an NFT, it’s price is independent of other assets.

Risks, however, underlie these assets as well. Most of the metaverse real estate platforms are very new, and any broader bearish trend in the blockchain ecosystem can adversely impact prices of virtual assets owned by investors.

No Comments Yet